Oil declines as supply rises, U.S. growth slows

MG News | August 04, 2025 at 01:42 PM GMT+05:00

August 4, 2025 (MLN): Oil prices continued to fall on Monday following OPEC+’s decision to implement another significant production increase in September, while worries over a slowing U.S. economy the world’s largest oil consumer further weighed on the market.

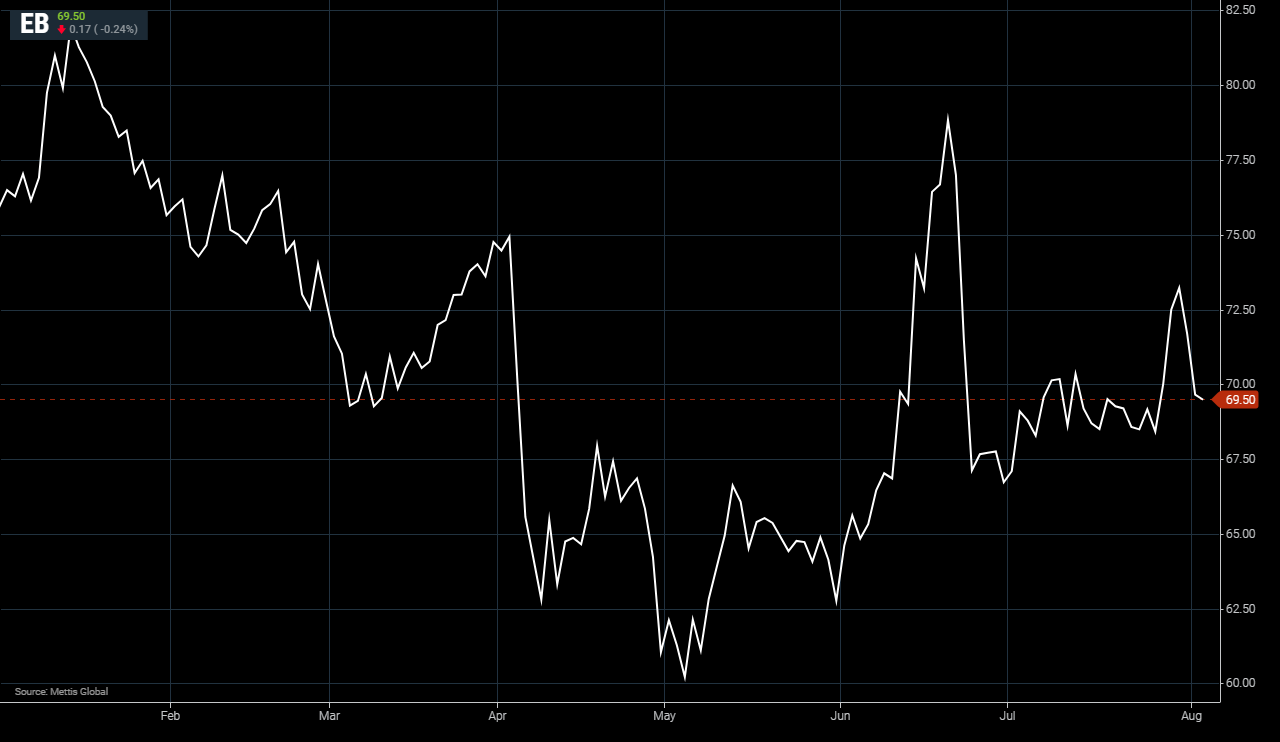

Brent crude futures decreased by $0.17, or 0.24%, to $69.50 per

barrel.

West Texas Intermediate (WTI) crude futures fall by $0.03, or 0.04%, to $67.30 per barrel by [1:25 pm] PST.

The Organization of the Petroleum Exporting Countries and its allies, known

as OPEC+, agreed on Sunday to raise oil production by 547,000 barrels per day

for September.

This marks the latest in a series of accelerated output hikes aimed at

regaining market share, citing a strong economy and low stockpiles as the basis

for the decision, as CNBC reported.

The move, which met market expectations,

represents a full and early reversal of OPEC+’s largest output cuts and

includes an additional production increase for the United Arab Emirates.

The total increase amounts to about 2.5 million barrels per day, roughly

2.4% of global demand.

Analysts at Goldman Sachs estimate that the

actual increase in supply from the eight OPEC+ countries that have raised

output since March will be around 1.7 million barrels per day, or about

two-thirds of the announced figure.

This is due to other members cutting production after previously exceeding

their quotas.

“While OPEC+ policy remains flexible and the

geopolitical outlook uncertain, we assume that OPEC+ keeps required production

unchanged after September,” Goldman Sachs said in a note.

They added that strong growth in non-OPEC supply would likely limit space

for additional OPEC+ barrels.

RBC Capital Markets analyst Helima Croft said, “The bet that the market

could absorb the additional barrels seems to have paid off for the holders of

spare capacity this summer, with prices not that far off from pre-tariff

Liberation Day levels.”

Despite this, investors remain cautious about

further U.S. sanctions on Iran and Russia that could disrupt global oil supply.

U.S.

President Trump has threatened to impose 100% secondary tariffs on buyers of

Russian crude in an effort to pressure Moscow to end its war in Ukraine.

Trade sources reported on Friday that at least

two vessels carrying Russian oil to Indian refiners have been redirected

following new U.S. sanctions, as reflected in LSEG trade flow data.

However, two Indian government sources told

Reuters on Saturday that India will continue purchasing Russian oil despite

Trump’s threats.

Concerns over the impact of U.S. tariffs on

global economic growth and fuel demand are also weighing on the market,

especially after Friday’s U.S. jobs data came in below expectations.

U.S.

Trade Representative Jamieson Greer said on Sunday that the tariffs imposed

last week on multiple countries are likely to remain in effect as negotiations

continue.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,303.25 328.07M | 0.73% 1217.67 |

| ALLSHR | 101,798.94 781.32M | 0.57% 578.22 |

| KSE30 | 51,168.55 142.41M | 0.78% 396.53 |

| KMI30 | 242,124.59 148.48M | 0.92% 2201.24 |

| KMIALLSHR | 66,390.97 419.71M | 0.53% 348.17 |

| BKTi | 45,186.23 25.50M | 0.18% 79.85 |

| OGTi | 33,669.86 17.96M | 0.26% 86.81 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,525.00 | 92,620.00 89,800.00 | 1925.00 2.15% |

| BRENT CRUDE | 62.51 | 63.96 62.34 | -1.24 -1.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.20 0.22% |

| ROTTERDAM COAL MONTHLY | 97.00 | 97.70 97.00 | -0.25 -0.26% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.85 | 60.30 58.68 | -1.23 -2.05% |

| SUGAR #11 WORLD | 14.83 | 14.93 14.72 | 0.03 0.20% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|