Oil prices climb amid U.S.-Venezuela tensions

Hafiz Muhammad Abdullah Hashim | December 15, 2025 at 01:04 PM GMT+05:00

December 15, 2025 (MLN): Oil prices rebounded on Monday, recovering a portion of last week’s 4% decline, as geopolitical concerns over U.S.-Venezuela tensions overshadowed lingering oversupply fears and potential impacts from a Russia-Ukraine peace deal.

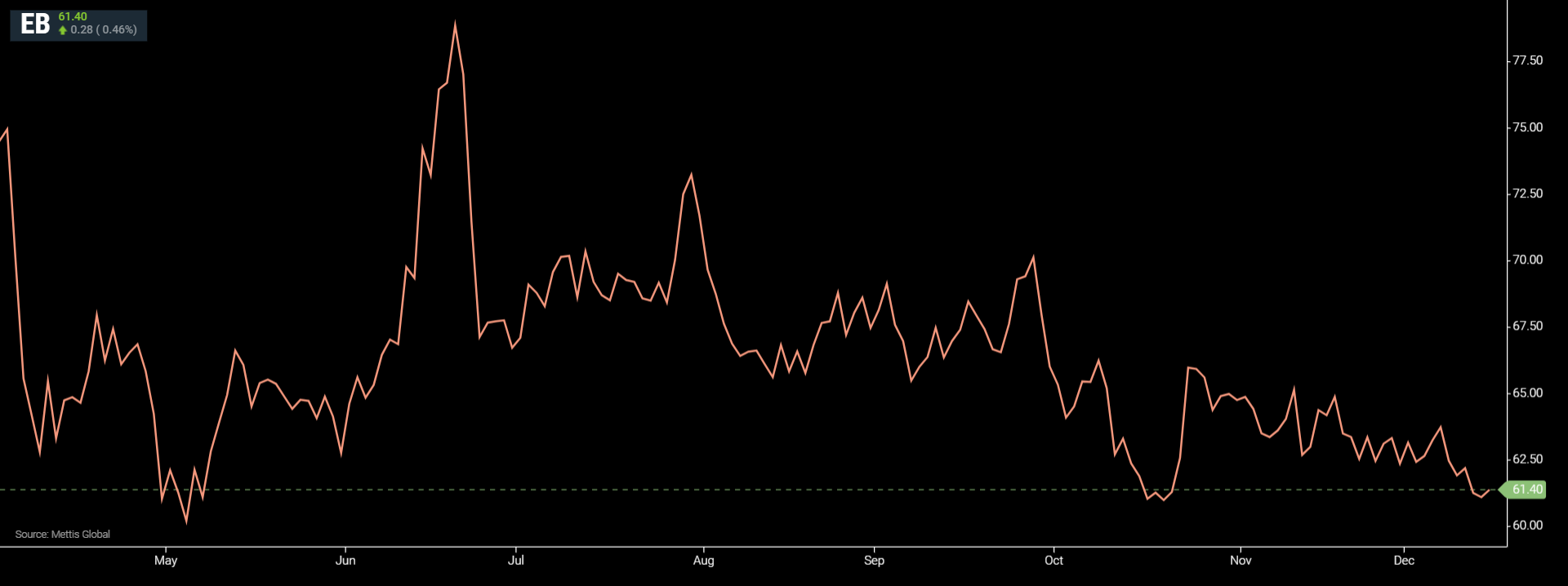

Brent crude futures increased by $0.28, or 0.46%, to $61.40

per barrel.

West Texas Intermediate (WTI) crude futures went up by $0.28,

or 0.49%, to $57.72 per barrel by [12:40 pm] PST.

Tsuyoshi Ueno, senior economist, said that Russia-Ukraine

peace talks fluctuate between cautious optimism and setbacks. He added that

rising tensions between Venezuela and the U.S. are raising worries about

possible supply disruptions.

Despite the gains, oversupply concerns persist. Ueno said

that unless geopolitical risks escalate sharply, WTI crude could dip below $55

per barrel in the early months of next year, according to CNBC.

In Berlin on Sunday, Ukrainian President Volodymyr Zelenskyy

reportedly offered to abandon his country’s NATO membership ambitions during

five hours of discussions with U.S. envoys.

Talks are scheduled to continue on Monday. U.S. envoy Steve

Witkoff noted that “significant progress” was made, though specific details

were not disclosed.

Meanwhile, Ukraine’s military claimed on Friday that it had

struck a major Russian oil refinery in Yaroslavl, northeast of Moscow. Industry

sources reported that the facility temporarily halted operations.

In Venezuela, opposition leader Maria Corina Machado made

headlines after secretly leaving the country to accept the Nobel Peace Prize.

Her actions follow heightened tensions after the U.S. seized

a Venezuelan oil tanker last week, compounded by new sanctions on shipping

firms trading with the Latin American nation.

These developments have contributed to a sharp drop in

Venezuela’s oil exports.

On the supply front, U.S. energy companies reduced the number of oil and natural gas rigs for the second time in three weeks, according to Baker Hughes, reflecting ongoing caution in domestic production.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 173,169.71 245.48M | 0.58% 999.42 |

| ALLSHR | 103,952.96 533.68M | 0.46% 476.31 |

| KSE30 | 53,042.90 95.92M | 0.73% 384.11 |

| KMI30 | 242,931.39 83.21M | 1.01% 2420.10 |

| KMIALLSHR | 66,507.09 270.16M | 0.79% 519.06 |

| BKTi | 51,058.55 42.50M | 0.09% 45.65 |

| OGTi | 34,159.98 10.77M | 1.77% 594.51 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,925.00 | 68,450.00 66,565.00 | 720.00 1.07% |

| BRENT CRUDE | 71.68 | 72.34 71.06 | 0.02 0.03% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.45 -1.36% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.31 | 0.00 0.00 | -0.17 -0.26% |

| SUGAR #11 WORLD | 13.86 | 14.02 13.61 | 0.16 1.17% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account