Gold gains as traders eye possible fed cut in September

MG News | August 13, 2025 at 04:53 PM GMT+05:00

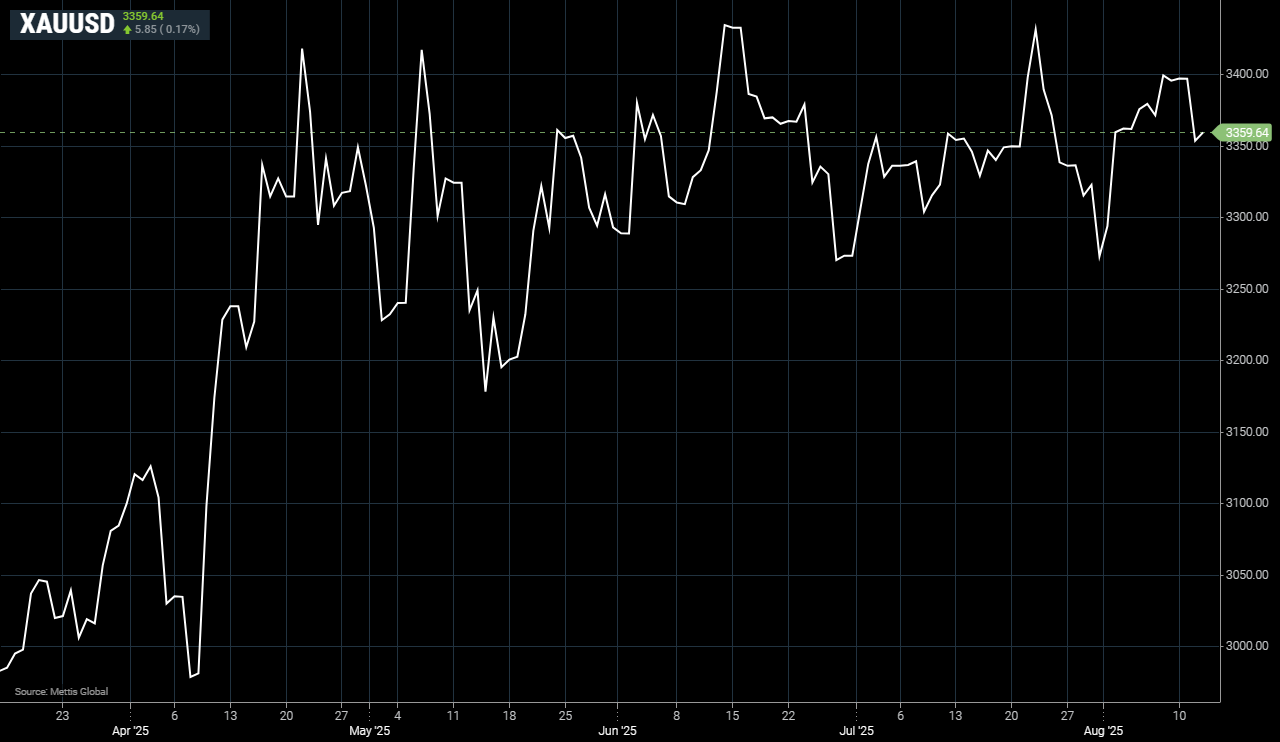

August 13, 2025 (MLN): Gold spot prices increased by 0.17% ($5.85) at $3,359.64 per ounce, as of [4:45 am PST] from the prior day's close

Gold climbed on Wednesday as soft U.S. inflation data strengthened

expectations of a Federal Reserve rate cut in September, while a weaker dollar

boosted demand for the metal.

Gold prices gained traction on Wednesday as traders increased bets on a

potential U.S. Federal Reserve interest rate cut in September, with some even

speculating a 50-basis-point reduction after comments from U.S. Treasury

Secretary Bessent.

UBS commodity analyst Giovanni Staunovo noted that expectations are being

reinforced by weaker incoming U.S. economic data.

Market odds now point to over a 90% likelihood of a September cut,

following July’s mild inflation rise, which suggested U.S. import tariffs have

had little effect on consumer prices.

Investors also anticipate at least one more rate reduction before the end

of the year.

As a non-yielding safe-haven asset, gold tends to benefit from lower

interest rates. Its appeal was further supported by a weaker dollar, which fell

to a two-week low, making the metal cheaper for buyers using other currencies.

On the geopolitical front, European and Ukrainian leaders are set to hold

a virtual meeting with U.S. President Donald Trump ahead of his upcoming summit

with Russian President Vladimir Putin.

The talks aim to caution against compromising Kyiv’s position for a

ceasefire deal. However, Staunovo said such discussions are unlikely to have a

lasting impact on gold, though they could spark short-term price swings.

He expects gold to trade sideways in the near term until fresh U.S.

economic data signals a quicker Fed easing cycle.

In trade developments, the U.S. and China agreed to extend their tariff

truce by another 90 days, avoiding steep mutual duties on goods.

Among other precious metals, spot silver rose 1.3% to $38.39 an ounce,

platinum gained 0.8% to $1,346.05, and palladium inched up 0.4% to $1,133.72.

Copyright Mettis Link

News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,303.25 328.07M | 0.73% 1217.67 |

| ALLSHR | 101,798.94 781.32M | 0.57% 578.22 |

| KSE30 | 51,168.55 142.41M | 0.78% 396.53 |

| KMI30 | 242,124.59 148.48M | 0.92% 2201.24 |

| KMIALLSHR | 66,390.97 419.71M | 0.53% 348.17 |

| BKTi | 45,186.23 25.50M | 0.18% 79.85 |

| OGTi | 33,669.86 17.96M | 0.26% 86.81 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,525.00 | 92,620.00 89,800.00 | 1925.00 2.15% |

| BRENT CRUDE | 62.51 | 63.96 62.34 | -1.24 -1.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.20 0.22% |

| ROTTERDAM COAL MONTHLY | 97.00 | 97.70 97.00 | -0.25 -0.26% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.85 | 60.30 58.68 | -1.23 -2.05% |

| SUGAR #11 WORLD | 14.83 | 14.93 14.72 | 0.03 0.20% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|