Weekly Market Roundup

MG News | November 09, 2025 at 12:58 AM GMT+05:00

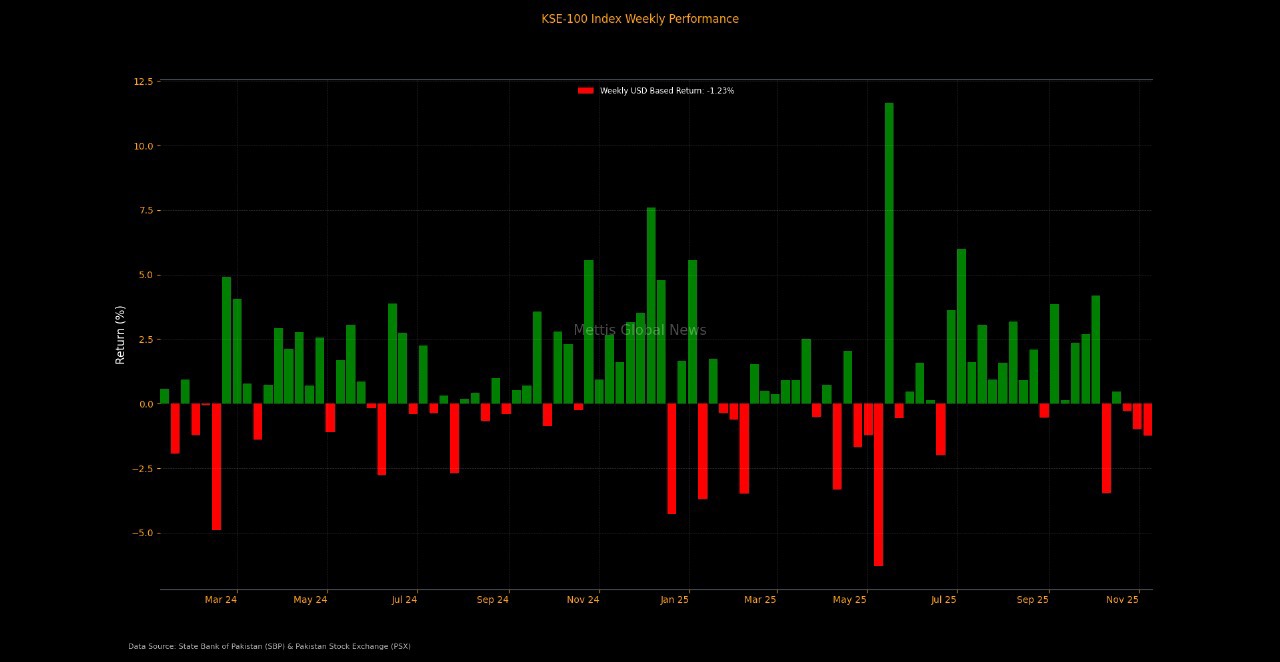

November 08, 2025 (MLN): The benchmark KSE-100 Index began the week on a negative note, extending its downward momentum as investors opted for profit-taking following weeks of strong performance.

However, a late-week rebound on Friday helped the index recover part of its earlier losses.

By week’s end, the index closed at 159,593 points, down by 2,038 points or 1.3% WoW.

The overall sentiment remained cautious as the market consolidated amid concerns over inflation and rising secondary market yields.

Market capitalization also reflected the decline, falling to Rs4.69 trillion ($16.71 billion) from Rs4.77tr ($16.99bn) a week earlier._20251108192751709_18ef16.jpeg)

In dollar terms, the market posted a -1.23% weekly return, compared to -0.98% last week, indicating a slightly sharper dip in foreign investor value terms.

Inflation figures added to investor unease, with the Consumer Price Index (CPI) for October 2025 climbing to 6.2% YoY, the highest reading since October 2024, up from 5.6% in September 2025.

The uptick was attributed to seasonal food price increases and adjustments in energy tariffs.

Remittances provided a bright spot for the economy. In October 2025, inflows from overseas Pakistanis increased 12% YoY to $3.42bn (up from $3.05bn in October 2024) and rose 7% MoM.

However, trade data continued to raise red flags. According to the Pakistan Bureau of Statistics (PBS), the trade deficit widened to $3.2bn in October 2025.

Despite these headwinds, the Pakistani Rupee showed remarkable stability, appreciating marginally by 0.03% against the US dollar, closing the week at PKR 280.8.

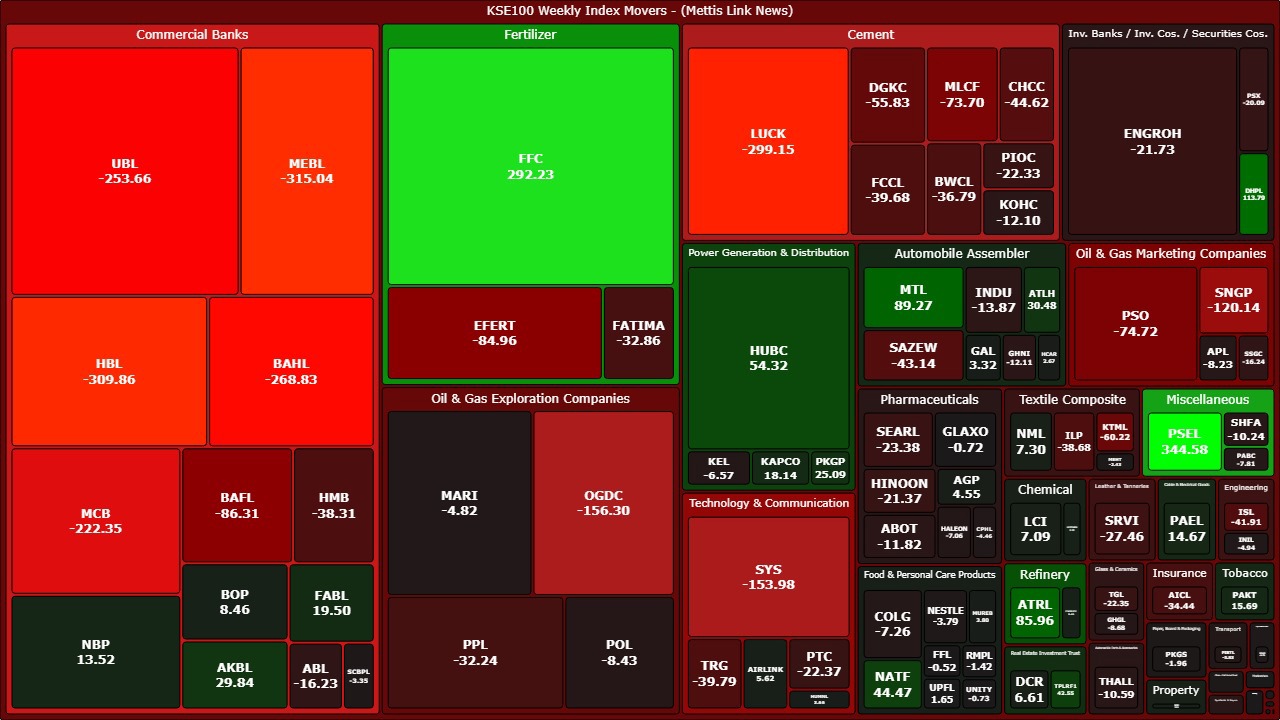

Index Movers

Among the major sectors, Commercial Banks were the biggest drag on the index, contributing a hefty 1,443-point decline due to heavyweights such as HBL (-309.9 pts), MEBL (-315.0 pts), and UBL (-253.7 pts).

Cement, Oil & Gas Marketing, and Technology also saw notable weakness amid profit-taking, losing 584 pts, 219 pts, and 207 pts, respectively. The Oil & Gas Exploration sector shed 202 pts.

On the positive side, select sectors provided some cushion to the index. Fertilizer, Refinery, and Power Generation & Distribution posted gains of 174 pts, 94 pts, and 91 pts, respectively, as investors rotated funds into defensive counters.

The Miscellaneous sector also added 327 pts, reflecting renewed interest in smaller-cap plays._20251108192639990_341b88.jpeg)

In terms of individual scrip performance, PSEL (+345 pts), FFC (+292 pts), and DHPL (+114 pts) emerged as top gainers.

Other notable contributors included MTL, ATRL, HUBC, and NATF. On the losing side, large-cap names such as HBL, MEBL, UBL, LUCK, and MCB were the main laggards.

FIPI/LIPI:

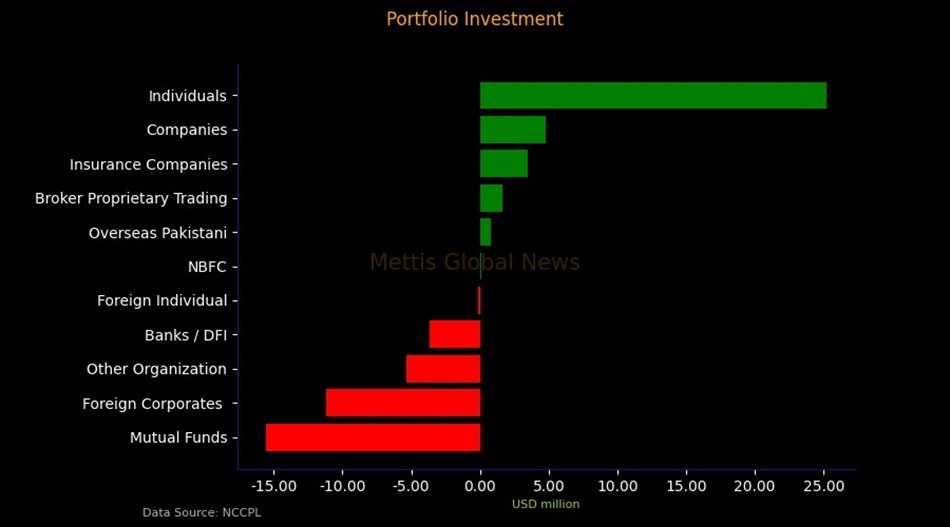

Foreign participation remained muted during the week. Foreign corporates offloaded $11.2 million, while foreign individuals sold $0.14m, bringing the total net FIPI outflow to $10.57m.

On the local front, individual investors and companies were the key buyers, with net purchases of $25.2m and $4.8m, respectively.

However, mutual funds continued their selling streak, offloading $15.6m, likely driven by redemptions and profit-taking.

The net balance of flows showed that locals absorbed foreign selling, helping the market avoid steeper losses and setting a stage for possible recovery in the coming sessions.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,202.86 341.59M | -0.20% -384.80 |

| ALLSHR | 112,423.22 745.46M | -0.07% -79.96 |

| KSE30 | 57,956.48 141.89M | -0.12% -70.41 |

| KMI30 | 267,375.33 135.18M | -0.39% -1043.48 |

| KMIALLSHR | 72,363.20 391.84M | -0.20% -146.78 |

| BKTi | 53,485.97 53.11M | 0.26% 139.85 |

| OGTi | 38,916.61 17.01M | 0.72% 278.13 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,690.00 | 88,985.00 87,550.00 | 105.00 0.12% |

| BRENT CRUDE | 66.17 | 66.78 65.00 | 0.58 0.88% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.65 -2.96% |

| ROTTERDAM COAL MONTHLY | 99.00 | 0.00 0.00 | 0.30 0.30% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.22 | 61.86 60.14 | 0.59 0.97% |

| SUGAR #11 WORLD | 14.93 | 14.98 14.74 | 0.14 0.95% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market