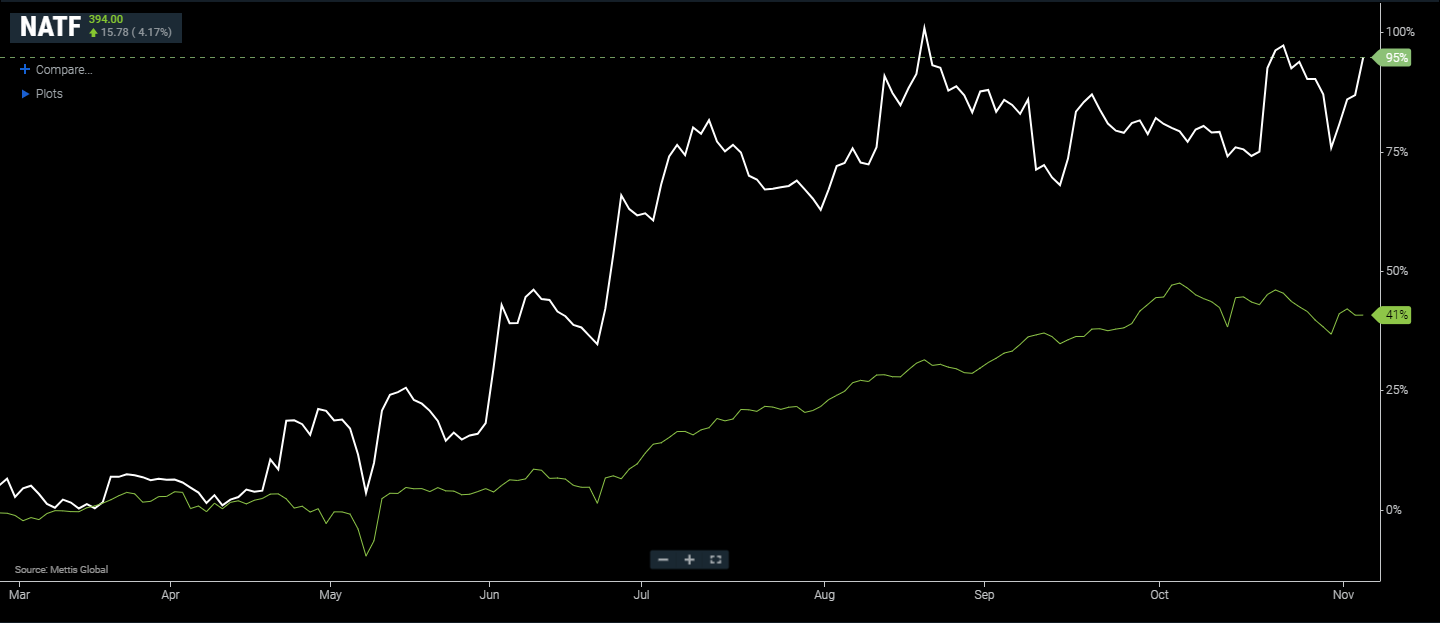

NATF cooking up gains, eyes Rs485/share

MG News | November 05, 2025 at 11:55 AM GMT+05:00

November 05, 2025 (MLN): National Foods Ltd (PSX:NATF)

is projected to reach a target price of Rs485 per share December 2026, a potential upside from

current price of Rs394.

JS Global Capital Ltd has reinitiated coverage on National Foods with a “Buy” rating, citing robust earnings growth potential, sustained margins, and benefits from tax incentives under the company’s expansion into a Special Economic Zone (SEZ) in Faisalabad.

The brokerage expects National Foods’ standalone earnings to

post a five-year CAGR of 28%, with Pakistan operations contributing over 90% of

consolidated profits and 76% of the target price.

The report highlights the company’s strong brand

positioning, pricing power, and growing demand for convenience food products as

key drivers supporting a 15% five-year sales CAGR.

Despite input cost pressures in FY23–24, NATF sustained

gross margins above 30%. With raw material prices easing, the start of

production at its cost-efficient Faisalabad facility, and greater in-house

sourcing, margins are expected to remain above 35% already reaching 38% in

1QFY26.

The company’s tax rate is projected to decline to around 12%

during FY26–34, reflecting the SEZ exemption.

At its recent Annual General and Corporate Briefing Sessions

(AGM & CBS), the management reaffirmed that National Foods remains the

market leader in ketchup, recipe mixes, pickles, salt, and jams.

The company has also introduced a new range under its

‘Drizzle’ sauces brand, aiming to strengthen its presence in the fast-growing

condiments segment. Ketchup, recipe mixes, and pickles together account for

60–70% of total revenues.

The company reiterated its commitment to a consistent

dividend policy, with Rs18 per share declared in the first quarter, including

Rs3 in recurring DPS and Rs15 as a special payout from the A1 Bags &

Supplies divestment gain.

For FY26, NATF

expects earnings between Rs25–30 per share, with gross margins to stay around

first-quarter levels of approximately 38%.

|

NATF: Key Statistics |

||||||

|

Rs mn |

FY23 |

FY24 |

FY25 |

FY26E |

FY27E |

FY28E |

|

Sales |

29,603 |

37,377 |

44,587 |

51,586 |

60,187 |

69,116 |

|

Sales

Growth |

10% |

26% |

19% |

16% |

17% |

15% |

|

Gross

Margins |

34% |

31% |

35% |

37% |

37% |

37% |

|

PAT |

2,151 |

1,268 |

3,181 |

5,143 |

6,182 |

7,732 |

|

EPS

(Rs) |

9.23 |

5.44 |

13.65 |

22.06 |

26.52 |

33.17 |

|

EPS

Growth |

9% |

-41% |

151% |

62% |

20% |

25% |

|

DPS

(Rs) |

2.5 |

6.5 |

9 |

28 |

21.22 |

26.54 |

|

EPS

Consol (Rs) |

13.62 |

8.19 |

14.85 |

75.63 |

26.65 |

35.08 |

|

P/E |

8.52 |

17.03 |

13.51 |

5 |

14.19 |

10.78 |

|

D/Y |

2% |

5% |

4% |

7% |

6% |

7% |

SOURCE: COMPANY FINANCIALS, JS GLOBAL

The management noted that the new Faisalabad plant is

already delivering cost efficiencies and improved product pricing flexibility,

while UAE-based subsidiaries are expected to achieve breakeven within two to

three years.

According to the brokerage, a 15% upside to FY27 earnings is

possible if reinvestment yields from the divestment proceeds reach 10%,

compared to the 4.5% currently assumed. It, however, cautioned that soft

domestic demand or delays in new investment projects could affect near-term

sentiment.

National Foods currently trades at a FY27 forward P/E of

14.2x, well below its 10-year average of 29x and peers’ average of 21x. The

stock’s PEG ratio of 0.6x also suggests attractive relative valuation compared

to its five-year historical average of 1.3x.

JS Global’s liking for the stock is anchored on its strong

revenue base, stable margins, and long-term growth opportunities arising from

demographic shifts, increasing urbanization, and rising demand for convenience

and packaged food products. The brokerage also sees upside from exports to

regional markets, the divestment-driven deleveraging plan, and lower interest

rates ahead.

However, the report also flags key risks, including

potential weakness in domestic demand due to persistent inflation and slower

recovery in household spending, as well as volatility in agricultural input

prices that could pressure margins if cost increases are not fully passed on.

The brokerage also warned that any early withdrawal or delay

in the SEZ tax holiday could materially affect earnings forecasts beyond FY34,

while execution risks around reinvestment of A1 divestment proceeds and new

overseas ventures may result in longer payback periods or lower-than-expected

returns.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 164,626.29 351.26M | -0.98% -1632.25 |

| ALLSHR | 98,999.23 613.73M | -0.76% -757.44 |

| KSE30 | 50,342.54 122.55M | -1.13% -575.33 |

| KMI30 | 229,014.43 138.56M | -1.61% -3757.33 |

| KMIALLSHR | 63,057.91 362.66M | -1.13% -722.77 |

| BKTi | 49,028.54 65.39M | -0.01% -2.61 |

| OGTi | 32,109.94 7.71M | -1.79% -583.79 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile