Gold hits fresh record above $5,200

MG News | January 28, 2026 at 12:01 PM GMT+05:00

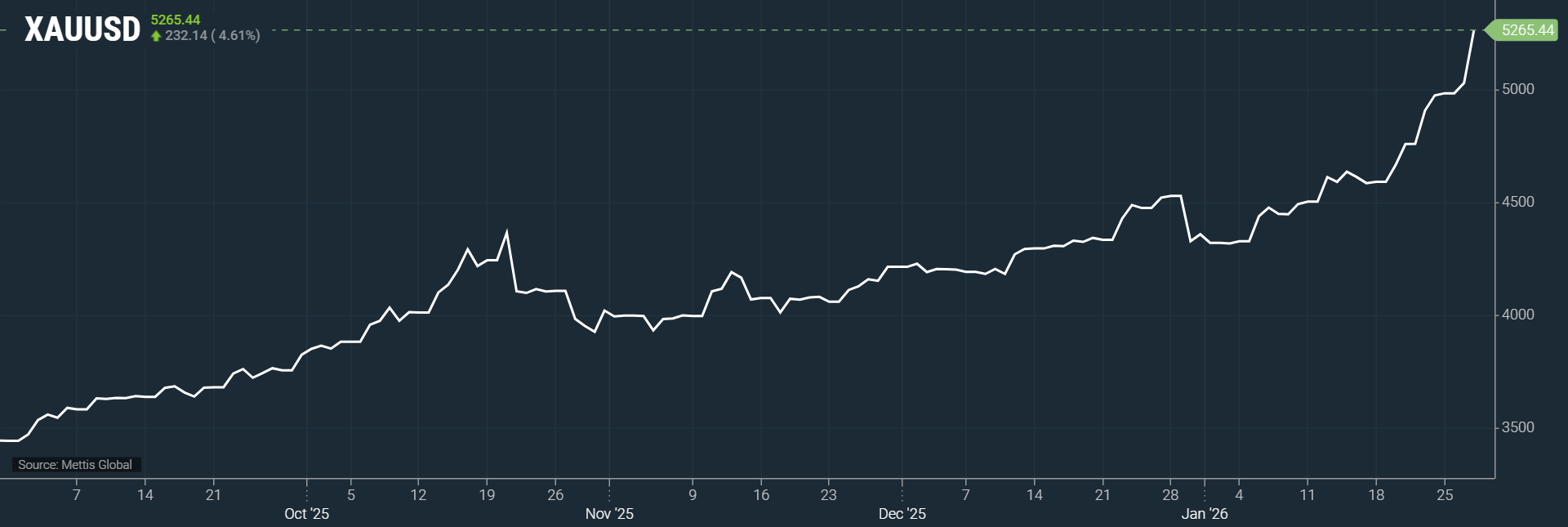

January 28, 2026 (MLN): Gold prices shattered a historic milestone on Wednesday, climbing above the $5,200 mark for the first time as the U.S. dollar weakened sharply and geopolitical uncertainty continued to fuel safe-haven demand ahead of a key Federal Reserve policy announcement.

Spot gold rise 4.61% to $5,265 an ounce as of [11:56

AM] PST, according to data reported by Mettis Global.

In early Asian trading, spot gold advanced 1.1% to

$5,243.58 per ounce, after touching an all-time high of $5,247.21.

The yellow metal has now gained more than 20%

year-to-date, supported by strong investor inflows and sustained macroeconomic

risks.

Meanwhile, U.S. gold futures for February delivery jumped

3.1% to $5,237.70 per ounce, extending Tuesday’s sharp rally of over 3%.

The latest surge primarily to the steep decline in the

U.S. dollar, which hovered near a four-year low, according to CNBC.

The dollar’s slide was amplified by deteriorating U.S.

economic sentiment.

Data released this week showed consumer confidence

plunging to its lowest level in more than 11 years, as concerns mounted over

slowing job growth and persistent inflation pressures.

Adding to market volatility, President Trump indicated that he would soon unveil his nominee for the next Federal Reserve Chair, while forecasting lower interest rates once the new leadership is in place.

Reinforcing the optimistic outlook, Deutsche Bank said in

a recent note that gold prices could climb as high as $6,000 per ounce by 2026,

citing robust central-bank purchases and a structural shift toward non-dollar

assets.

Elsewhere in the precious metals market, spot silver rose

1.9% to $115.11 per ounce, after hitting a record high of $117.69 earlier this

week. Silver prices have already surged nearly 60% so far this year.

Platinum gained 2% to $2,692.60 per ounce, following a

fresh all-time high of $2,918.80, while palladium climbed 1.4% to $1,961.68.

With weakening dollar dynamics, shifting Fed expectations, and strong institutional demand, precious metals continue to attract investors seeking protection against economic and geopolitical uncertainty.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SCRA Balance

SCRA Balance