Oil climbs after OPEC+ freezes output for Q1 2026

MG News | November 03, 2025 at 10:34 AM GMT+05:00

November 3, 2025 (MLN): Oil prices edged higher in early Asian trade on Monday after OPEC+ informed it would delay planned production increases during the first quarter of 2026, easing market concerns about a potential supply glut.

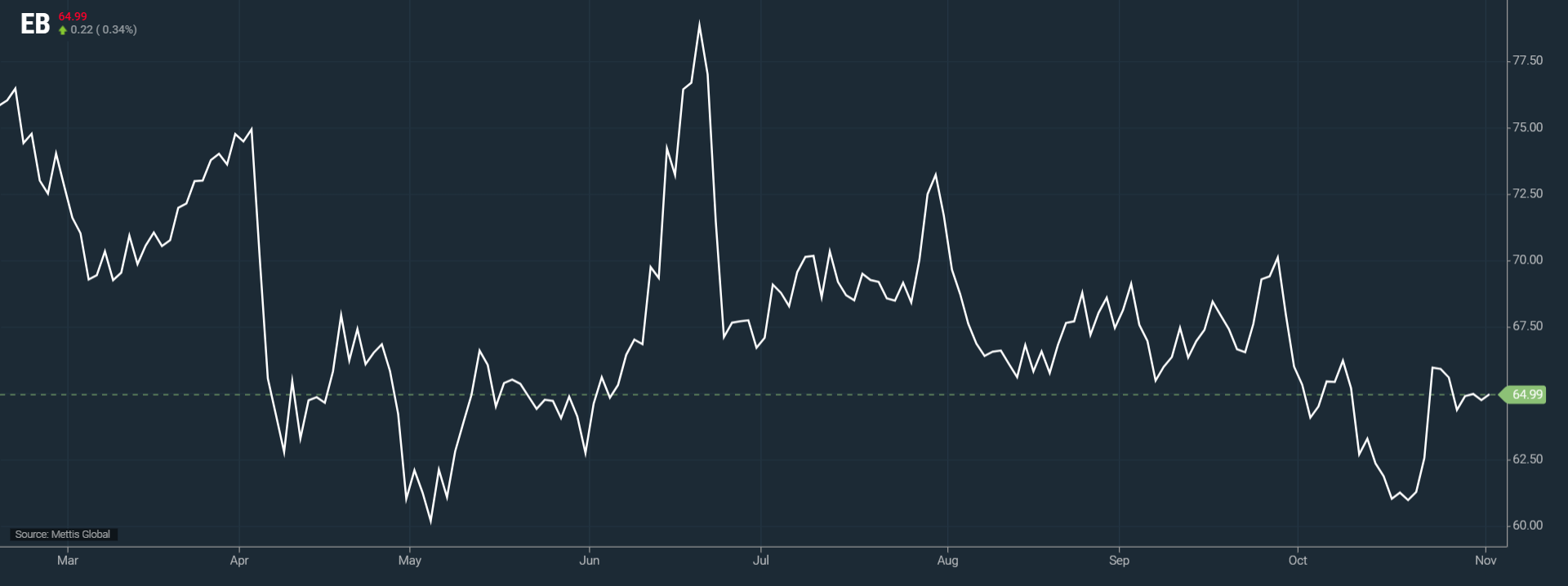

Brent crude futures went up by $0.22, or 0.34%, to $64.99 per barrel.

West Texas Intermediate (WTI) crude futures decreased by

$0.22, or 0.36%, to $61.20 per barrel by [10:30 am] PST.

The Organization of the Petroleum Exporting Countries and

its allies, collectively known as OPEC+, said on Sunday that crude output will

rise by 137,000 barrels per day (bpd) in December consistent with the

increments approved for October and November.

“Beyond December, due to seasonality, the eight countries

also decided to pause the production increments in January, February, and March

2026,” the group said in its official statement.

Market analysts welcomed the decision, calling it a

prudent move amid lingering demand uncertainty. RBC Capital Markets analyst Helima

Croft noted that “there is ample ground for a cautious approach given the

uncertainty over the Q1 supply picture and the anticipated demand softness.”

Croft added that Russia remains a major supply risk,

particularly after the United States imposed sanctions on Rosneft and Lukoil

and amid continued Ukrainian drone attacks targeting Russian energy assets.

Over the weekend, a Ukrainian strike hit the Tuapse oil

port on Russia’s Black Sea coast, igniting a fire and damaging at least one

vessel.

Oil prices have been under pressure in recent months,

with both Brent and WTI crude declining more than 2% for a third consecutive

month in October, reaching a five-month low on October 20 amid worries about

excess supply and broader economic headwinds linked to U.S. tariffs.

Meanwhile, data from the U.S. Energy Information

Administration (EIA) revealed that American crude production climbed by 86,000

bpd to a record 13.8 million bpd in August, underscoring persistent supply

strength from U.S. producers.

Adding to the geopolitical backdrop, U.S. President

Donald Trump on Friday denied reports that Washington was considering military

strikes inside Venezuela, amid growing speculation that the U.S. could expand

drug-trafficking-related operations in the region.

With OPEC+ opting for caution and global supply dynamics in flux, traders are now closely monitoring demand indicators and geopolitical developments that could set the tone for oil prices heading into 2026.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 179,603.73 379.80M | -0.50% -908.92 |

| ALLSHR | 108,021.19 705.75M | -0.35% -379.48 |

| KSE30 | 54,828.33 124.04M | -0.69% -379.24 |

| KMI30 | 253,396.08 110.85M | -0.77% -1976.44 |

| KMIALLSHR | 69,330.18 392.81M | -0.57% -398.02 |

| BKTi | 51,913.39 44.12M | -0.50% -259.93 |

| OGTi | 35,053.03 27.27M | -0.84% -295.86 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,980.00 | 69,580.00 65,970.00 | 3480.00 5.31% |

| BRENT CRUDE | 67.73 | 68.05 66.89 | 0.21 0.31% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -1.50 -1.54% |

| ROTTERDAM COAL MONTHLY | 104.60 | 104.60 104.60 | 1.30 1.26% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.81 | 63.26 62.14 | -0.03 -0.05% |

| SUGAR #11 WORLD | 13.55 | 13.57 13.42 | 0.07 0.52% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260212114015138_13c55d.jpg?width=280&height=140&format=Webp)

Weekly Inflation

Weekly Inflation