Weekly Market Roundup

MG News | February 01, 2026 at 07:23 PM GMT+05:00

February 1, 2026 (MLN): The Pakistan Stock Exchange (PSX) ended the outgoing week on a decisively bearish note, as the benchmark KSE-100 Index fell 4,992.34 points, or 2.64% WoW, closing at 184,174.49, compared to 189,166.83 at the end of the previous week.

The market downturn was fueled by heightened geopolitical

uncertainty alongside a disappointing corporate earnings development, which

dampened investor confidence.

Sentiment took a further hit after Fauji

Fertilizer Company’s (FFC) results missed expectations, primarily due to

pressure on gross margins, triggering heavy selling in index-heavy stocks._20260201141829496_9a3760.jpeg)

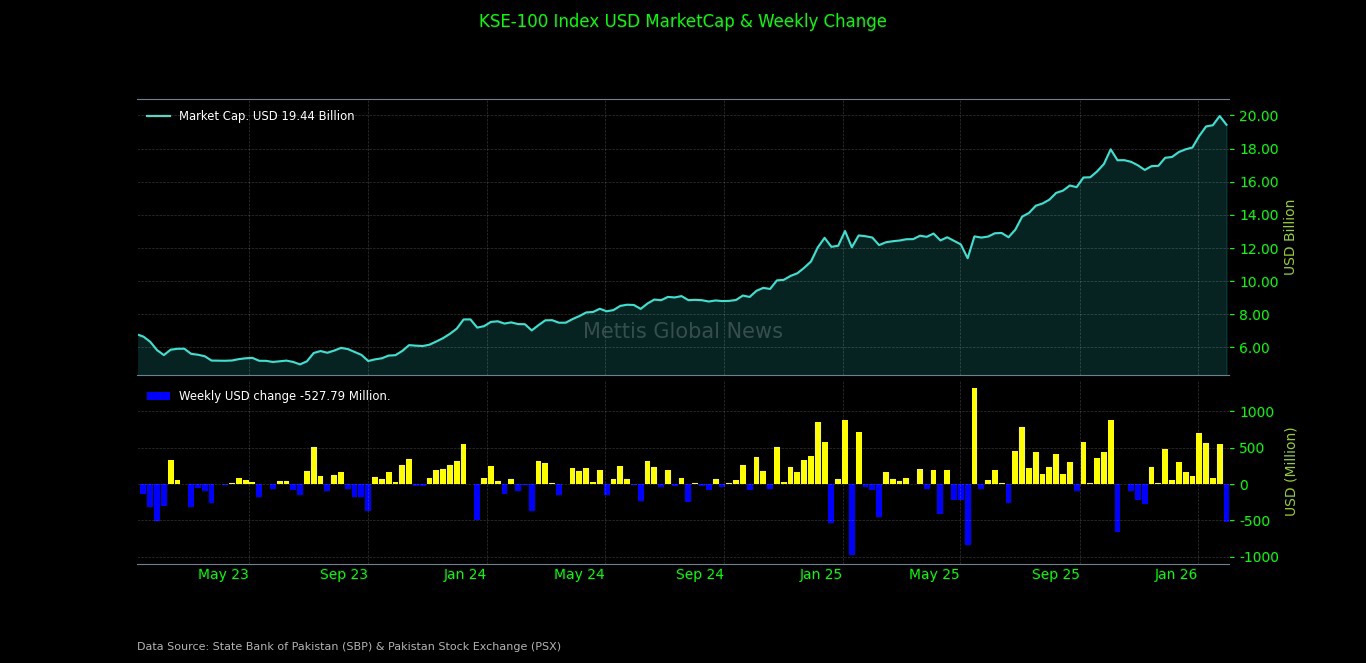

Market Capitalization

In terms of market capitalization, total market cap

in rupee terms declined to Rs5.44 trillion, down from Rs5.59tr last

week.

This translates into a loss of approximately Rs149.5bn,

or 2.67% WoW, largely in line with the benchmark’s decline, showing

widespread selling in index-heavy stocks.

In dollar terms, market capitalization fell to $19.44bn

from $19.97bn, marked a decline of $527.9m, or 2.64% WoW.  Consequently, USD returns for the week turned negative at

-2.61%, compared to +2.23% in the previous week, indicated weaker

foreign-adjusted equity performance despite minimal currency volatility.

Consequently, USD returns for the week turned negative at

-2.61%, compared to +2.23% in the previous week, indicated weaker

foreign-adjusted equity performance despite minimal currency volatility.

_20260201141802310_b21890.jpeg) On the macroeconomic front, scheduled banks’ deposits

grew 5.8% MoM to Rs37.43tr

in December (up 23.6% YoY), while advances rose 10.9% MoM to Rs14.88tr but

stayed 7.1% lower YoY, pushing ADR to 39.8%, as investments increased 3.2% MoM

to Rs37.91tr with IDR at 101.3%.

On the macroeconomic front, scheduled banks’ deposits

grew 5.8% MoM to Rs37.43tr

in December (up 23.6% YoY), while advances rose 10.9% MoM to Rs14.88tr but

stayed 7.1% lower YoY, pushing ADR to 39.8%, as investments increased 3.2% MoM

to Rs37.91tr with IDR at 101.3%.

The SBP

bought $1.033bn from the interbank FX market in October 2025, taking total

purchases in 4MFY26 to $2.5bn lower than $3.26bn last year while cumulative net

FX purchases since June 2024 stand at $10.76bn.

Pakistan’s Business Confidence Index rose

by 2.0 points to 55.4 in January 2026, led by improvements in both current

and expected confidence, while inflation expectations stayed flat and capacity

utilization in manufacturing edged down slightly to 66.2%.

Pakistan’s Consumer Confidence Index edged

up by 0.8 points to 41.6 in January 2026, with improvements in current and

expected economic conditions, while inflation expectations inched higher to

69.9.

The SBP kept its policy

rate unchanged at 10.5% from January 27, 2026, citing contained inflation,

improving growth momentum, stable external conditions, and rising FX reserves,

while upgrading its FY26 GDP growth outlook to 3.75–4.75% despite market

expectations of a rate cut.

The Pakistani rupee remained broadly stable, posted a

marginal appreciation during the week. The PKR strengthened slightly to Rs279.77

per USD, compared to Rs279.86 a week earlier.

Index Movers

Index movers showed a sharply negative sector-wise

performance, with selling pressure spread across most major segments.

Fertilizer stocks emerged as the largest drag,

shaving off 2,151 points from the index, primarily due to heavy losses

in key fertilizer names. This was followed by Investment Banks / Investment

Companies / Securities Companies, which subtracted 569 points, while

Cement stocks erased 521 points.

Power Generation & Distribution weighed down the

index by 422 points, and Commercial Banks contributed a further 362-point

decline, showing sustained selling in major banking names.

Additional downside pressure came from Oil & Gas

Exploration Companies (-196 points), Oil & Gas Marketing Companies

(-174 points), Pharmaceuticals (-155 points), Insurance (-114

points), and Technology & Communication (-111 points).

Losses were also recorded in Chemicals, Cable &

Electrical Goods, Food & Personal Care Products, Refinery, Engineering, and

Transport, collectively deepening the weekly correction.

On the positive side, only a few sectors provided support,

with Automobile Assemblers adding 147 points, Property contributing

110 points, and Textile Composite adding 31 points, though these

gains were insufficient to offset the broad-based selling._20260201141843540_3d162f.jpeg)

Scrip-wise, Fauji Fertilizer Company (FFC)

emerged as the single largest laggard, shaving off 1,800 points

from the KSE-100 Index.

It was followed by ENGRO Holdings (ENGROH), which

dragged the index by 518 points, and Hub Power Company (HUBC),

which contributed a 453-point decline.

Other major negative contributors included EFERT (-219

points), MCB Bank (-212 points), Lucky Cement (-146 points), PSO

(-138 points), FATIMA Fertilizer (-132 points), POL (-117 points),

MARI (-115 points), OGDC (-86 points), AICL (-114 points),

along with several cement and banking stocks, emphasized heavy selling in index

heavyweights.

On the upside, selective buying was seen in SAZEW (+138

points), PPL (+122 points), JVDC (+110 points), UBL (+95

points), MTL (+64 points), and BAFL (+48 points), providing

limited relief to the index._20260201141642692_960870.jpeg)

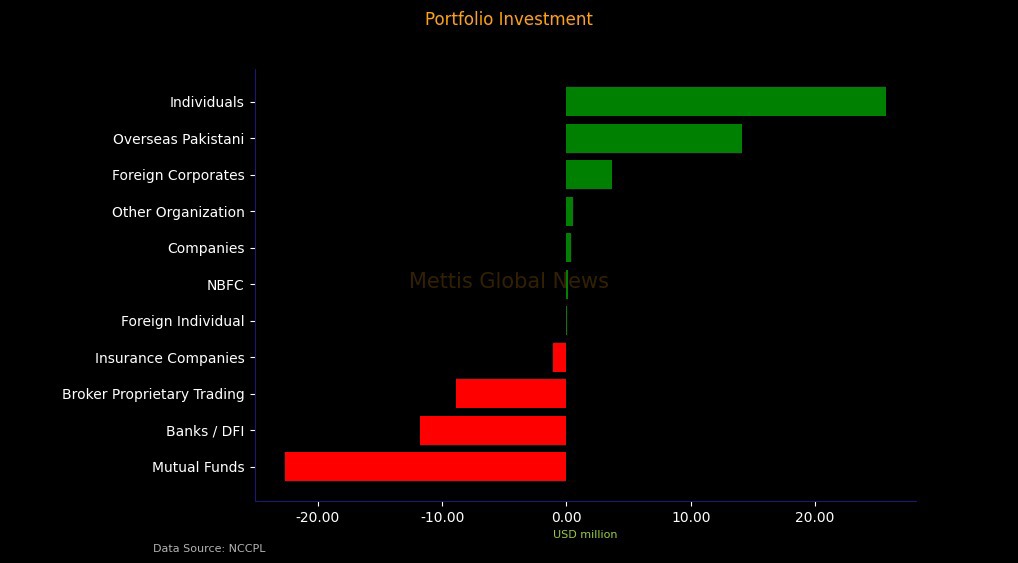

FIPI / LIPI

From an investor flow perspective, foreign investors turned net buyers, with cumulative FIPI inflows of $17.76m during the week.

Foreign investors reversed their recent selling trend,

emerging as net buyers this week with FIPI recording a net inflow of Rs4.97bn,

signaling renewed confidence in the market.

Buying was largely driven by overseas Pakistanis, who

recorded net inflows of $14.08m, followed by foreign corporates

with $3.68m, while foreign individuals remained broadly neutral.

In contrast, local investors emerged as net sellers,

as LIPI recorded net outflows of $17.76m.

Selling was led by mutual funds ($22.67m), banks/DFIs

($11.81m), and broker proprietary trading ($8.91m), which outweighed

net buying by individual investors ($25.71m) and marginal inflows from

companies and other organizations.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 184,174.49 344.20M | 1.01% 1836.37 |

| ALLSHR | 110,725.47 802.30M | 1.02% 1116.66 |

| KSE30 | 56,462.88 128.04M | 0.96% 535.72 |

| KMI30 | 261,050.23 116.63M | 1.37% 3522.37 |

| KMIALLSHR | 71,230.99 382.91M | 1.23% 862.76 |

| BKTi | 53,229.04 40.62M | 1.01% 532.20 |

| OGTi | 38,590.42 18.06M | 1.28% 488.37 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 84,560.00 | 0.00 0.00 | 455.00 0.54% |

| BRENT CRUDE | 69.83 | 70.21 67.79 | 0.24 0.34% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -0.90 -0.99% |

| ROTTERDAM COAL MONTHLY | 103.70 | 103.70 99.40 | 4.90 4.96% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.74 | 0.00 0.00 | 0.53 0.81% |

| SUGAR #11 WORLD | 14.26 | 14.71 14.15 | -0.44 -2.99% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Total Advances, Deposits & Investments of Scheduled Banks

Total Advances, Deposits & Investments of Scheduled Banks