PSX Closing Bell: Under Pressure

MG News | October 30, 2025 at 03:59 PM GMT+05:00

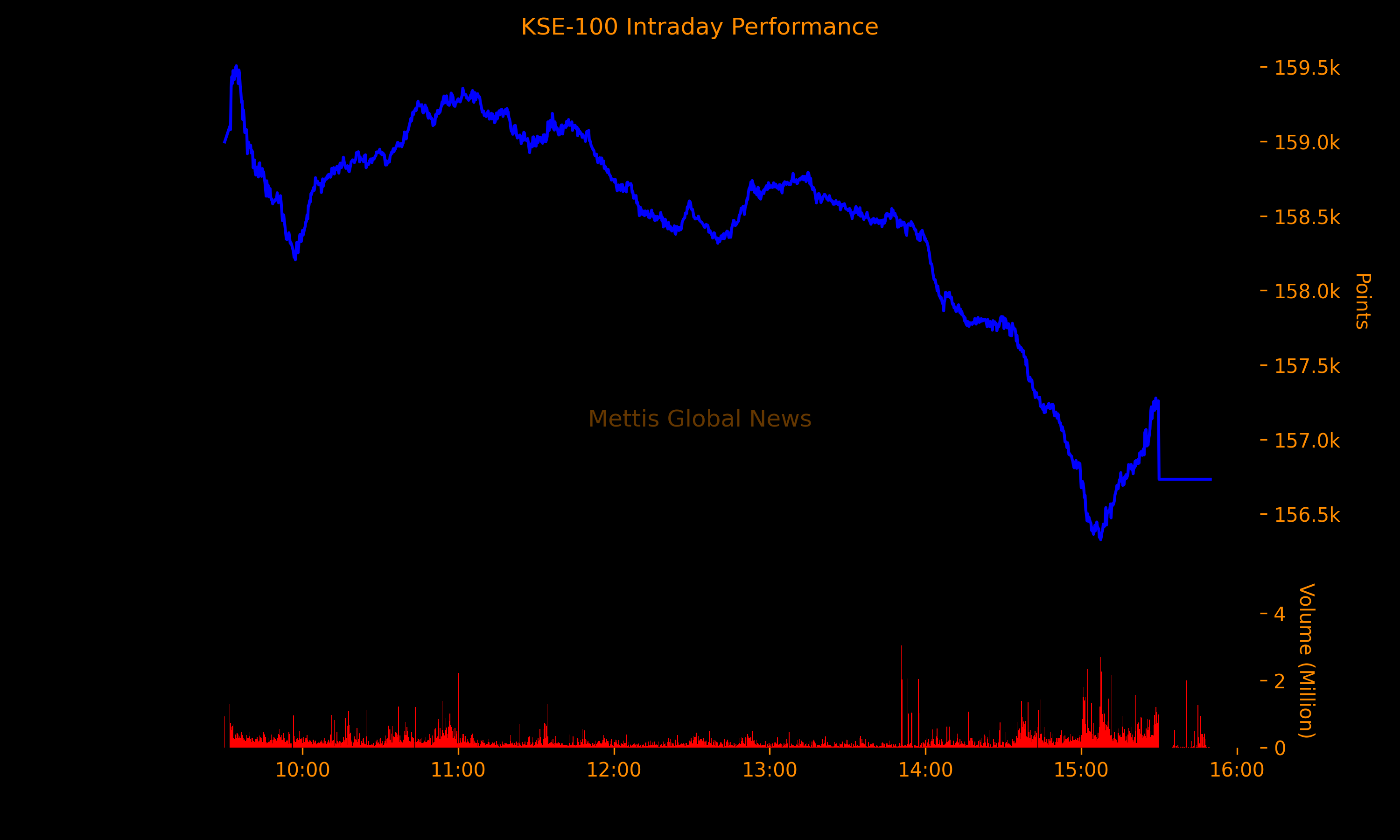

October 30, 2025 (MLN): The benchmark KSE-100 Index concluded Thursday's trading session at 156,732.87, showing a decrease of 1,732.18 points or 1.09%.

The index traded in a range of 3,179.81 points showing an intraday high of 159,507.41 (+1,042.36) and a low of 156,327.60 (-2,137.45) points.

The total volume of the KSE-100 Index was 378.02 million shares.

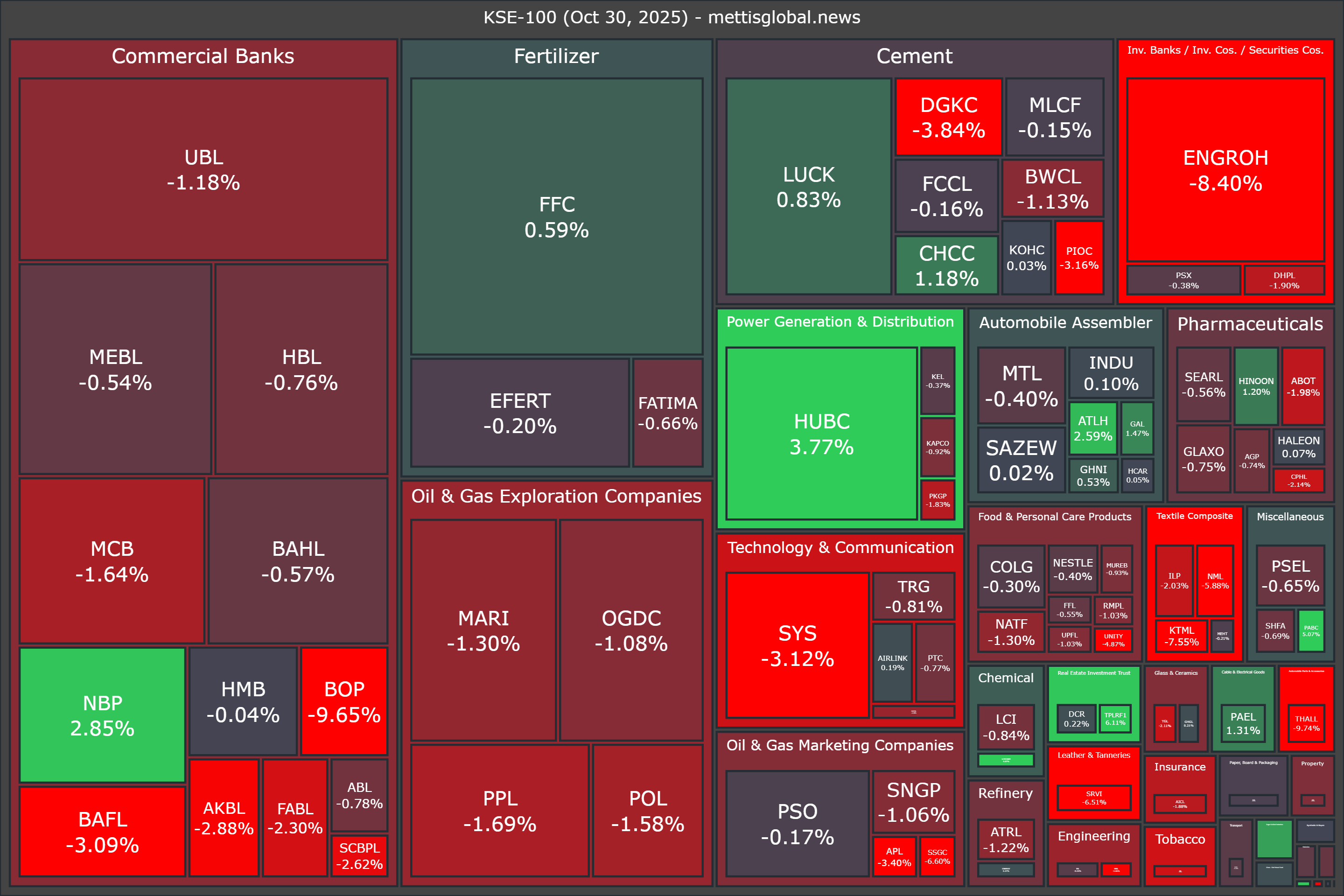

Of the 100 index companies 25 closed up, 74 closed down, while 1 were unchanged.

Top losers during the day were THALL (-9.74%), BOP (-9.65%), ENGROH (-8.40%), KTML (-7.55%), and SSGC (-6.60%).

On the other hand, top gainers were SSOM (+10.00%), TPLRF1 (+6.11%), PABC (+5.07%), LOTCHEM (+4.57%), and HUBC (+3.77%).

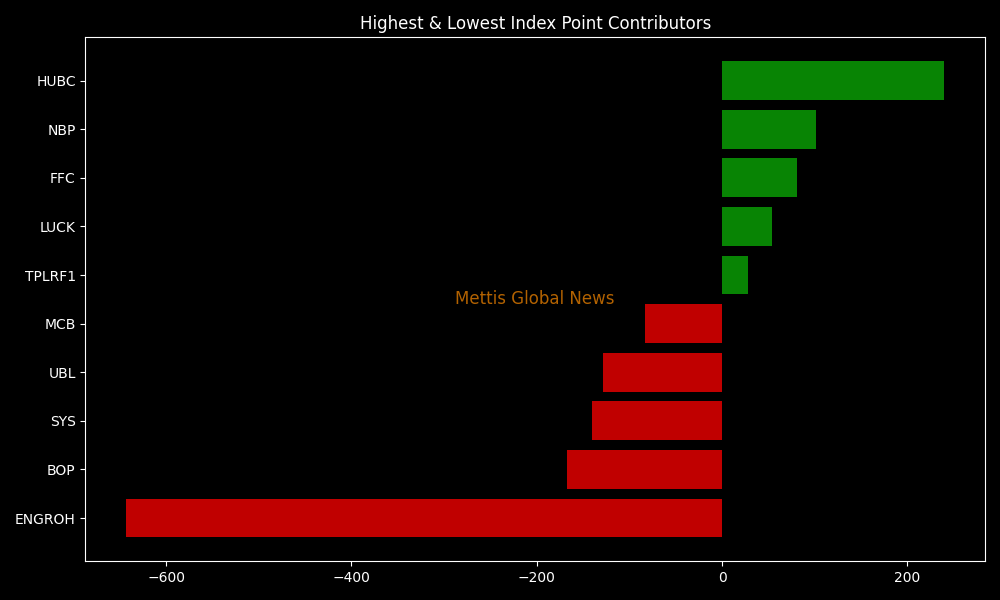

In terms of index-point contributions, companies that dragged the index lower were ENGROH (-642.95pts), BOP (-167.42pts), SYS (-140.84pts), UBL (-128.14pts), and MCB (-82.68pts).

Meanwhile, companies that added points to the index were HUBC (+239.69pts), NBP (+101.27pts), FFC (+80.62pts), LUCK (+54.29pts), and TPLRF1 (+28.26pts).

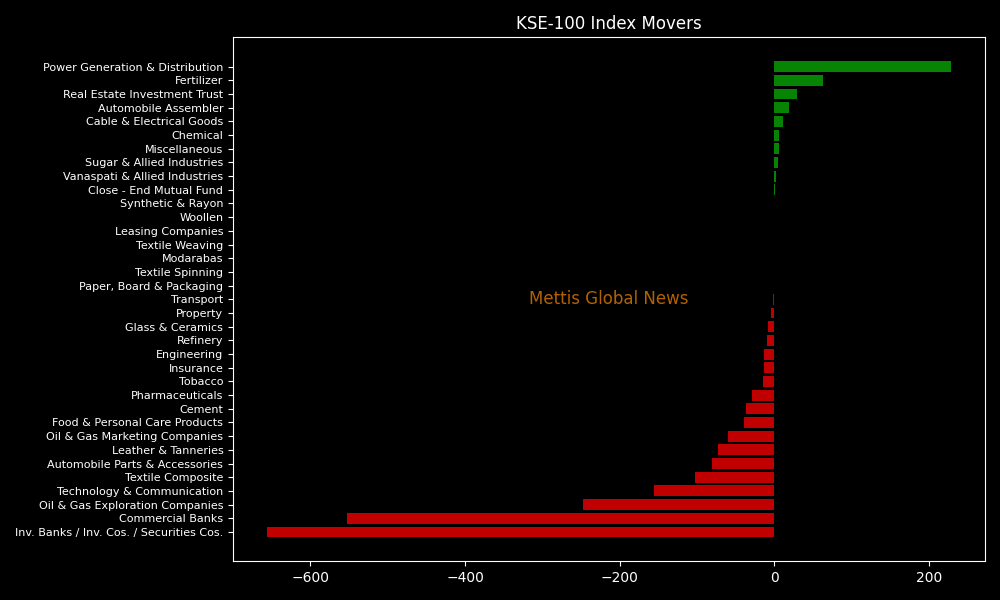

Sector-wise, KSE-100 Index was let down by Inv. Banks / Inv. Cos. / Securities Cos. (-655.64pts), Commercial Banks (-552.43pts), Oil & Gas Exploration Companies (-247.49pts), Technology & Communication (-155.82pts), and Textile Composite (-103.07pts).

While the index was supported by Power Generation & Distribution (+227.86pts), Fertilizer (+63.32pts), Real Estate Investment Trust (+29.58pts), Automobile Assembler (+18.69pts), and Cable & Electrical Goods (+10.83pts).

In the broader market, the All-Share Index closed at 49,552.27 with a net loss of 630.65 points or 1.26%.

Total market volume was 848.30 million shares compared to 951.84m from the previous session while traded value was recorded at Rs37.61 billion showing a decrease of Rs3.70bn.

There were 392,601 trades reported in 474 companies with 147 closing up, 293 closing down, and 34 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| BOP | 33.5 | -9.65% | 84,162,148 |

| WTL | 1.76 | -2.22% | 50,188,058 |

| KEL | 5.42 | -0.37% | 47,800,771 |

| WAVES | 13.43 | 8.66% | 45,684,253 |

| PAEL | 48.57 | 1.31% | 44,450,860 |

| HASCOLNC | 15.83 | 1.87% | 40,703,613 |

| CNERGY | 7.43 | 0.27% | 35,277,431 |

| FNEL | 15.43 | -1.53% | 26,214,716 |

| DSLNC | 8.89 | 1.02% | 24,369,696 |

| QUICE | 9.37 | -8.05% | 20,216,413 |

To note, the KSE-100 has gained 31,106 points or 24.76% during the fiscal year, whereas it has increased 41,606 points or 36.14% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes