Oil slips as Russian exports resume after brief halt

MG News | November 18, 2025 at 04:36 PM GMT+05:00

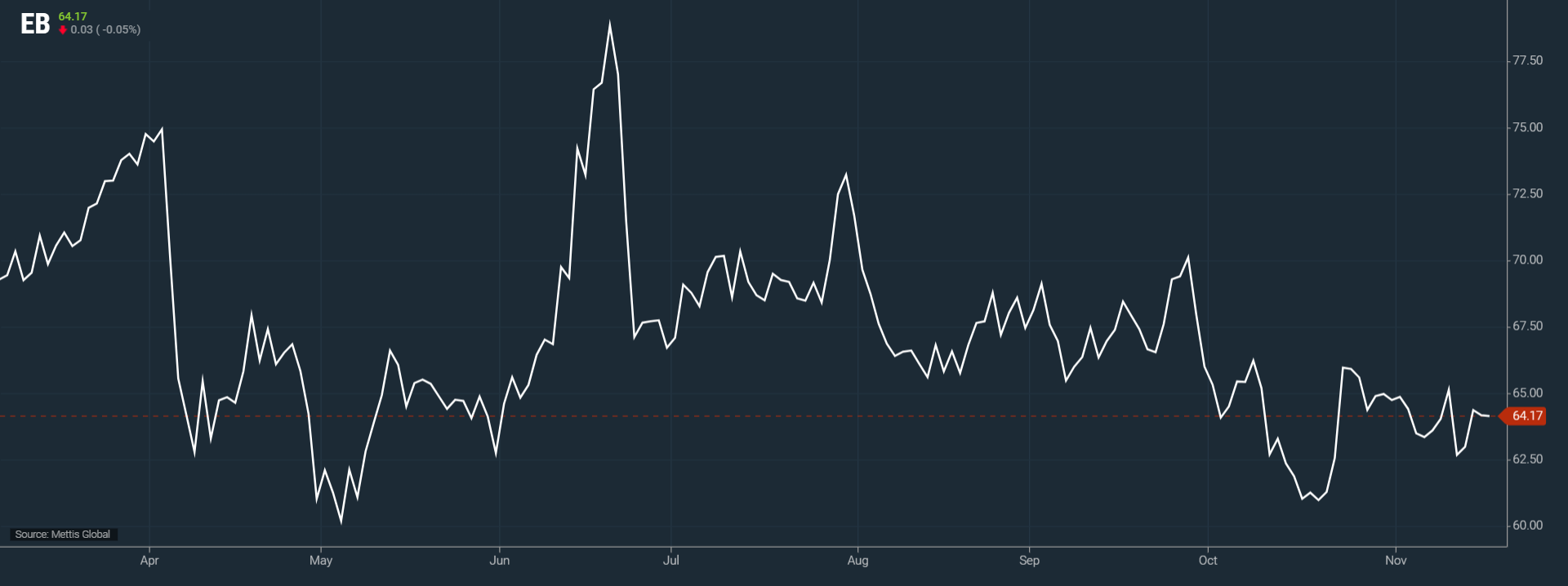

November 18, 2025 (MLN): Oil prices edged lower on Tuesday, falling nearly 1%, after supply worries eased with the swift resumption of crude loadings at Russia’s Novorossiysk export hub.

The facility had been temporarily shut following a Ukrainian drone and

missile strike, but operations recovered sooner than expected, prompting

traders to reassess global supply risks.

Brent crude futures went

down by $0.03, or 0.05%, to $64.17 per barrel.

West Texas Intermediate (WTI) crude futures decreased by

$0.02, or 0.03%, to $59.93 per barrel by [1:05 pm] PST.

According to industry sources and LSEG data, oil loadings at Novorossiysk resumed on Sunday after a two-day halt triggered by the attack.

The disruption had initially halted exports from both Novorossiysk and a nearby Caspian Pipeline Consortium terminal together responsible for about 2.2 million barrels per day, or nearly 2% of global oil supply.

The sudden outage sent prices up more than 2% on

Friday, but markets have since stabilized, as per Reuters.

With immediate supply risks easing,

traders are shifting their focus back to the broader impact of Western

sanctions on Russian oil flows.

The U.S. Treasury recently stated

that sanctions imposed in October on energy giants Rosneft and Lukoil are

already pressuring Moscow’s oil revenues and are likely to gradually reduce

export volumes.

Commonwealth Bank of Australia

strategist Vivek Dhar highlighted that markets remain concerned about

increasing volumes of unsold Russian oil sitting on tankers as buyers weigh the

risk of violating sanctions.

However, he added that Russia has

historically found alternative routes and methods to bypass restrictions. “We

expect any disruption from U.S. sanctions will prove temporary as Russia finds

ways to circumvent sanctions once again,” Dhar said.

In Washington, geopolitical tension

continues to shape the energy outlook. A senior White House official said U.S.

President Donald Trump is prepared to sign new Russia sanctions legislation,

provided he retains final authority over how it is enforced.

Trump also indicated that

Republicans are drafting a bill targeting any country conducting business with

Russia potentially extending to Iran.

Copyright Mettis Link

News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 160,935.13 302.86M | -0.47% -752.05 |

| ALLSHR | 97,686.29 1,543.63M | -0.40% -388.98 |

| KSE30 | 48,680.99 105.19M | -0.55% -269.99 |

| KMI30 | 229,518.04 108.34M | -0.52% -1206.38 |

| KMIALLSHR | 63,481.12 606.98M | -0.42% -269.58 |

| BKTi | 43,984.51 23.92M | -0.89% -393.05 |

| OGTi | 30,948.28 5.94M | -0.56% -175.69 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,505.00 | 92,305.00 89,325.00 | -465.00 -0.51% |

| BRENT CRUDE | 64.09 | 64.29 63.62 | -0.11 -0.17% |

| RICHARDS BAY COAL MONTHLY | 85.75 | 0.00 0.00 | 0.20 0.23% |

| ROTTERDAM COAL MONTHLY | 96.45 | 96.45 96.45 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 59.80 | 59.99 59.26 | -0.06 -0.10% |

| SUGAR #11 WORLD | 14.81 | 14.88 14.72 | 0.01 0.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Private Sector Credit

Private Sector Credit