Weekly Market Roundup

MG News | October 04, 2025 at 11:58 PM GMT+05:00

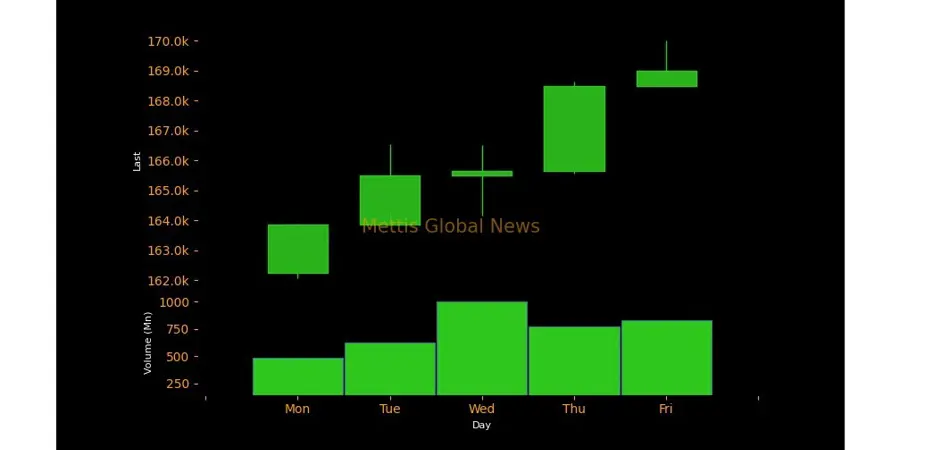

October 04, 2025 (MLN): The benchmark KSE-100 Index closed the week on a strong note at 168,990 points, gaining 6,733 points or 4.15% week-on-week.

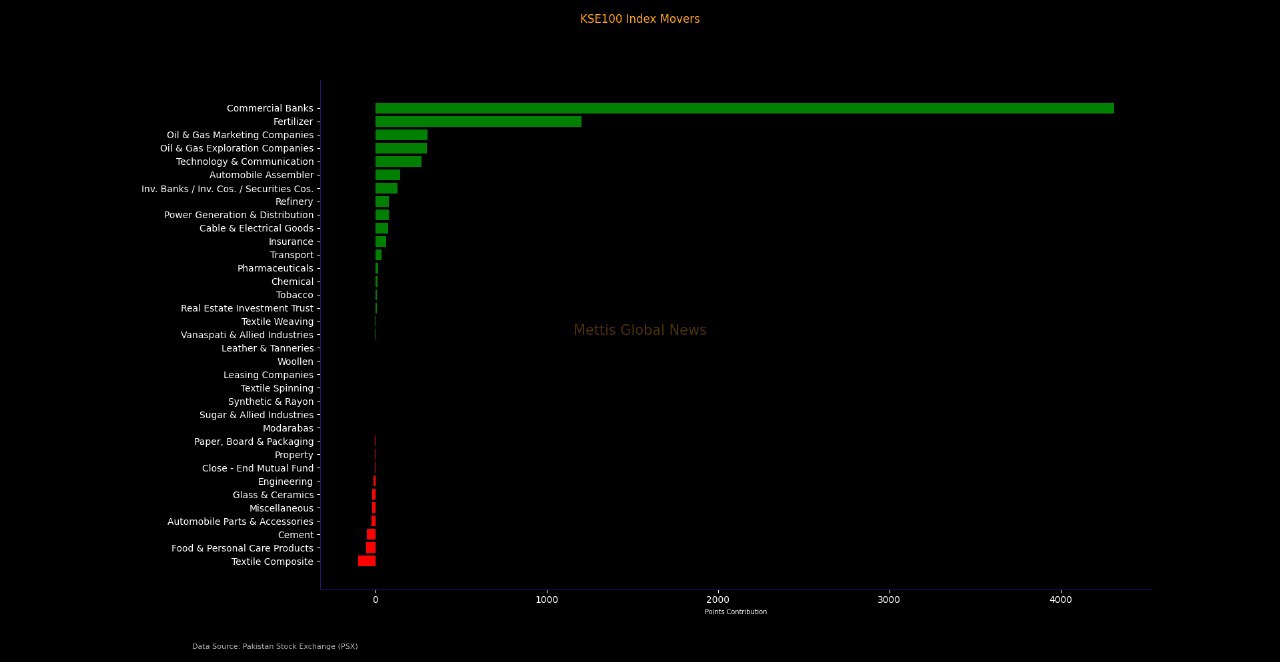

The rally was driven largely by commercial banks, fertilizer producers, and oil marketing companies, which together added more than 5,800 points to the index.

The KSE-100 market capitalization stood at Rs5.04trillion, up 5.15% from the previous week’s Rs4.8tr.

The strong uptick highlights improving investor confidence, particularly as gains came on the back of heavyweights in the financial and fertilizer sectors._20251004185852826_d55030.jpeg)

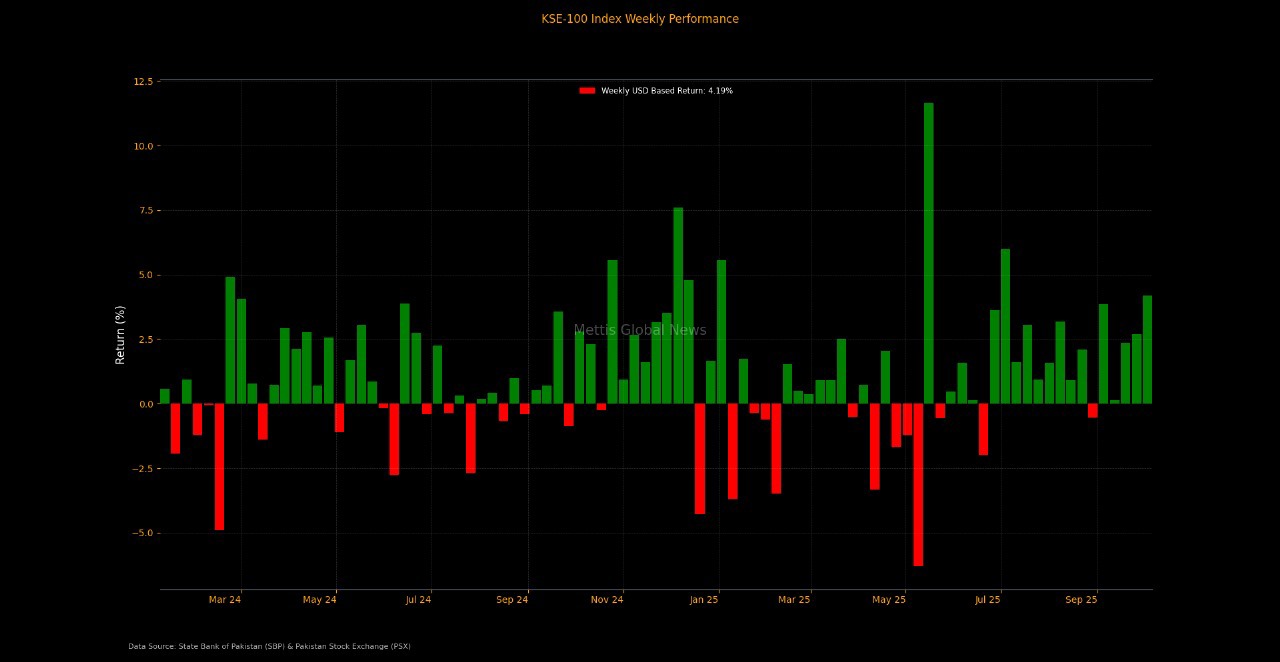

In dollar terms, the KSE-100 delivered a weekly return of 4.18%, a notable acceleration from 2.7% in the prior week.

The rise in USD-adjusted performance emphasized the market’s resilience, given the largely stable exchange rate and growing participation from local institutions and individuals.

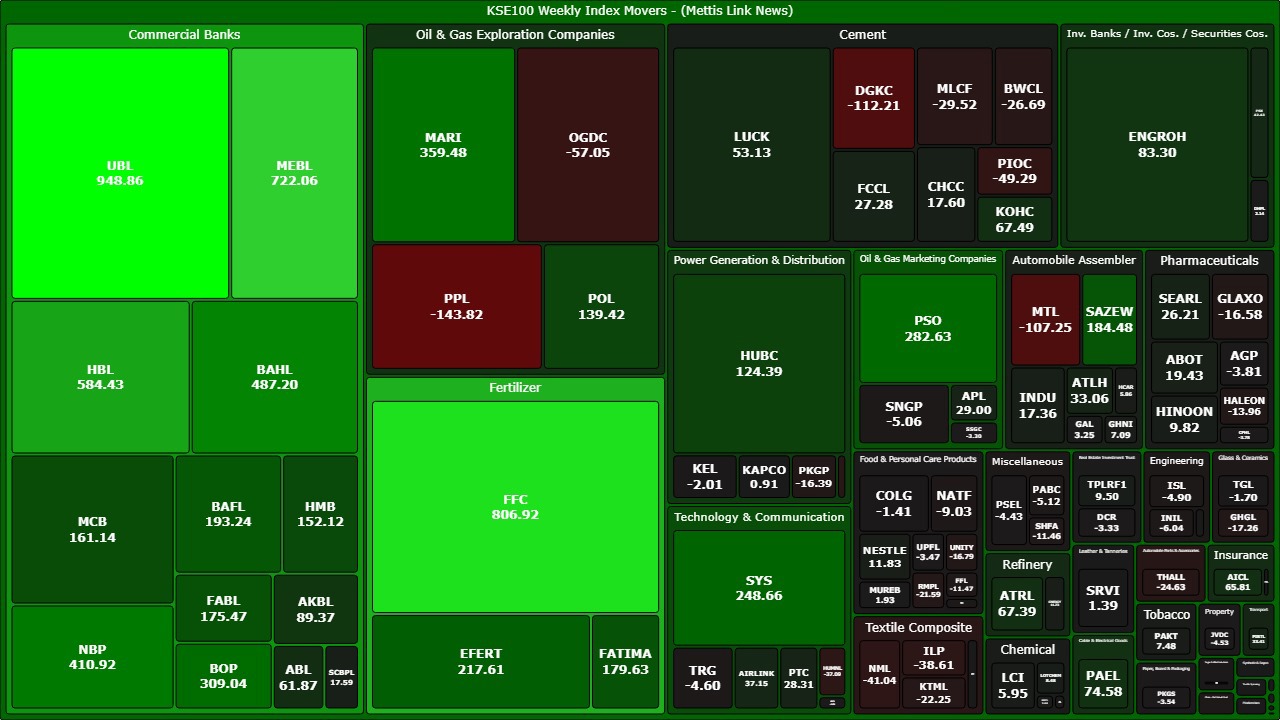

Commercial banks were the biggest contributors, lifting the index by 4,313 points, followed by fertilizers with a 1,204-point gain and OMCs adding 303 points.

Among individual stocks, United Bank Limited was the star performer, contributing nearly 949 points, while Fauji Fertilizer Company and Meezan Bank added 807 and 722 points, respectively.

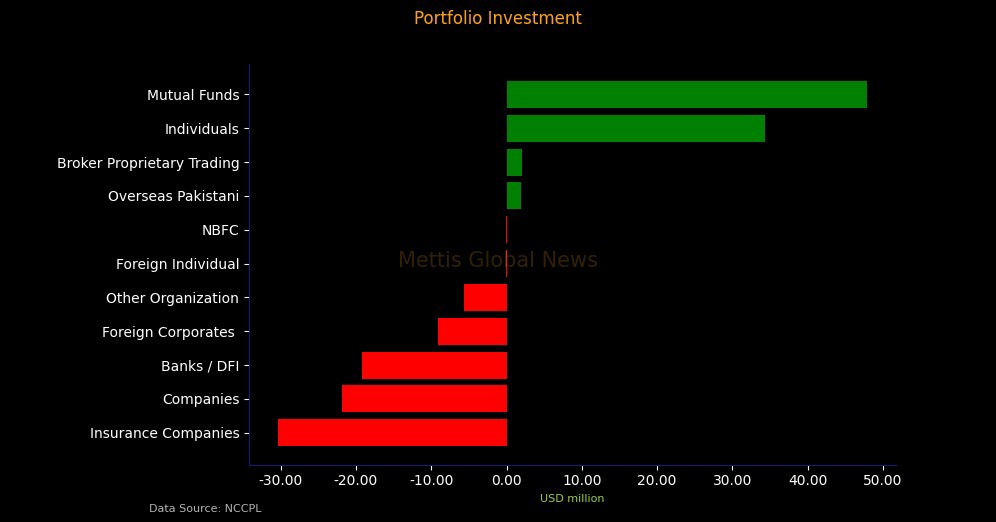

Foreign investors, however, continued to trim exposure, offloading equities worth $7.24 million.

The bulk of the selling came from foreign corporates, which shed $9.16 million, while overseas Pakistanis provided some support with net buying of $1.92 million.

Local investors were net buyers, led by mutual funds with $47.9 million and individual investors with $34.3 million in inflows.

On the other side, insurance firms and companies booked profits, selling shares worth $30.3 million and $21.9 million, respectively.

On the macro front, Pakistan has successfully repaid its $500 million International Bond (Eurobond) that matured on September 30, 2025, meeting its obligations to global investors on schedule.

September inflation accelerated sharply to 5.6% YoY compared with 3% in August, driven by food and energy prices.

The State Bank of Pakistan (SBP) raised Rs977.19 billion through its treasury bills and Pakistan Investment Bonds auctions, indicating sustained government borrowing from the domestic market to meet fiscal requirements.

External balances came under pressure as the trade deficit widened to $3.3 billion in September.

The Central Bank made a net purchase of $502m from the interbank foreign exchange market in June 2025, bringing total purchases in FY25 to $7.684bn.

The rupee ended the week almost flat, appreciating 0.03% to close at 281.37 against the dollar.

Despite rising inflation and a ballooning trade deficit, equities continued to ride on liquidity and sectoral momentum, with banks and fertilizers sustaining the market’s upward drive.

Investors, however, remain watchful of macro headwinds that could test the durability of this rally in the coming weeks.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 163,018.66 138.30M | 0.05% 81.72 |

| ALLSHR | 98,973.80 403.59M | 0.17% 164.66 |

| KSE30 | 49,460.79 51.40M | 0.03% 14.97 |

| KMI30 | 233,011.03 39.62M | 0.13% 295.18 |

| KMIALLSHR | 64,476.20 200.81M | 0.14% 88.53 |

| BKTi | 44,076.19 19.45M | 0.29% 129.30 |

| OGTi | 32,306.98 7.87M | 0.17% 56.15 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 84,030.00 | 88,150.00 81,485.00 | -2410.00 -2.79% |

| BRENT CRUDE | 62.34 | 63.02 62.26 | -1.04 -1.64% |

| RICHARDS BAY COAL MONTHLY | 85.00 | 0.00 0.00 | 0.25 0.30% |

| ROTTERDAM COAL MONTHLY | 96.25 | 0.00 0.00 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.88 | 58.80 57.81 | -1.12 -1.90% |

| SUGAR #11 WORLD | 14.68 | 14.80 14.58 | 0.02 0.14% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Large Scale Manufacturing (LSM)

Large Scale Manufacturing (LSM)