Oil prices steady after hitting two-week lows

MG News | November 06, 2025 at 11:01 AM GMT+05:00

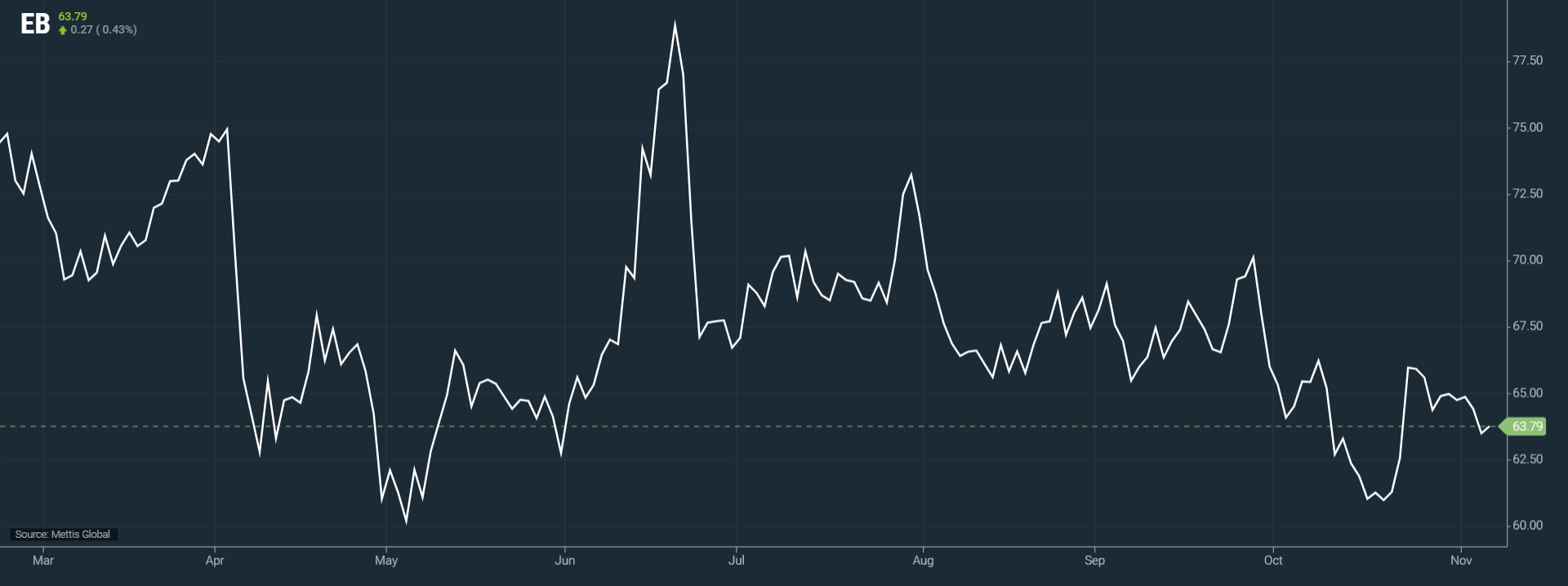

November 06, 2025 (MLN): Oil prices were steady in early trading on Thursday, following a sharp drop to two-week lows in the previous session, as concerns over slowing global demand and rising crude inventories continued to weigh on the market.

Brent crude futures went up by $0.27, or 0.43%, to $63.79

per barrel.

West Texas Intermediate (WTI) crude futures decreased by $0.24,

or 0.40%, to $59.84 per barrel by [11:00 am] PST.

According to a client note from J.P. Morgan, global

oil demand has increased by 850,000 barrels per day (bpd) so far this

year through November 4 slightly below the bank’s earlier forecast of 900,000

bpd growth.

The note also highlighted that “high-frequency indicators

suggest that U.S. oil consumption remains subdued,” citing weak travel activity

and declining container shipments.

Prices came under additional pressure after the U.S.

Energy Information Administration (EIA) reported a larger-than-expected

rise in crude inventories. U.S. crude stockpiles surged by 5.2m barrels

to 421.2m barrels last week, far exceeding market expectations for a

modest 603,000 barrel increase.

Analysts at Capital Economics predicted further

downside for oil prices, saying, “We expect downward pressure on crude to

persist, aligning with our below-consensus forecast of $60 per barrel by

end-2025 and $50 per barrel by end-2026.”

Global oil prices also ended October lower for the third consecutive month, as fears of oversupply intensified. The OPEC+ alliance ramped up production, while output from major non-OPEC producers continued to rise, adding to market imbalance and dampening investor sentiment.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 159,538.98 142.12M | -0.02% -39.21 |

| ALLSHR | 96,960.51 559.13M | 0.03% 28.80 |

| KSE30 | 48,267.45 53.68M | -0.21% -101.46 |

| KMI30 | 227,940.14 38.20M | -0.27% -615.54 |

| KMIALLSHR | 63,001.53 176.21M | -0.30% -189.55 |

| BKTi | 44,506.79 14.91M | -0.05% -20.68 |

| OGTi | 30,675.54 3.11M | -0.37% -113.60 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 103,585.00 | 104,590.00 103,090.00 | -655.00 -0.63% |

| BRENT CRUDE | 63.85 | 63.86 63.48 | 0.33 0.52% |

| RICHARDS BAY COAL MONTHLY | 87.15 | 87.50 87.00 | 0.35 0.40% |

| ROTTERDAM COAL MONTHLY | 97.00 | 97.50 97.00 | -0.75 -0.77% |

| USD RBD PALM OLEIN | 1,082.50 | 1,082.50 1,082.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 59.96 | 59.97 59.55 | 0.36 0.60% |

| SUGAR #11 WORLD | 14.12 | 14.32 14.05 | -0.10 -0.70% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

PIB Auction

PIB Auction