Oil mixed with U.S. freeze disrupting supply

MG News | January 28, 2026 at 11:28 AM GMT+05:00

January 28, 2026 (MLN): Oil prices traded mixed on Wednesday, with Brent crude edging slightly lower while U.S. West Texas Intermediate (WTI) futures posted modest gains, as markets weighed fresh supply disruptions against expectations of a surplus later this year.

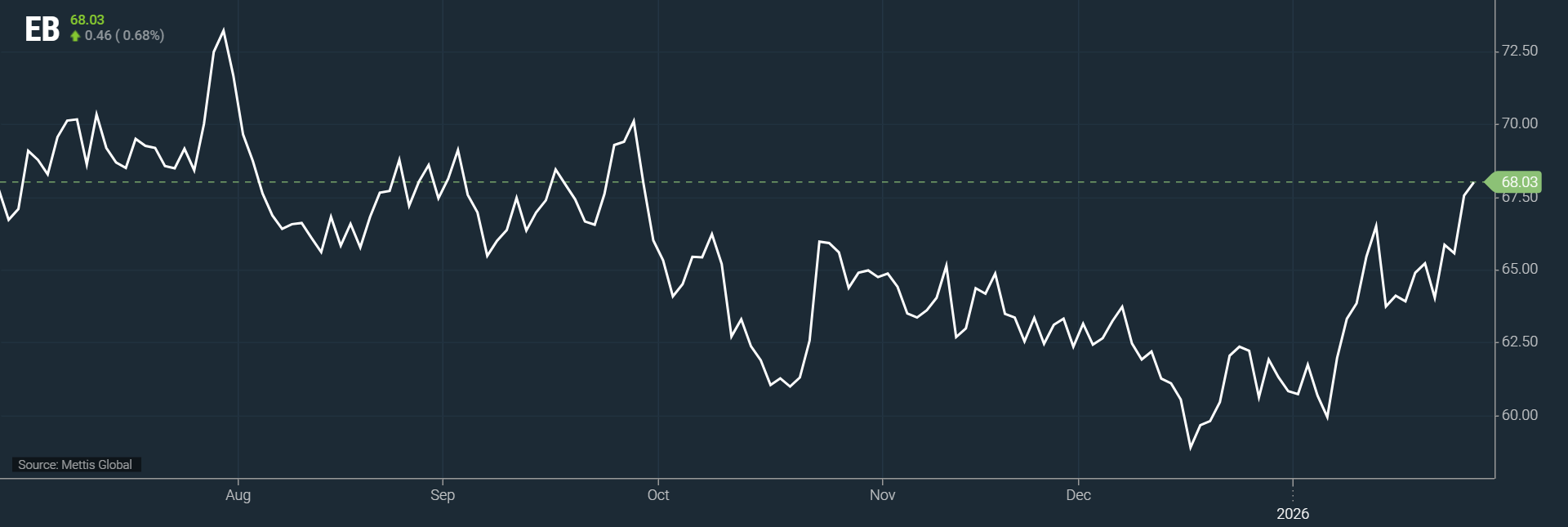

Brent crude futures went down by $0.46, or 0.68%, to $68.03

per barrel, according to data by Mettis Global.

West Texas Intermediate (WTI) crude futures decreased by $0.55,

or 0.88%, to $62.94 per barrel by [11:23 am] PST.

Both global benchmarks had climbed nearly 3% in the previous

session, driven by concerns that a severe winter storm in the United States had

knocked out a significant portion of crude production and exports over the

weekend.

U.S. producers temporarily lost up to 2 million barrels per

day around 15% of total national output as freezing conditions strained energy

infrastructure and disrupted power grids, according to CNBC.

The impact was also felt on the export front, with crude oil

and liquefied natural gas shipments from U.S. Gulf Coast ports falling to zero

on Sunday, data from ship-tracking firm Vortexa showed.

The weather-related outages, combined with overseas supply

issues, are lending short-term support to prices.

Geopolitical developments also remained in focus. A U.S.

aircraft carrier, accompanied by supporting warships, has arrived in the Middle

East, according to U.S. officials, expanding Washington’s military posture in

the region amid heightened tensions involving Iran.

On the policy front, OPEC+ which includes the Organization of the Petroleum Exporting Countries, Russia, and allied producers is expected to maintain its pause on planned output increases for March.

As traders digest conflicting signals from supply

disruptions, inventory trends, and geopolitics, oil markets are expected to

remain volatile in the days ahead.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,992.31 188.93M | 0.42% 789.45 |

| ALLSHR | 112,969.08 452.08M | 0.49% 545.85 |

| KSE30 | 58,226.89 53.82M | 0.47% 270.41 |

| KMI30 | 268,038.86 51.77M | 0.25% 663.54 |

| KMIALLSHR | 72,653.91 222.53M | 0.40% 290.71 |

| BKTi | 53,860.56 20.29M | 0.70% 374.58 |

| OGTi | 39,431.42 9.63M | 1.32% 514.81 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,350.00 | 89,505.00 88,770.00 | -40.00 -0.04% |

| BRENT CRUDE | 67.76 | 68.16 67.44 | 0.19 0.28% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.65 -2.96% |

| ROTTERDAM COAL MONTHLY | 99.00 | 0.00 0.00 | 0.30 0.30% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.64 | 63.00 62.34 | 0.25 0.40% |

| SUGAR #11 WORLD | 14.83 | 15.01 14.74 | 0.04 0.27% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market