SBP’s Dollar Buys and Policy Measures Support PKR Stability

MG News | October 29, 2025 at 02:06 AM GMT+05:00

October

29, 2025 (MLN): The

State Bank of Pakistan (SBP) continued to purchase U.S. dollars from the

interbank foreign exchange market in July 2025, albeit at a slower pace than in

previous months.

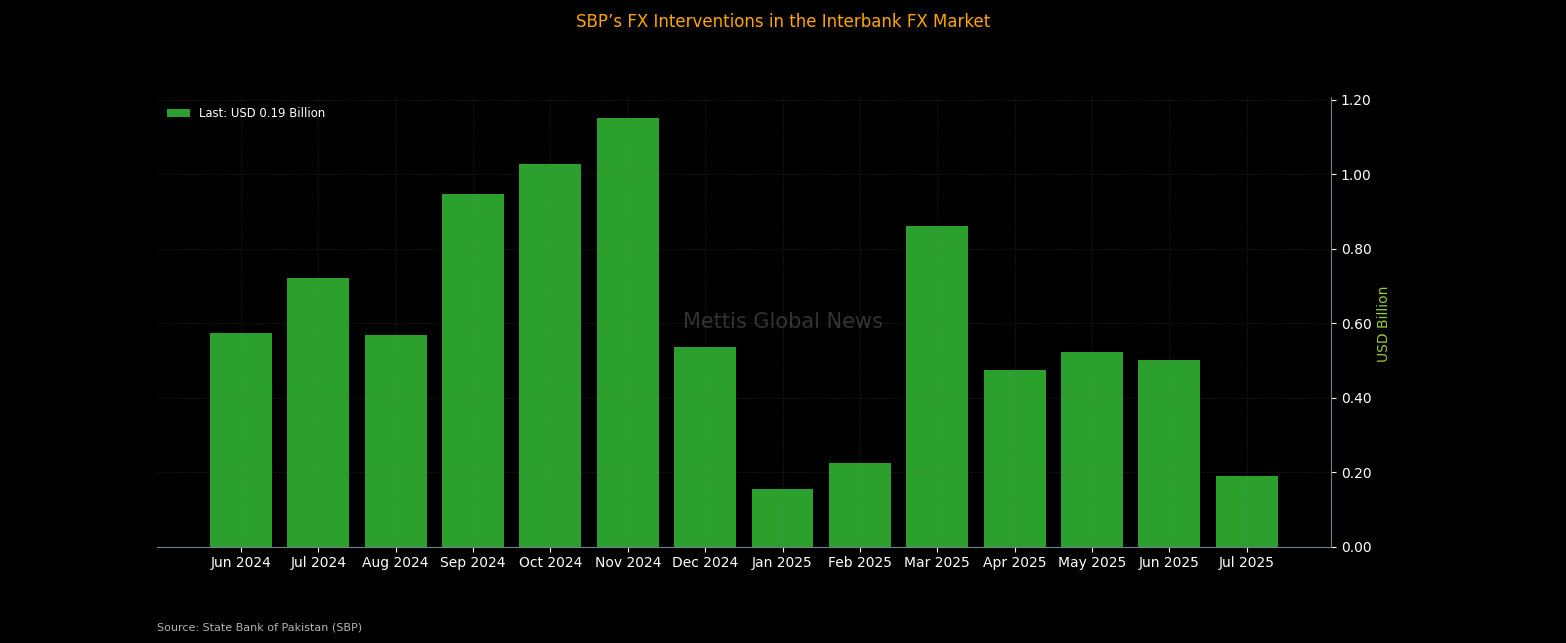

Data released by the central bank showed

net purchases totaling USD 189 million during the month. The SBP defines

Net FX Intervention as outright

and swap purchases of foreign exchange minus outright and swap sales conducted

with banks in the interbank market.

Since the data series was first

published in June 2024, the SBP has accumulated net purchases of USD 8,446

million (or USD 8.446 billion), reflecting an aggressive push to rebuild

reserves and stabilize the exchange rate.

As of July 31, 2025, the SBP’s

foreign exchange reserves stood at USD 14,324 million, up sharply from USD

9,221 million a year earlier and only slightly lower than USD 14,506

million at end-June 2025. This represents a remarkable recovery from the

all-time low of USD 2,917 million recorded in early February 2023, highlighting

the effectiveness of the SBP’s reserve-building strategy under the ongoing

stabilization program.

The PKR had depreciated

consecutively for nine months, falling from PKR 277.71 per USD in September 2024 to PKR 283.76 in June 2025, a net decline of 6.05 PKR (-2.13%). In

July 2025, however, the rupee reversed course slightly, appreciating by 0.32%

to close at PKR 282.87. This modest recovery indicates that the central

bank’s interventions had begun to temper volatility and support orderly market

conditions.

The SBP’s interventions in July

occurred against a backdrop of significant external obligations. According to

its June 30 liquidity report, Pakistan’s foreign currency assets are expected

to see a net outflow of USD 30.18 billion over the next 12 months,

including USD 2.12 billion due within the next month. The bulk of these

outflows consist of principal repayments totaling USD 26.44 billion, with

interest payments of USD 3.74 billion. Of the total obligations, USD 2.12

billion is payable within one month, USD 2.86 billion between one and three

months, and USD 25.2 billion within the remainder of the year. These short-term

net drains reflect contractual foreign currency obligations and underscore the

importance of SBP’s continued interventions to maintain adequate reserves and

support orderly market conditions.

Pakistan’s external position

continues to exert pressure on the rupee, despite improvements in the overall

balance of payments. The current account recorded a surplus of USD 1.932

billion in FY25, compared with a deficit of USD 2.072 billion in FY24,

reflecting a modest improvement in trade flows and remittances. However, at a

monthly level, the current account remained in deficit, with USD 379 million

in July 2025, slightly higher than the USD 355 million deficit in July

2024, highlighting ongoing short-term pressures on foreign exchange demand.

Administrative

Measures and Incentives for FX Stability

In addition to market interventions,

the SBP continued to employ administrative measures aimed at both restricting

outflows and incentivizing inflows.

Controlling Outflows: The central bank maintained a tight grip on dollar

outflows, particularly those related to imports. While these controls are

designed to manage the current account deficit, they have created challenges

for importers, who have reported delays in accessing foreign exchange for

business operations.

Implementing Structural Reforms: Key regulatory changes were finalized, including reforms to

foreign exchange companies. The SBP credited these steps with enhancing

stability and transparency in the broader FX market.

Incentivizing Inflows: To encourage remittances through formal channels, the SBP

introduced incentive schemes, including reimbursement of transfer charges,

aimed at reducing reliance on informal transfer systems such as hundi and

hawala.

These administrative steps were

complemented by revisions to key chapters of the Foreign Exchange

Manual—covering exports, imports, and remittances—underscoring the SBP’s

commitment to regulating foreign currency flows in support of macroeconomic

stability and the broader economic reform agenda.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,326.92 61.20M | -1.07% -1843.37 |

| ALLSHR | 102,231.32 131.52M | -1.20% -1245.33 |

| KSE30 | 52,165.78 21.24M | -0.94% -493.01 |

| KMI30 | 237,814.12 18.29M | -1.12% -2697.17 |

| KMIALLSHR | 65,233.84 66.28M | -1.14% -754.20 |

| BKTi | 50,496.47 8.66M | -1.01% -516.43 |

| OGTi | 33,507.40 3.39M | -0.17% -58.07 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,205.00 | 67,665.00 66,880.00 | 0.00 0.00% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.65 | 66.86 66.31 | 0.25 0.38% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account