SBP Ramps Up Dollar Purchases Amid FX Market Stabilization Efforts

MG News | September 29, 2025 at 08:54 PM GMT+05:00

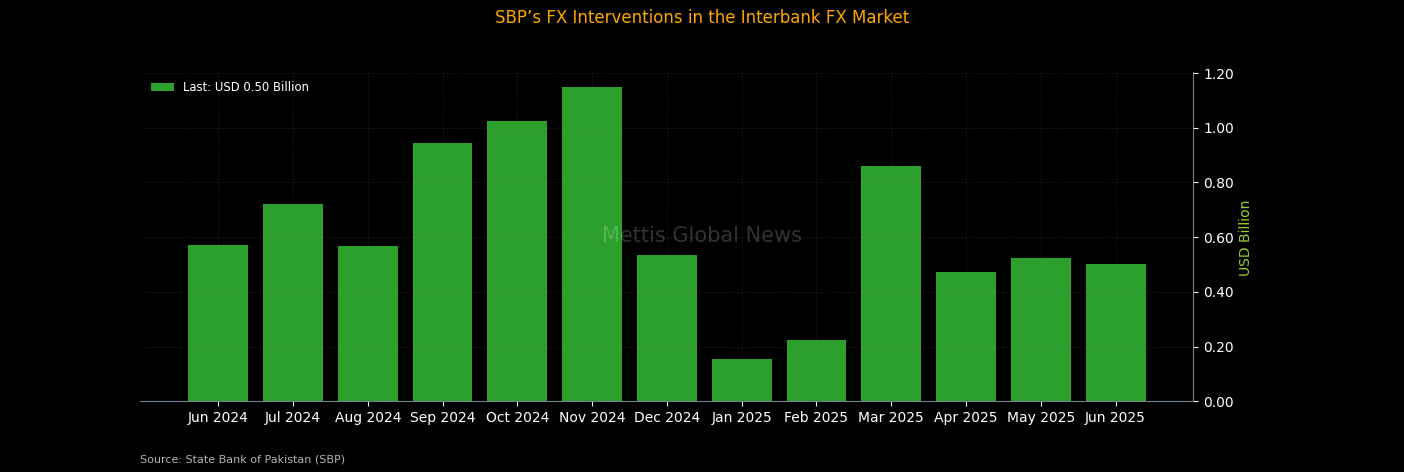

September 29, 2025 (MLN): The State Bank of Pakistan (SBP) made a net purchase of USD 502 million from the interbank foreign exchange market in June 2025, bringing total purchases in FY25 to USD 7.684 billion.

Administrative

Measures and Incentives for FX Stability

On the

administrative front, the SBP focused on both restricting outflows and

incentivizing inflows:

- Controlling Outflows: The SBP maintained a tight grip

on dollar outflows, particularly those linked to imports. While intended

to manage the current account deficit, these controls created challenges

for importers, who reported delays in accessing foreign exchange for

business operations.

- Implementing Structural Reforms: Key regulatory changes were

finalized, including reforms to foreign exchange companies. The SBP

credited these steps with enhancing stability and transparency in the

broader FX market.

- Incentivizing Inflows: To boost remittance inflows

through formal channels, the SBP introduced incentive schemes, including

reimbursing transfer charges. These initiatives aimed to reduce reliance

on informal transfer systems such as hundi and hawala.

These measures were complemented by revisions to key chapters of the Foreign Exchange Manual—covering Exports, Imports, and Remittances. Together, these steps underscore the SBP's commitment to regulating foreign currency flows in support of macroeconomic stability and the broader economic reform agenda.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 169,592.53 53.30M | -1.50% -2577.76 |

| ALLSHR | 101,832.80 117.34M | -1.59% -1643.85 |

| KSE30 | 51,915.04 19.61M | -1.41% -743.75 |

| KMI30 | 236,700.70 16.55M | -1.58% -3810.59 |

| KMIALLSHR | 64,988.14 56.91M | -1.52% -999.90 |

| BKTi | 50,291.87 8.12M | -1.41% -721.04 |

| OGTi | 33,304.17 3.19M | -0.78% -261.30 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,270.00 | 67,665.00 66,880.00 | 65.00 0.10% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.64 | 66.86 66.31 | 0.24 0.36% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account