Weekly SPI decreases by 0.03%

_20251003092603298_af0c50_20251010094012153_327c07.webp?width=950&height=450&format=Webp)

MG News | January 30, 2026 at 01:48 PM GMT+05:00

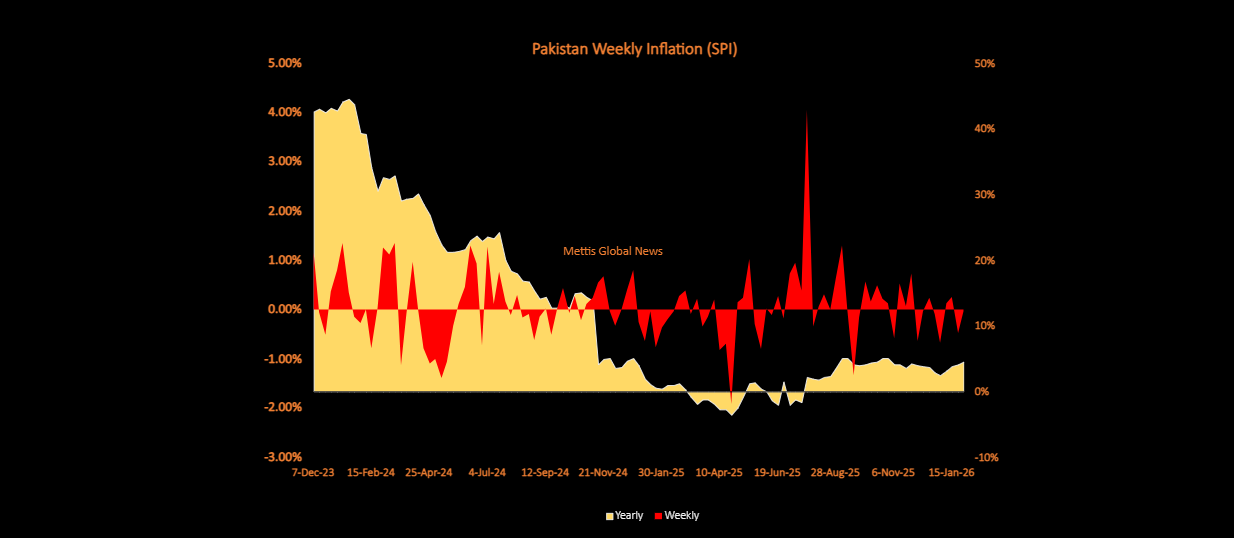

January 30, 2026 (MLN): Pakistan's short-term inflation, measured by the Sensitive Price Indicator (SPI), decreased by 0.03% for the week ended January 29, 2026, according to the latest data released by the Pakistan Bureau of Statistics (PBS).

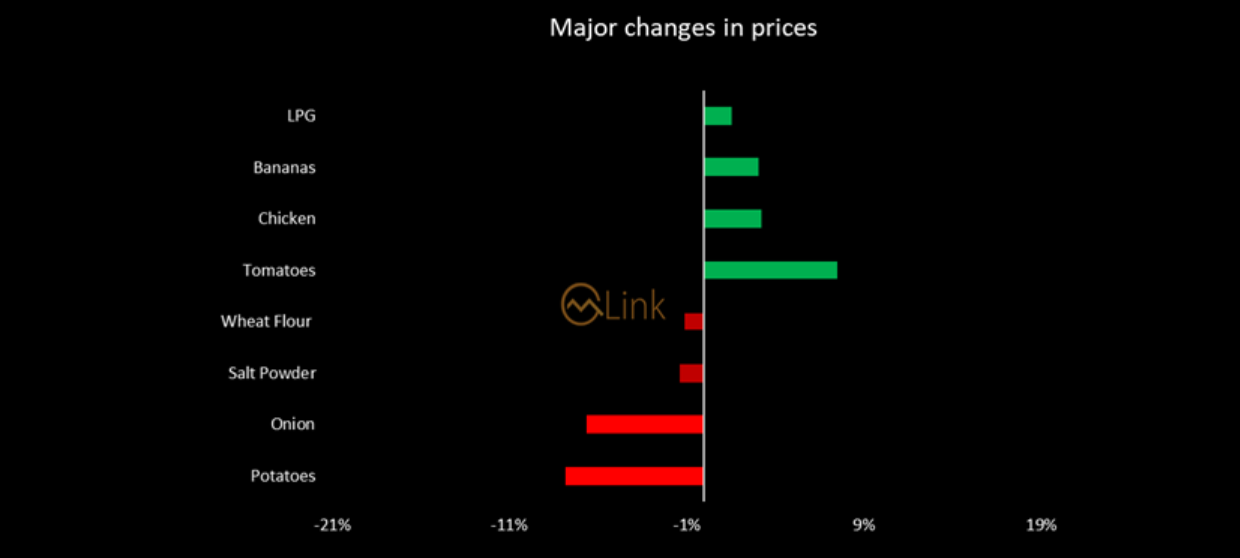

The notable decrease in weekly inflation was primarily

driven by a sharp fall in Potatoes (7.81%), Onions (6.66%), Salt Powder

(1.36%), Wheat Flour (1.17%), Pulse Masoor (0.75%), Eggs (0.30%), Gur (0.24%)

and Rice Basmati Broken (0.08%).

Conversely, the report highlighted increased in several

essential items including Tomatoes (7.53%), Chicken (3.25%), Bananas (3.07%),

LPG (1.56%), Pulse Mash (1.49%), Pulse Gram (1.31%), Chilies Powder (0.66%),

Pulse Moong (0.61%), Firewood (0.37%), Vegetable Ghee 2.5Kg (0.32%), Shirting

(0.25%) and Cigarettes (0.24%).

During the week, out of 51 items, prices of 18 (35.29%) items increased, 09 (17.65%) items decreased and 24 (47.06%) items remained stable.

On an annual basis, the SPI showed a year-on-year (YoY) increase of 4.52% compared to the same week last year.

The PBS attributed the increase in prices of Eggs (42.85%), Tomatoes (41.14%), Wheat Flour (38.29%), Gas Charges for Q1 (29.85%), Chilies Powder (13.30%), Beef (12.65%), Firewood (11.54%), LPG (11.31%), Powdered Milk (10.00%), Gur (9.25%), Shirting (8.49%) and Bananas (8.33%).

However, decrease was observed in prices of

The average price of Sona urea stood at Rs4,396 per 50 kg

bag, 1.22% higher from last week’s price, and a 2.29% decrease from last year.

Meanwhile, the average Cement price rise very slightly to

Rs1,406 per 50 kg bag, which is 0.14% higher than the previous week, and 2.46% above prices last year.

The SPI, which tracks price movements of 51 essential

commodities from 50 markets across 17 cities, serves as a key barometer of

short-term inflation trends in Pakistan.

The indicator is computed on a weekly basis to assess price movements of essential items at shorter intervals, enabling policymakers to review the country's price situation in near real-time.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,755.97 219.81M | 1.33% 2417.85 |

| ALLSHR | 111,116.36 501.13M | 1.38% 1507.55 |

| KSE30 | 56,679.97 80.32M | 1.35% 752.81 |

| KMI30 | 261,996.12 77.34M | 1.74% 4468.26 |

| KMIALLSHR | 71,491.35 244.08M | 1.60% 1123.12 |

| BKTi | 53,291.56 20.30M | 1.13% 594.72 |

| OGTi | 38,769.59 12.69M | 1.75% 667.53 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 82,765.00 | 84,945.00 81,210.00 | -1290.00 -1.53% |

| BRENT CRUDE | 69.00 | 69.73 67.79 | 0.60 0.88% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.35 -2.64% |

| ROTTERDAM COAL MONTHLY | 98.80 | 0.00 0.00 | -0.15 -0.15% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.88 | 65.87 63.64 | -0.54 -0.83% |

| SUGAR #11 WORLD | 14.56 | 14.71 14.55 | -0.14 -0.95% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks