PSX Opening Bell: Bargain Hunting

MG News | February 20, 2026 at 09:35 AM GMT+05:00

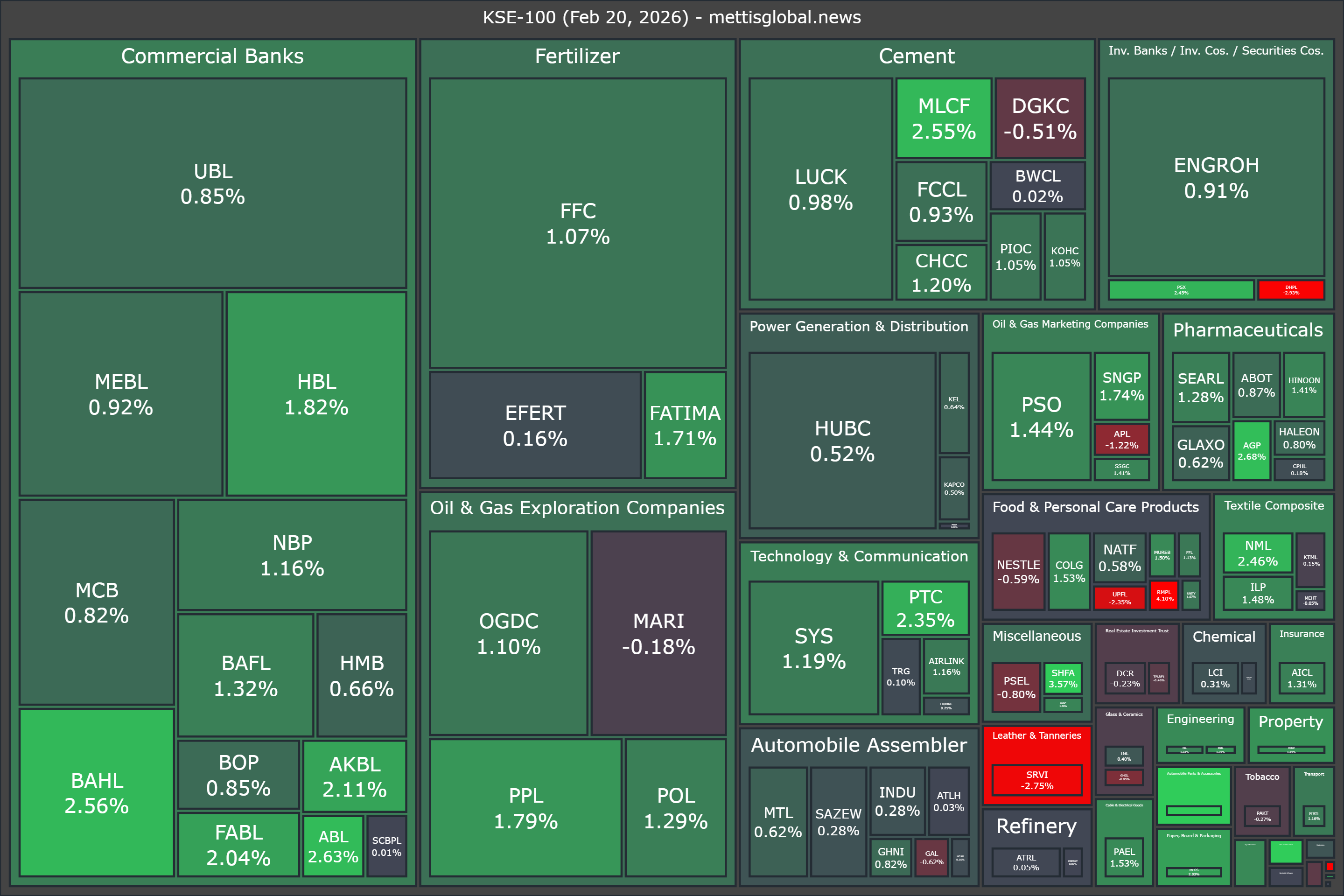

February 20, 2026 (MLN): After Thursday’s steep sell-off, the benchmark KSE-100 Index staged a recovery at the start of Friday’s session, as investors returned to the market to pick up blue-chip stocks at attractive valuations.

The index remained positive during early trading and was last seen at 173,878.88, up 1,708.59 points or 0.99%.

It touched an intraday high of 174,148.32 (+1,978.03 points), indicating steady buying interest from the opening bell.

Top gainers included HGFA (+9.33%), THALL (+4.98%), SHFA (+3.57%), AGP (+2.68%), and ABL (+2.63%).

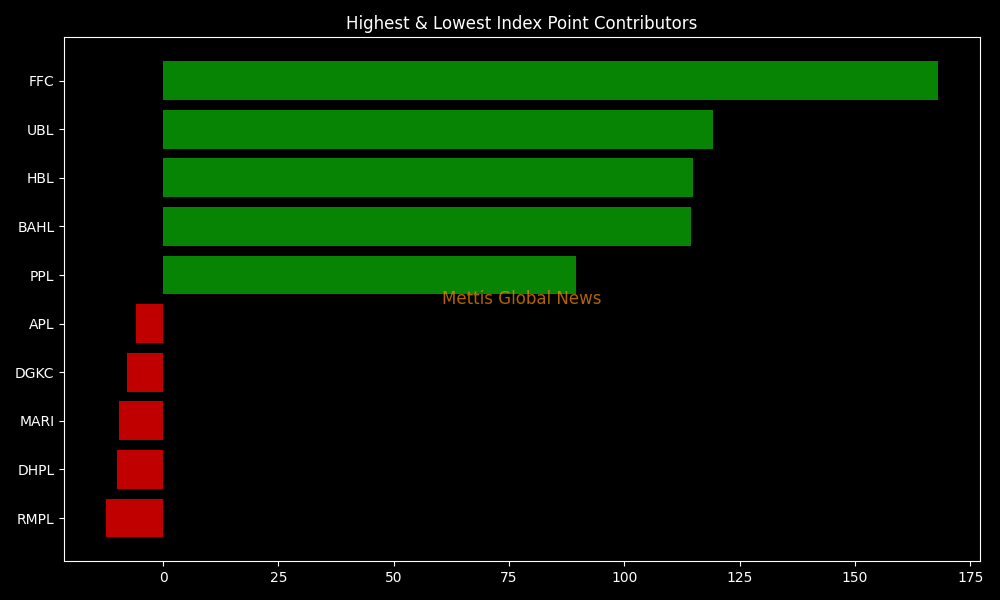

In terms of index impact, the rebound was largely driven by heavyweight stocks such as FFC, UBL, HBL, BAHL, and PPL, which collectively added significant points to the index.

Sector-wise, the recovery was led by Commercial Banks, Fertilizer, Oil & Gas Exploration, Cement, and Investment Companies, signaling renewed interest in cyclical and defensive heavyweights.

Minor drag came from Real Estate Investment Trusts, Glass & Ceramics, Tobacco, Vanaspati, and Textile Spinning sectors.

The positive start follows heightened global uncertainty driven by tensions between the United States and Iran, which had pushed oil prices sharply higher and triggered the previous day’s market rout.

Concerns intensified after Donald Trump warned that Iran had a limited time, possibly 10 to 15 days, to reach a nuclear agreement, while Washington reportedly deployed its largest military buildup in the Middle East since the 2003 Iraq war.

Reports from The Wall Street Journal also suggested that the US is weighing a limited early strike to pressure Tehran back into negotiations.

Despite these risks, local investors appear to be focusing on value opportunities after the steep correction, selectively buying blue-chip stocks while remaining cautious about external developments.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 171,582.35 155.67M | -0.34% -587.94 |

| ALLSHR | 103,043.24 324.69M | -0.42% -433.40 |

| KSE30 | 52,537.15 61.45M | -0.23% -121.64 |

| KMI30 | 240,664.42 48.87M | 0.06% 153.14 |

| KMIALLSHR | 65,971.88 167.64M | -0.02% -16.16 |

| BKTi | 50,486.48 26.97M | -1.03% -526.43 |

| OGTi | 33,833.90 8.50M | 0.80% 268.43 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,005.00 | 68,065.00 66,880.00 | 800.00 1.19% |

| BRENT CRUDE | 72.08 | 72.16 71.59 | 0.42 0.59% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.82 | 66.87 66.31 | 0.42 0.63% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpg?width=280&height=140&format=Webp)

.jpg_20260127052750720_42cc2c.jpeg?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account