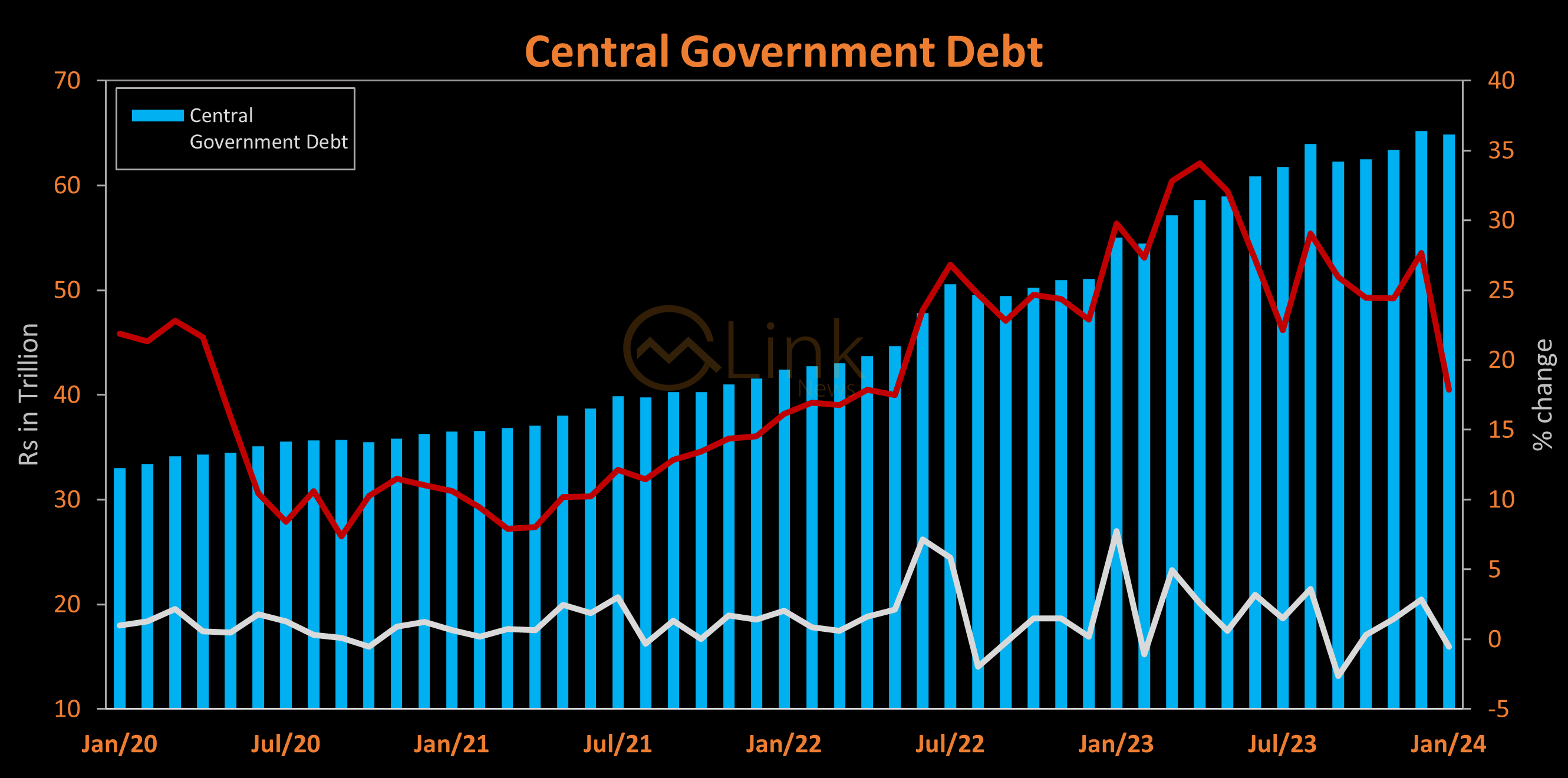

Central govt debt rises by 17.85% YoY to Rs64.84tr in January

MG News | March 05, 2024 at 03:36 PM GMT+05:00

March 05, 2024 (MLN): The total debt of the central government went up by 17.85% YoY to Rs64.84 trillion in January 2023, compared to Rs55.02tr in January 2022, the data released by the State Bank of Pakistan (SBP) showed.

The year-on-year increase in debt burden is primarily attributed to borrowing from domestic and foreign sources to cover the fiscal deficit.

Conversely, on a sequential basis, the central government debt decreased by 0.53% MoM compared to Rs65.19tr in December 2023.

As per details made available by SBP, the larger portion of the debt was domestic and stood at Rs42.63tr, comprising Rs34.15tr long-term debt, Rs8.38tr short-term debt and the remaining Rs103.6bn through Naya Pakistan Certificates.

The figures reported by the central bank for the domestic debt reflect a growth of 24.15% YoY and on a sequential basis an increase of 0.09%.

By the end of January 2023, the government’s long-term debt rose by 24.11% YoY to Rs34.15tr as compared to Rs27.51tr recorded in the same period a year ago, while increasing 0.14% MoM.

Similarly, the short-term debt increased by 25.16% YoY to Rs8.38tr in the review month.

Within the long-term domestic debt, the Pakistan Investment Bonds (PIBs) accounted for the majority proportion and stood at Rs25.6tr, up by 22.43% YoY, while down by 0.05% MoM.

Meanwhile, in the short-term domestic debt, Market Treasury Bills (MTBs) were dominant as borrowing through this security amounting to Rs8.29tr, Up by 25.16% YoY and 0.07% MoM.

Borrowing through Naya Pakistan Certificates has declined by 19.7% YoY to stand at Rs103.6bn in January 2023.

Comparison on a monthly metric shows that in January, the government borrowed 12.73% less through these certificates compared to Rs118.72bn in the previous month.

A breakup of the central government's external debt shows that nearly Rs22.14tr came from long-term loans while Rs76.34bn came from short-term loans.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 171,966.46 72.86M | -0.12% -203.83 |

| ALLSHR | 102,998.66 152.01M | -0.46% -477.99 |

| KSE30 | 52,713.59 25.45M | 0.10% 54.80 |

| KMI30 | 240,560.08 21.42M | 0.02% 48.79 |

| KMIALLSHR | 65,793.97 78.40M | -0.29% -194.07 |

| BKTi | 50,963.18 10.26M | -0.10% -49.73 |

| OGTi | 33,848.62 4.04M | 0.84% 283.15 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,280.00 | 67,665.00 66,880.00 | 75.00 0.11% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.64 | 66.86 66.31 | 0.24 0.36% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account