Inflation holds steady at 6.1% in November

MG News | December 01, 2025 at 02:46 PM GMT+05:00

December 01, 2025 (MLN): The headline inflation in November stood at 6.1%, easing slightly from 6.2% in October but remaining above last year’s 4.9%, according to the monthly data issued by the Pakistan Bureau of Statistics.

On a monthly basis, consumer prices climbed 0.4%, a notable slowdown from the sharp 1.8% jump recorded in the previous month.

_20251201095730432_2a3c35.jpeg)

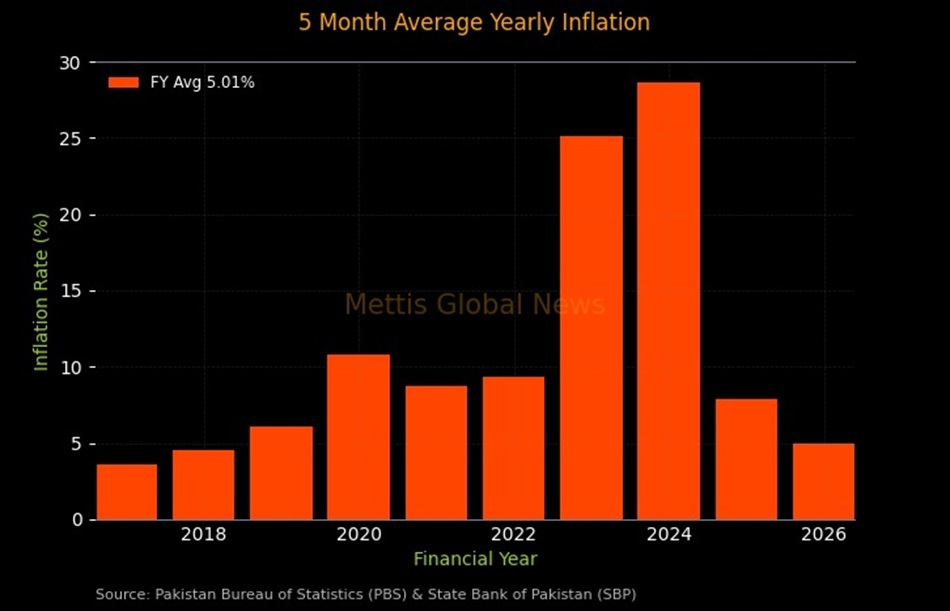

Cumulatively, on a 5MFY26 basis, the average CPI stands at 5.01% compared to 5.72% in the same period last year.

Urban and rural trends moved in different gears. Urban CPI came in at 6.1% YoY, inching up from 6.0% in October, while rural CPI eased to 6.3% compared to 6.6% previously.

Month-on-month, cities posted a 0.5% rise, whereas rural areas saw a softer 0.2% uptick, reflecting relative calm after last month’s volatility.

The Sensitive Price Index (SPI), a key indicator of weekly consumer essentials, also cooled to 4.2% YoY from 4.8%, with MoM inflation slowing to 0.4% from 0.9%.

At the producer level, the Wholesale Price Index (WPI) stayed steady at 1.1% YoY, unchanged from the previous month.

On a monthly basis, wholesale prices slipped 0.2%, reversing October’s 0.5% increase and hinting at easing supply-side cost pressures.

Core inflation, the barometer policymakers track to judge demand-side pressures, continued its gradual descent.

Core NFNE Urban fell to 6.6% YoY (from 7.5%), while Core NFNE Rural eased to 8.2% YoY (from 8.4%). Both measures posted smaller MoM gains, indicating weakening demand-driven pricing.

The trimmed mean measure followed suit as Urban trimmed core dropped to 5.3% YoY from 6.0% while Rural trimmed core dipped to 6.4% YoY from 6.8%

With core prices still sticky and food and energy costs unpredictable, the months ahead will determine whether this cooling trend can hold or if price pressures begin simmering again.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 169,592.53 53.30M | -1.50% -2577.76 |

| ALLSHR | 101,832.80 117.34M | -1.59% -1643.85 |

| KSE30 | 51,915.04 19.61M | -1.41% -743.75 |

| KMI30 | 236,700.70 16.55M | -1.58% -3810.59 |

| KMIALLSHR | 64,988.14 56.91M | -1.52% -999.90 |

| BKTi | 50,291.87 8.12M | -1.41% -721.04 |

| OGTi | 33,304.17 3.19M | -0.78% -261.30 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,270.00 | 67,665.00 66,880.00 | 65.00 0.10% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.64 | 66.86 66.31 | 0.24 0.36% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account