Oil edges up as market weighs Iran-Israel truce stability

MG News | June 25, 2025 at 12:45 PM GMT+05:00

June 25, 2025 (MLN): Oil prices edged higher on Wednesday, finding some respite after plummeting in the last two sessions, as investors assessed the stability of a ceasefire between Iran and Israel.

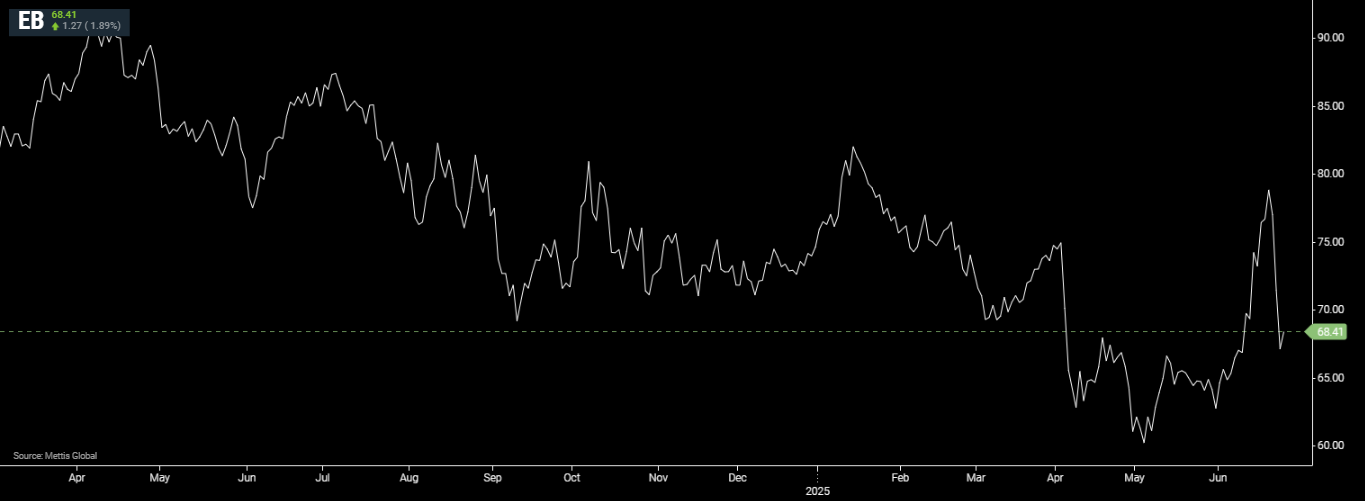

Brent crude futures increased by $1.27, or 1.89%, to $68.41 per barrel.

West Texas Intermediate (WTI) crude futures rose by $1.21, or 1.88%, to $65.58 per barrel by [12:45 pm] PST.

Brent settled on Tuesday at its lowest since June 10 and WTI since June 5, both before Israel launched a surprise attack on key Iranian military and nuclear facilities on June 13.

The earlier rally that pushed prices to five-month highs came after U.S. airstrikes targeted Iran’s nuclear facilities over the weekend.

However, a preliminary U.S. intelligence assessment indicated that the strikes failed to destroy Iran’s nuclear capability, merely delaying it by a few months.

The market appeared to ease as a fragile ceasefire, brokered by U.S. President Donald Trump, began to take hold.

Both Iran and Israel signaled Tuesday that the air war between them had paused, at least temporarily, after Trump publicly criticized both for violating the truce.

Civilian restrictions in both countries were lifted following 12 days of conflict, during which the U.S. joined the fray with attacks on Iran’s uranium enrichment infrastructure.

Each side has since sought to declare victory, as CNBC reported.

Oil traders had previously feared the conflict would disrupt flows through the Strait of Hormuz a vital maritime route between Iran and Oman through which 18–19 million barrels per day of crude and fuel pass, accounting for nearly a fifth of global consumption.

Meanwhile, attention has shifted to upcoming U.S. government inventory data due Wednesday.

According to market sources citing American Petroleum Institute (API) figures, U.S. crude stockpiles fell by 4.23m barrels in the week ended June 20, which could further influence price movements.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,529.31 298.88M | -0.32% -476.02 |

| ALLSHR | 90,649.25 645.24M | -0.13% -120.81 |

| KSE30 | 44,855.41 127.01M | -0.35% -156.33 |

| KMI30 | 208,066.95 107.55M | -0.47% -973.43 |

| KMIALLSHR | 60,419.98 382.07M | -0.25% -150.87 |

| BKTi | 41,101.09 38.49M | 0.35% 145.35 |

| OGTi | 30,764.81 26.70M | -1.30% -406.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,425.00 | 125,200.00 117,610.00 | -5005.00 -4.05% |

| BRENT CRUDE | 66.86 | 66.99 65.55 | 1.23 1.87% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 63.96 | 64.10 62.58 | 1.31 2.09% |

| SUGAR #11 WORLD | 16.58 | 16.85 16.51 | -0.27 -1.60% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Auto Sales

Auto Sales