Weekly Market Roundup

MG News | December 14, 2025 at 09:21 AM GMT+05:00

December 14, 2025 (MLN): The Pakistan Stock Exchange extended its upward momentum during the week as the benchmark KSE-100 Index climbed from 167,086 points last week to 169,865 points, registering a strong gain of 2,779 points, or 1.66% on a week-on-week basis.

The rally reflected sustained investor confidence, supported by improving macro signals and clarity on external financing, which helped the market remain resilient despite selective sector-wise profit-taking.

_20251214041449561_08a9cc.jpeg)

Market Cap:

Market capitalization mirrored the index performance, rising to Rs4.99 trillion this week from Rs4.91 trillion last week.

This translates into a week-on-week increase of around 1.66%, indicating that the index gains were broad-based and supported by value accretion across key sectors rather than isolated price movements.

In dollar terms, total market capitalization improved to $17.79 billion compared to $17.49 billion in the previous week, posting a week-on-week increase of nearly 1.70%.

The rise in USD market cap was aided by both equity market gains and marginal appreciation in the Pakistani rupee, reinforcing foreign-currency-adjusted returns.

_20251214041517609_5424bc.jpeg)

From a returns perspective, USD-based market returns improved meaningfully to 1.70% this week, a sharp acceleration from last week’s modest 0.28% gain.

_20251214041458959_bcc544.jpeg)

Key macro developments largely drove positive sentiment throughout the week.

These included the approval of a $1.2 billion disbursement under the IMF’s Extended Fund Facility (EFF) second review, alongside the first tranche under the Resilience and Sustainability Facility (RSF).

On the macroeconomic front, remittance inflows remained supportive. Overseas Pakistanis sent $3.19 billion in November 2025, a 9% year-on-year increase from $2.92 billion in November 2024.

However, on a month-on-month basis, remittances declined by 7%, indicating some seasonal normalization.

In the money market, the State Bank of Pakistan (SBP) raised a combined Rs1.172 trillion in its latest auction of Market Treasury Bills (MTBs) and 10-year Pakistan Investment Bond – Floating Rate (PIB-PFL).

Sectoral data showed mixed trends in the real economy. The sales of cars, including LCVs, vans, and jeeps, in Pakistan increased by 51.9% in November 2025, clocking in at 15,442 units compared to 10,163 units recorded in the same month of last year.

On the external buffers side, SBP-held foreign exchange reserves rose by $12 million to $14.6 billion during the week, while reserves held by commercial banks also increased by $12 million to $5.02 billion.

The Pakistani rupee strengthened slightly by 0.036% on a week-on-week basis, closing at PKR 280.32 per US dollar, which further supported USD-adjusted equity returns.

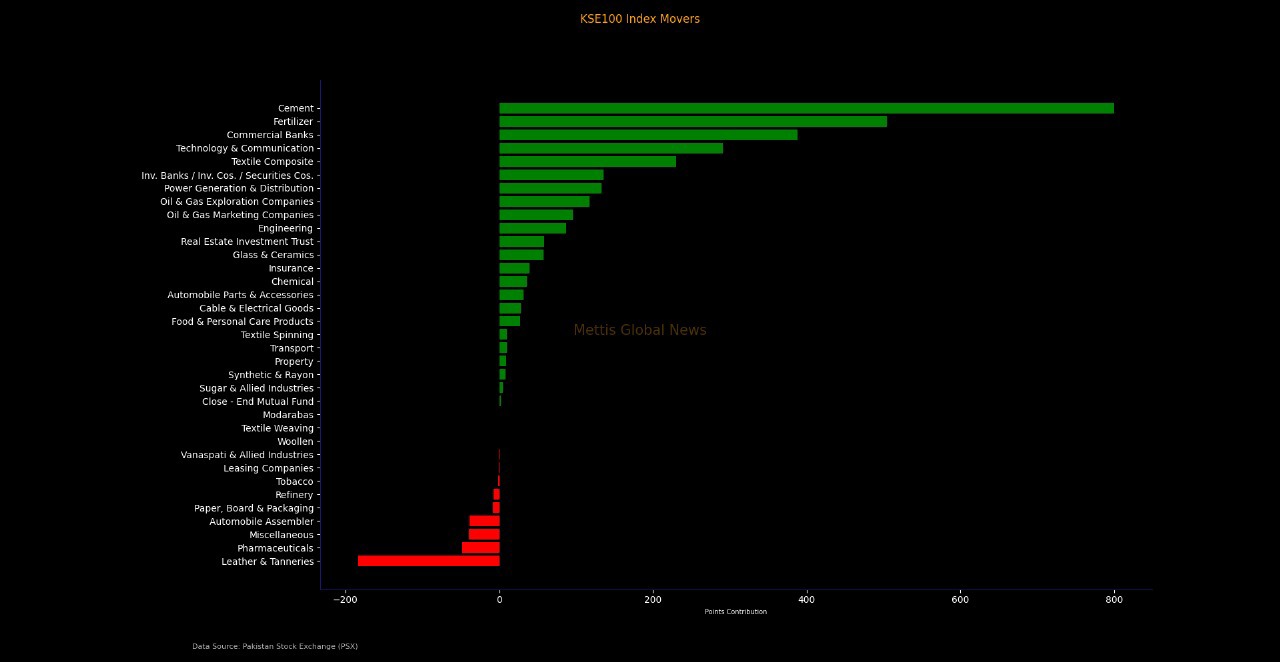

Index Movers:

Sector-wise performance on the PSX was largely positive, led by heavyweight sectors.

Cement, Fertilizer, Commercial Banks, Technology & Communication, and Power Generation & Distribution emerged as major contributors to index gains, supported by strong volumes and renewed institutional interest.

Oil & Gas Exploration and Marketing Companies also posted solid gains, reflecting stability in energy prices and improving sentiment around sector earnings.

On the downside, selective pressure was observed in Leather & Tanneries, Pharmaceuticals, Automobile Assemblers, Refineries, and Paper & Packaging, largely due to profit-taking and stock-specific factors.

In terms of stock-level contribution, FFC, SYS, MLCF, LUCK, NML, and MCB were among the top contributors to the index’s upward movement, alongside notable support from cement, banking, and technology names.

Conversely, stocks such as SRVI, TRG, PSEL, SAZEW, and FATIMA weighed on the index, though their impact was insufficient to offset broader market strength.

_20251214041527126_f35d63.jpeg)

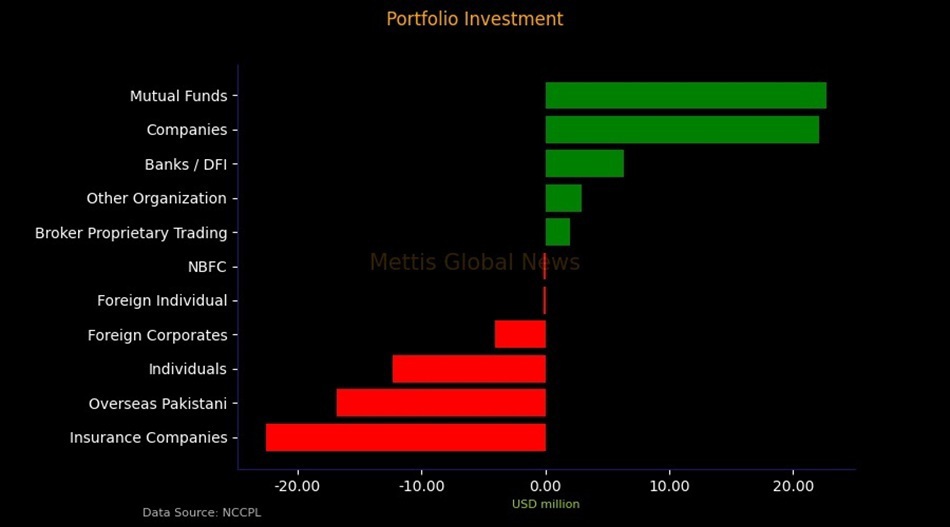

FIPI/LIPI:

Investor participation showed a clear divergence between foreign and local investors.

Foreign investors remained net sellers, with a cumulative outflow of $21.07 million, led primarily by overseas Pakistanis and foreign corporates. In contrast, local investors stepped in decisively, with net buying of $21.07 million.

Mutual funds and companies were the largest buyers, while insurance companies and individuals booked profits, reflecting portfolio rebalancing amid rising prices.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,496.10 196.19M | -2.30% -3714.58 |

| ALLSHR | 94,227.01 359.74M | -1.95% -1870.28 |

| KSE30 | 48,330.20 95.67M | -2.92% -1451.54 |

| KMI30 | 224,687.33 101.59M | -2.56% -5909.78 |

| KMIALLSHR | 60,839.09 199.88M | -2.16% -1344.18 |

| BKTi | 45,489.96 23.93M | -2.22% -1033.26 |

| OGTi | 32,083.47 15.22M | -1.82% -594.75 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,400.00 | 71,645.00 67,860.00 | -3130.00 -4.38% |

| BRENT CRUDE | 93.32 | 94.64 83.16 | 7.91 9.26% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 129.00 123.00 | 3.55 2.88% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 91.27 | 92.61 78.24 | 10.26 12.67% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes