Gold steadies ahead of U.S. jobs data as fed rate cut bets grow

MG News | September 05, 2025 at 04:48 PM GMT+05:00

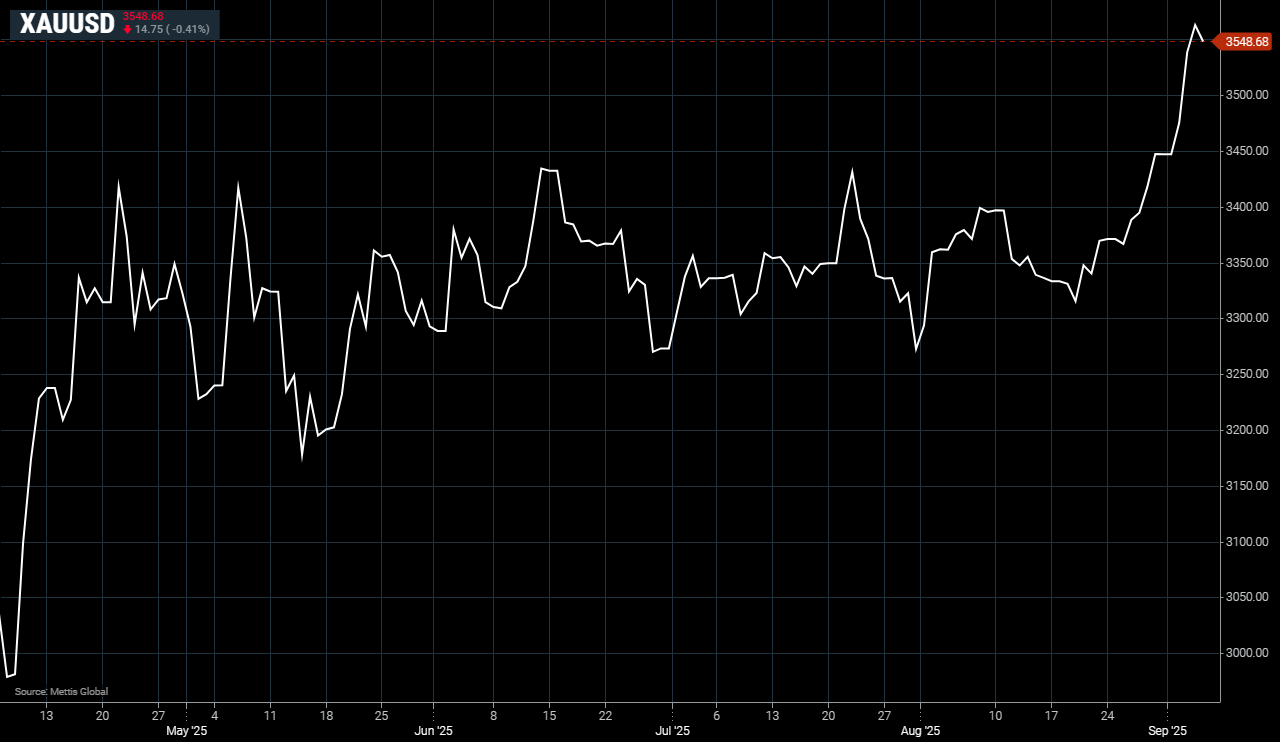

September 05, 2025 (MLN): Gold spot prices increased by 0.41% ($14.75) at $3,548.68 per ounce, as of [4:33 pm PST]

Gold prices rose on Friday, heading for their strongest

weekly advance in three months, as growing expectations of a Federal Reserve

rate cut lifted the metal’s appeal while investors looked ahead to the release

of U.S. non-farm payrolls data later in the day.

Initial jobless claims in the United States came in higher than anticipated

last week, while the ADP National Employment Report indicated private sector

hiring in August fell short of expectations both reinforcing signs of a slowing

labor market.

Markets are now awaiting the release of the U.S.

non-farm payrolls data at 1230 GMT.

Saxo Bank’s head of commodity strategy, Ole

Hansen, noted that the trajectory of gold in the near term will largely depend

on the payrolls outcome and how it shapes expectations for Federal Reserve

policy, as well as movements in bond yields and the dollar.

He added that weaker-than-expected data could push gold toward $3,650, while

the $3,450–$3,500 range remains a crucial support zone.

Earlier this week, several Fed officials

flagged employment concerns as strengthening the argument for easing monetary

policy.

Traders broadly anticipate the central bank will initiate its first rate cut

of the year a 25 basis point reduction, when it concludes its September 17–18

policy meeting.

Gold, which set a fresh all-time high of

$3,578.50 on Wednesday, typically thrives in lower interest rate environments

as it does not yield interest.

Hansen emphasized that a backdrop of reduced borrowing costs, lingering

geopolitical tensions, doubts about Fed independence, a steeper yield curve,

and a weaker dollar all continue to support the precious metals outlook.

Elsewhere

in the market, spot silver gained 0.2% to $40.76 per ounce, on track for a

third consecutive weekly rise. Platinum advanced 1% to $1,381.17, while

palladium slipped 0.7% to $1,119.23.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes