RDA attracts $216m in Jan

MG News | February 18, 2026 at 11:59 AM GMT+05:00

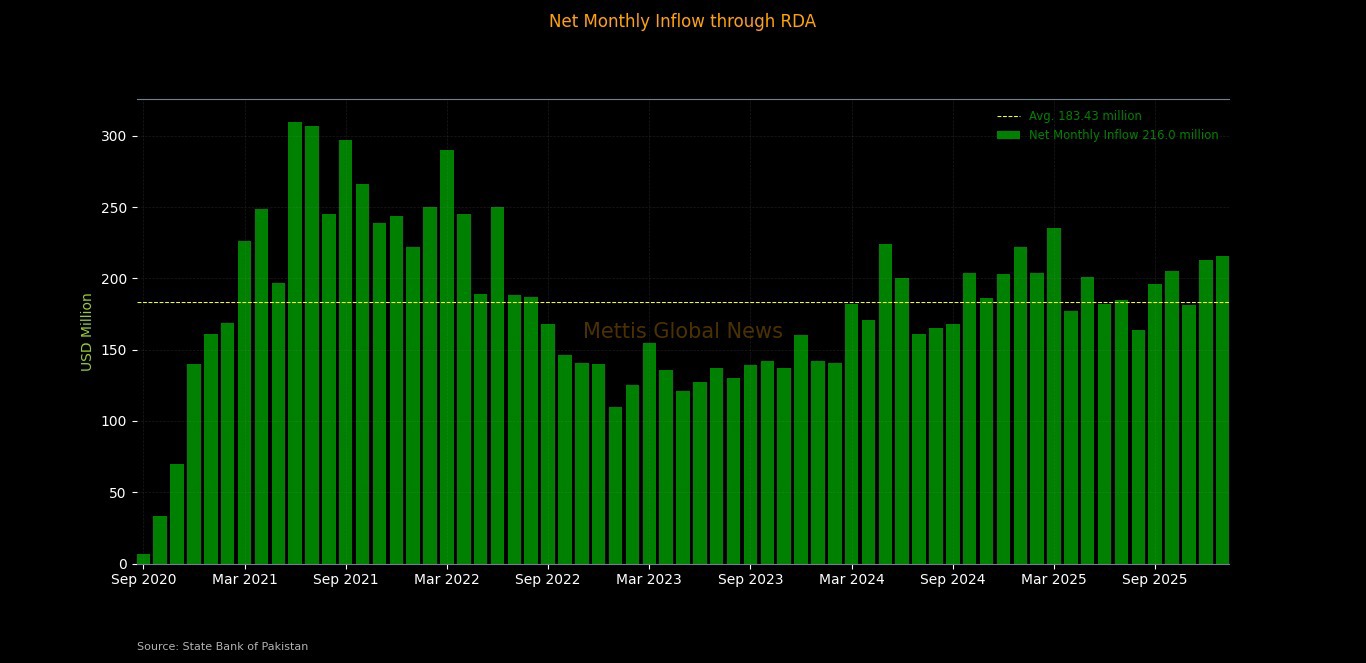

February 18, 2026 (MLN): Total inflows into Roshan Digital Accounts (RDA) during January 2026 stood at $216 milliom, bringing cumulative inflows into RDA to $11.923 billion.

Compared to the previous month’s inflow of $213m, January recorded an increase of $3m.

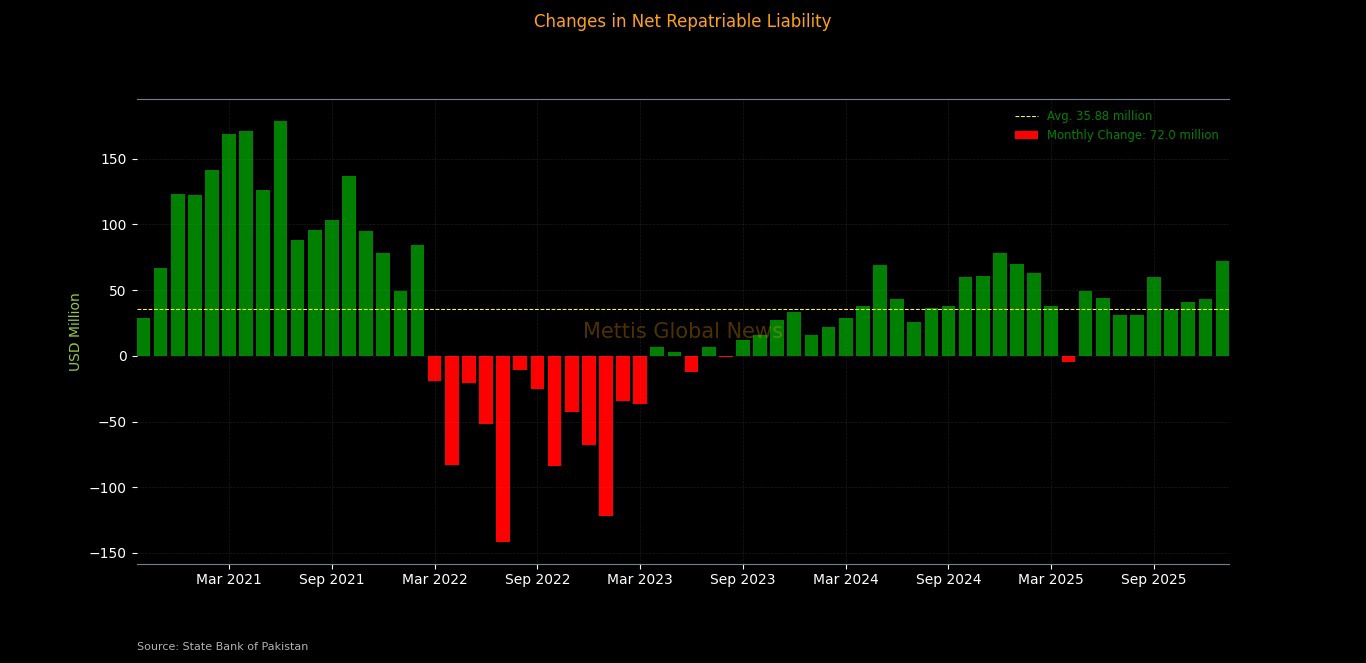

According to data released by the SBP, the amount repatriated and locally utilized during the month was $144m, indicating that the Net Repatriable Liability (NRL) of RDA increased by $72m in January.

The amount repatriated during the month was $22m, while $123m was utilized locally.

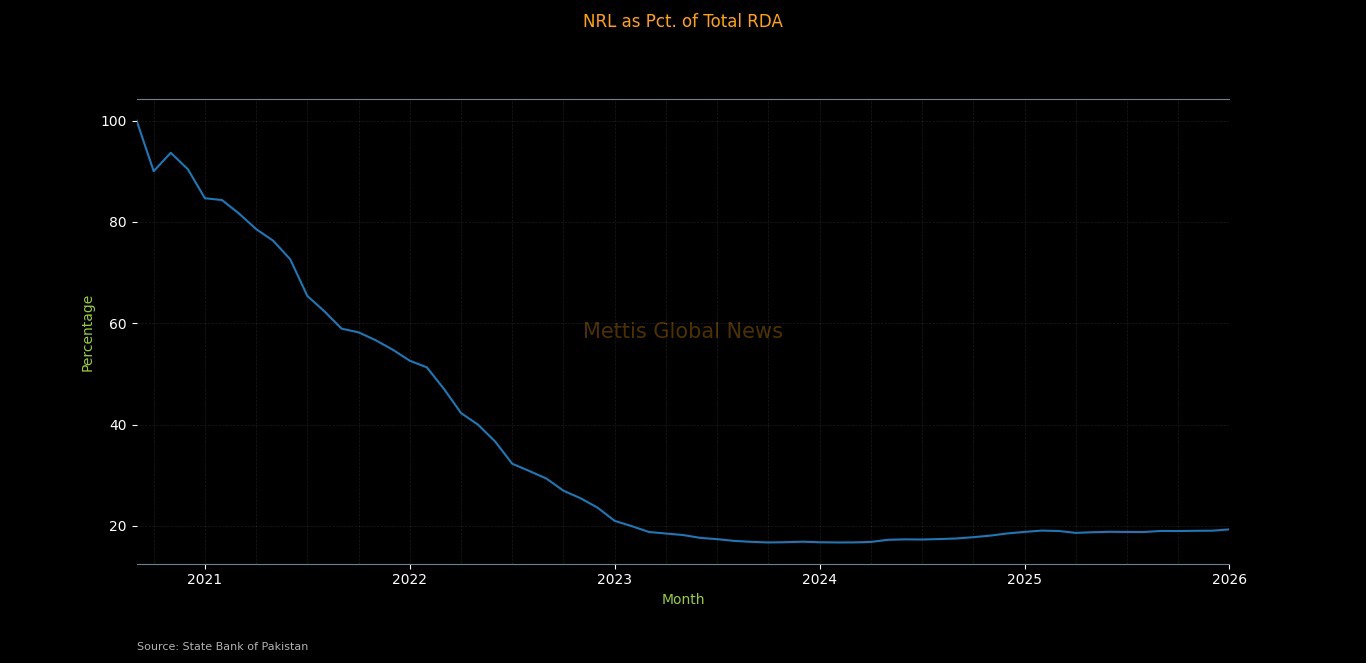

Cumulatively, total repatriation and local utilization stood at $9.62b, out of which $1.965b has been repatriated and $7.655b utilized locally, making the NRL $2.303b, or 19.32% of total RDA.

Breakup of the NRL shows $499m still invested in Conventional Naya Pakistan Certificates (NPC), $1.024b in Islamic NPC, equity investment of $106m, account balances of $543m, and other liabilities of $59m.

Total inflows during the current financial year reached $1.36b, compared to $1.309b in the corresponding period last year. Total repatriation and local utilization during the same period stood at $1.047b, up from $940m last year.

During January, 8,634 new accounts were opened, taking the total number of RDA accounts to 901,764.

_20260218065526674_511d33.jpeg)

The highest monthly inflow into RDA was recorded in June 2021, with $310m received, while the highest monthly repatriation and local utilization was in July 2022, when the NRL of RDA fell by $330m.

RDA is a major initiative of SBP, in collaboration with commercial banks operating in Pakistan.

These accounts provide innovative banking solutions for millions of Non-Resident Pakistanis (NRPs), including Non-Resident Pakistan Origin Card (POC) holders, seeking to undertake banking, payment, and investment activities in Pakistan.

SBP has made it possible to allow overseas Pakistanis to open an account in a Pakistani bank completely digitally in a presenceless manner and without needing to visit any bank, any embassy, or consulate.

The account opening process requires only basic information and documents, with banks instructed to complete all necessary customer due diligence within 48 hours.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 176,943.43 201.47M | 2.19% 3793.01 |

| ALLSHR | 106,311.23 355.86M | 1.87% 1947.67 |

| KSE30 | 54,072.33 111.36M | 2.38% 1256.05 |

| KMI30 | 248,022.90 72.68M | 1.08% 2659.24 |

| KMIALLSHR | 68,072.60 203.02M | 1.04% 699.21 |

| BKTi | 51,914.01 52.75M | 5.35% 2635.34 |

| OGTi | 34,737.98 21.91M | -0.06% -19.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,390.00 | 68,545.00 66,910.00 | 525.00 0.77% |

| BRENT CRUDE | 67.74 | 67.81 67.36 | 0.32 0.47% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 105.50 105.50 | 0.15 0.14% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.54 | 62.60 62.04 | 0.21 0.34% |

| SUGAR #11 WORLD | 13.47 | 13.86 13.46 | -0.02 -0.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account