PSX Closing Bell: What a Feeling!

MG News | October 31, 2025 at 05:06 PM GMT+05:00

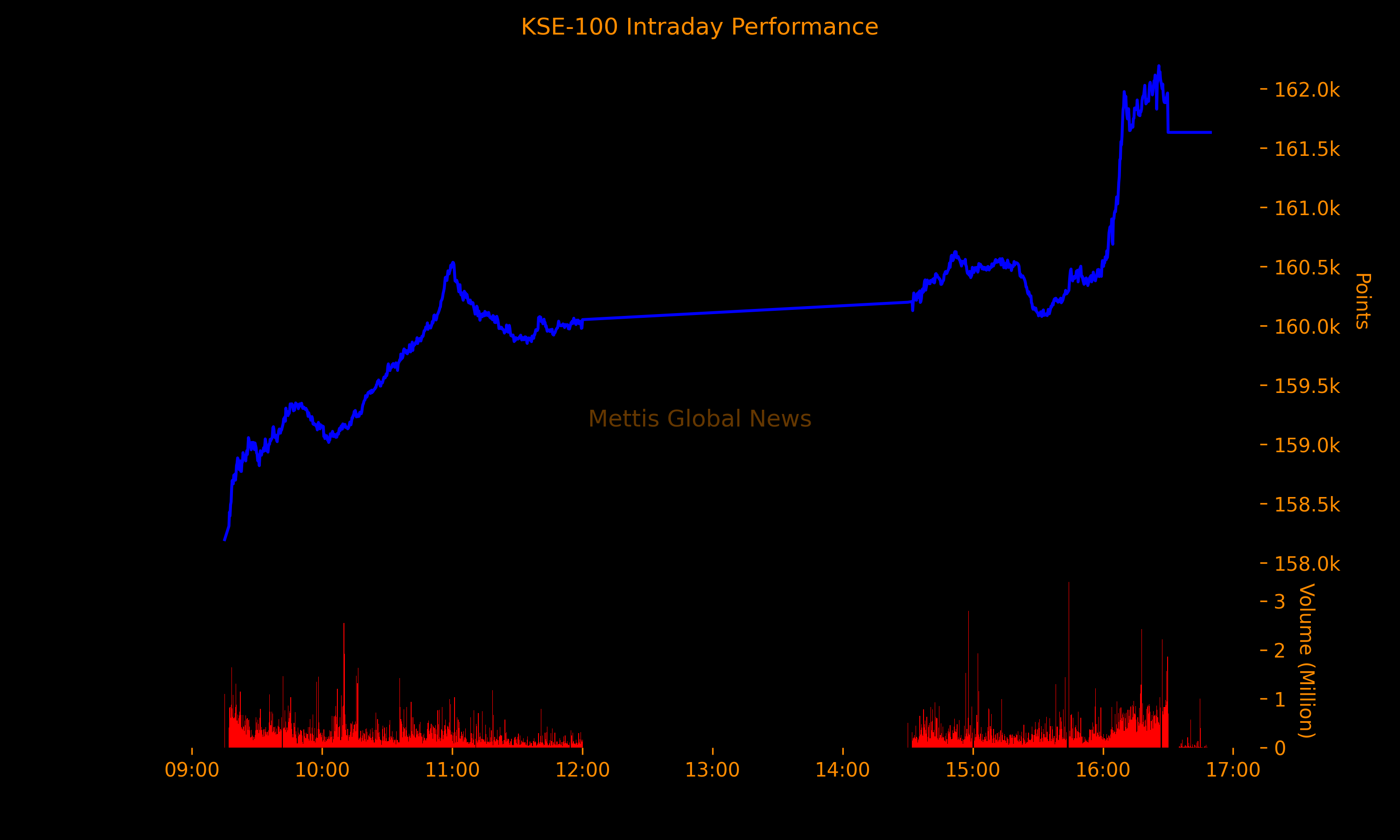

October 31, 2025 (MLN): The benchmark KSE-100 Index concluded Friday's trading session at 161,631.73, showing an increase of 4,898.86 points or 3.13%.

The index remained positive throughout the day showing an intraday high of 162,194.30 (+5,461.43) and a low of 158,195.54 (+1,462.67) points.

Yesterday, the Pakistan Stock Exchange (PSX) extended its losing streak, with the benchmark KSE-100 Index tumbling 1,732 points (1.09%) to settle at 156,733.

Investor sentiment remained weak amid rising regional tensions following the breakdown of Islamabad–Kabul talks, which dented optimism for cross-border trade and broader economic stability.

However, the market rebounded today as investor sentiment improved following news that Pakistan and Afghanistan agreed to extend their ceasefire after talks in Istanbul.

The development eased regional tension concerns and boosted hopes for stability and cross-border trade, driving renewed buying interest in the market.

The total volume of the KSE-100 Index was 408.94 million shares.

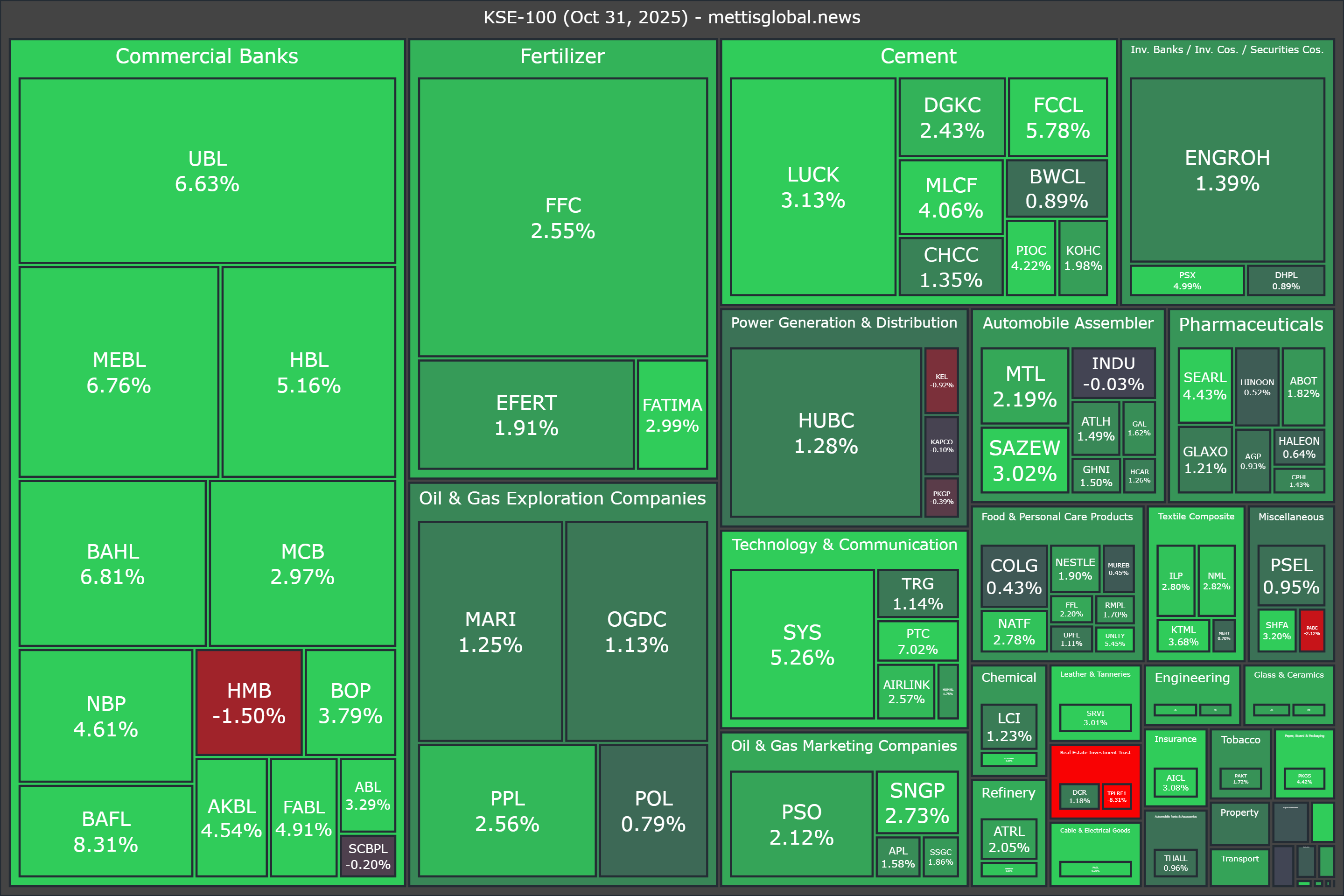

Of the 100 index companies 91 closed up, 8 closed down, while 1 were unchanged.

Top gainers during the day were PAEL (+9.29%), BAFL (+8.31%), PTC (+7.02%), BAHL (+6.81%), and MEBL (+6.76%).

On the other hand, top losers were TPLRF1 (-8.31%), PABC (-2.12%), HMB (-1.50%), KEL (-0.92%), and PKGP (-0.39%).

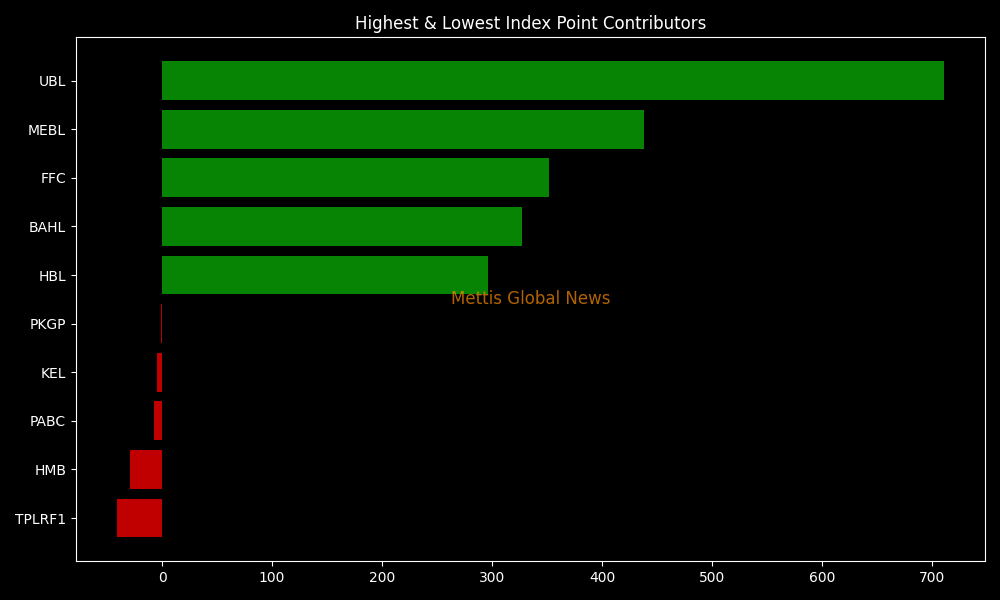

In terms of index-point contributions, companies that propped up the index were UBL (+710.40pts), MEBL (+438.48pts), FFC (+351.38pts), BAHL (+327.01pts), and HBL (+296.11pts).

Meanwhile, companies that dragged the index lower were TPLRF1 (-40.80pts), HMB (-29.07pts), PABC (-7.58pts), KEL (-4.68pts), and PKGP (-1.21pts).

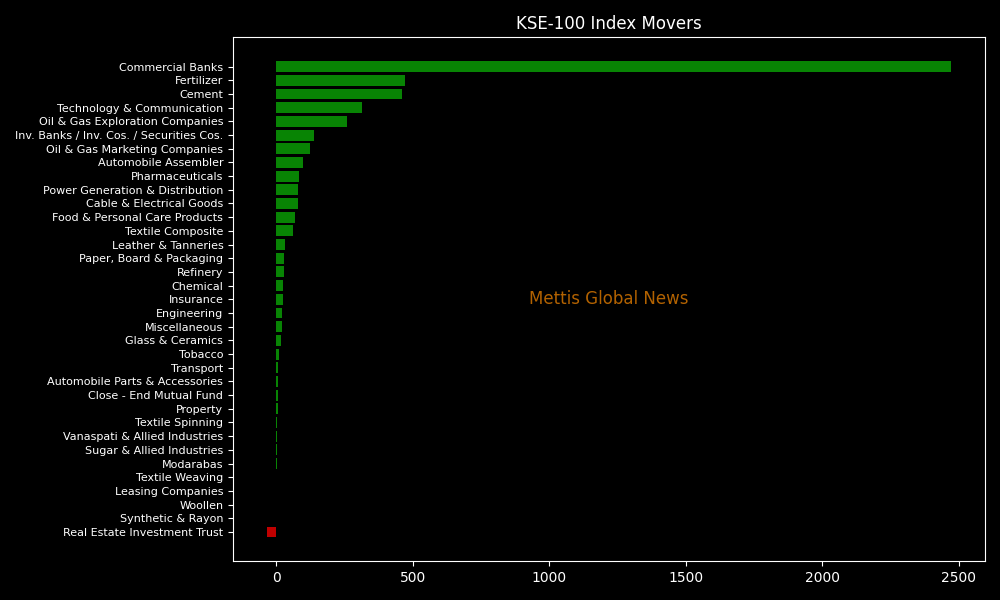

Sector-wise, KSE-100 Index was supported by Commercial Banks (+2471.42pts), Fertilizer (+471.43pts), Cement (+461.67pts), Technology & Communication (+311.91pts), and Oil & Gas Exploration Companies (+259.77pts).

While the index was let down by Real Estate Investment Trust (-33.83pts), Synthetic & Rayon (+0.00pts), Woollen (+0.16pts), Leasing Companies (+0.17pts), and Textile Weaving (+0.33pts).

In the broader market, the All-Share Index closed at 51,061.04 with a net gain of 1,508.77 points or 3.04%.

Total market volume was 952.86 million shares compared to 848.30m from the previous session while traded value was recorded at Rs42.27 billion showing an increase of Rs4.66bn.

There were 408,847 trades reported in 486 companies with 372 closing up, 77 closing down, and 37 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| WTL | 1.81 | 2.84% | 98,940,254 |

| KEL | 5.37 | -0.92% | 85,822,419 |

| BOP | 34.77 | 3.79% | 78,458,333 |

| WAVES | 14.68 | 9.31% | 40,614,705 |

| PAEL | 53.08 | 9.29% | 39,587,850 |

| BML | 6.25 | -0.48% | 38,383,389 |

| FCSC | 8.68 | 13.02% | 35,341,881 |

| PACE | 26.32 | 9.99% | 34,886,095 |

| TELE | 11.65 | 6.59% | 27,569,427 |

| TREET | 33.3 | 7.66% | 23,874,030 |

To note, the KSE-100 has gained 36,004 points or 28.66% during the fiscal year, whereas it has increased 46,505 points or 40.39% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes