Pakistan’s economy gains stability, growth rebounds to 3%: SBP

.jpg?width=950&height=450&format=Webp)

MG News | October 17, 2025 at 10:29 AM GMT+05:00

October 17, 2025 (MLN): Pakistan’s economy regained macroeconomic stability in FY25, marked by a sharp decline in inflation, improved external account position, and moderate growth recovery, according to the State Bank of Pakistan’s Annual Report on the State of Pakistan’s Economy 2024–25.

The report highlighted that average inflation dropped to 4.5%, an eight-year low, from 23.4% a year earlier, driven by stable exchange rates, subdued domestic demand, and lower global commodity prices.

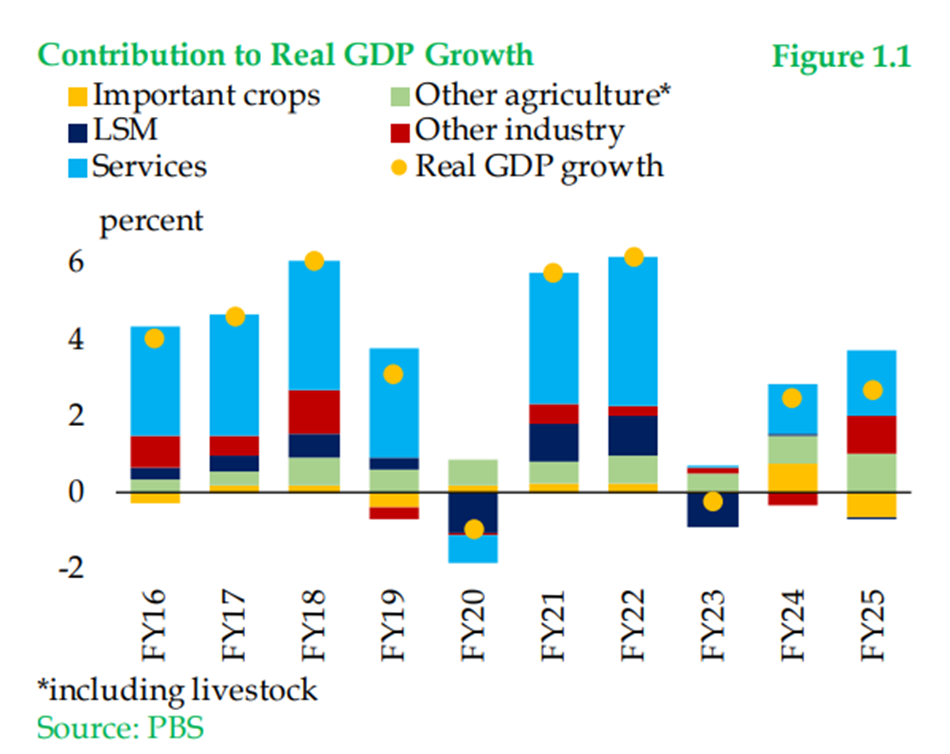

Meanwhile, real GDP grew by 3.0%, up from 2.6% in FY24, primarily driven by the recovery in services and industry.

The current account balance (CAB) posted a record surplus of $2.1 billion, the first in 14 years, as a strong surge in workers’ remittances to $38.3bn offset a widening trade deficit.

Fiscal consolidation also gained momentum, as the fiscal deficit declined to 5.4% of GDP, the lowest in nine years, while the primary surplus expanded to 2.4% from 0.9% in FY24.

Agricultural output slowed to 1.5%, hit by erratic rainfall, dry spells, and seed shortages. Major crops such as wheat, cotton, and rice declined, while output of pulses, oilseeds, and vegetables increased.

Industrial activities showed revival, growing 5.3%, led by electricity, gas, and construction sectors. However, large-scale manufacturing (LSM) contracted marginally by 0.7%, reflecting subdued domestic demand and high input costs.

Inflation and Monetary Policy

SBP attributed the sharp disinflation to lower food and energy prices, policy tightening, and fiscal prudence.

“The average national CPI inflation dropped below the medium-term target range of 5–7%,” the report noted.

This improved outlook allowed the Monetary Policy Committee (MPC) to slash the policy rate by 1,000 basis points between June 2024 and January 2025, bringing it down to 11% by fiscal year-end.

Fiscal and External Accounts

Revenue collection surged 26%, with both tax and non-tax revenues contributing equally. FBR’s tax collection hit a multi-year high amid the withdrawal of exemptions and rationalization of rates.

SBP’s reserves jumped to $14.5 billion by June 2025, from $9.4 billion a year earlier, aided by inflows from the IMF’s Extended Fund Facility (EFF) and bilateral lenders.

Growth Outlook

For FY26, SBP projected GDP growth between 3.25%–4.25%, warning of downside risks from recent floods in KPK and Punjab, which damaged crops and infrastructure.

While domestic stability and IMF-supported reforms improved credit ratings from Fitch, S&P, and Moody’s, SBP cautioned that inflation could temporarily exceed 7% in FY26 before stabilizing.

The current account deficit is projected between 0–1% of GDP, and fiscal deficit between 3.8–4.8%, reflecting continued consolidation efforts.

Policy Recommendations

SBP urged structural reforms to address low domestic savings, improve public sector efficiency, and reduce reliance on bank borrowing.

Key recommendations included:

-

Rationalizing subsidies, especially in the power sector

-

Improving tax administration and documentation

-

Enhancing coordination between federal and provincial spending

-

Reforming PSEs and accelerating privatization

The report also emphasized leveraging mineral resources, tourism potential, and agriculture market reforms to achieve sustainable, inclusive growth.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 154,421.43 202.93M | -0.92% -1437.05 |

| ALLSHR | 92,487.78 401.80M | -0.96% -898.05 |

| KSE30 | 47,322.74 112.52M | -1.11% -528.79 |

| KMI30 | 221,927.00 101.40M | -0.80% -1792.09 |

| KMIALLSHR | 59,889.41 199.88M | -1.08% -652.12 |

| BKTi | 44,127.70 34.85M | -1.99% -894.82 |

| OGTi | 31,715.42 8.74M | -2.31% -748.93 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 69,935.00 | 71,145.00 69,345.00 | -890.00 -1.26% |

| BRENT CRUDE | 97.56 | 101.59 95.20 | 5.58 6.07% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -10.20 -9.31% |

| ROTTERDAM COAL MONTHLY | 121.50 | 0.00 0.00 | 0.10 0.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 92.29 | 95.97 88.61 | 5.04 5.78% |

| SUGAR #11 WORLD | 14.25 | 14.43 14.23 | 0.00 0.00% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20251003092603298_af0c50_20251010094012153_327c07.webp?width=280&height=140&format=Webp)

_20260312080750658_635649.jpg?width=280&height=140&format=Webp)

Auto Numbers

Auto Numbers