Weekly Market Roundup

MG News | November 16, 2025 at 11:11 PM GMT+05:00

November 16, 2025 (MLN): The Pakistan Stock Exchange extended its winning streak as the KSE-100 Index closed the week at 161,935.19 points, rising from last week’s 159,592.9 and securing a 1.47% weekly gain.

The advance was steady and broad-based, powered by sector-specific triggers, improving macro indicators, and renewed domestic investor appetite.

Market Cap:

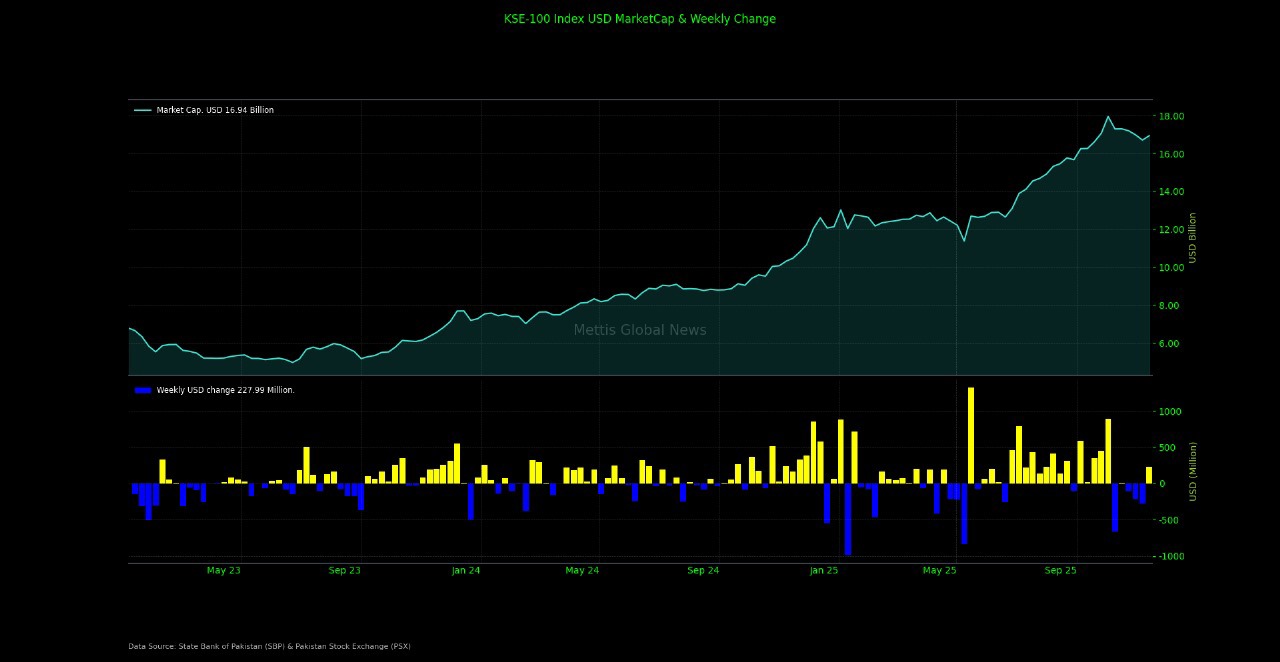

Market capitalization also expanded meaningfully, reaching Rs4.755 trillion, up 1.32% in PKR terms, while dollar-based capitalization climbed 1.36% to settle at $16.94 billion, reflecting healthy confidence across the board.

This upward move came despite heightened regional tensions, demonstrating that the market was in no mood to tap the brakes.

Instead, it gained momentum from developments within key sectors, particularly fertilizers and cement, which acted as the engines of the rally.

The USD-based weekly return stood at 1.50%, extending the market’s streak of dollar-positive weeks._20251116175136559_54e9c2.jpeg)

Index Movers:

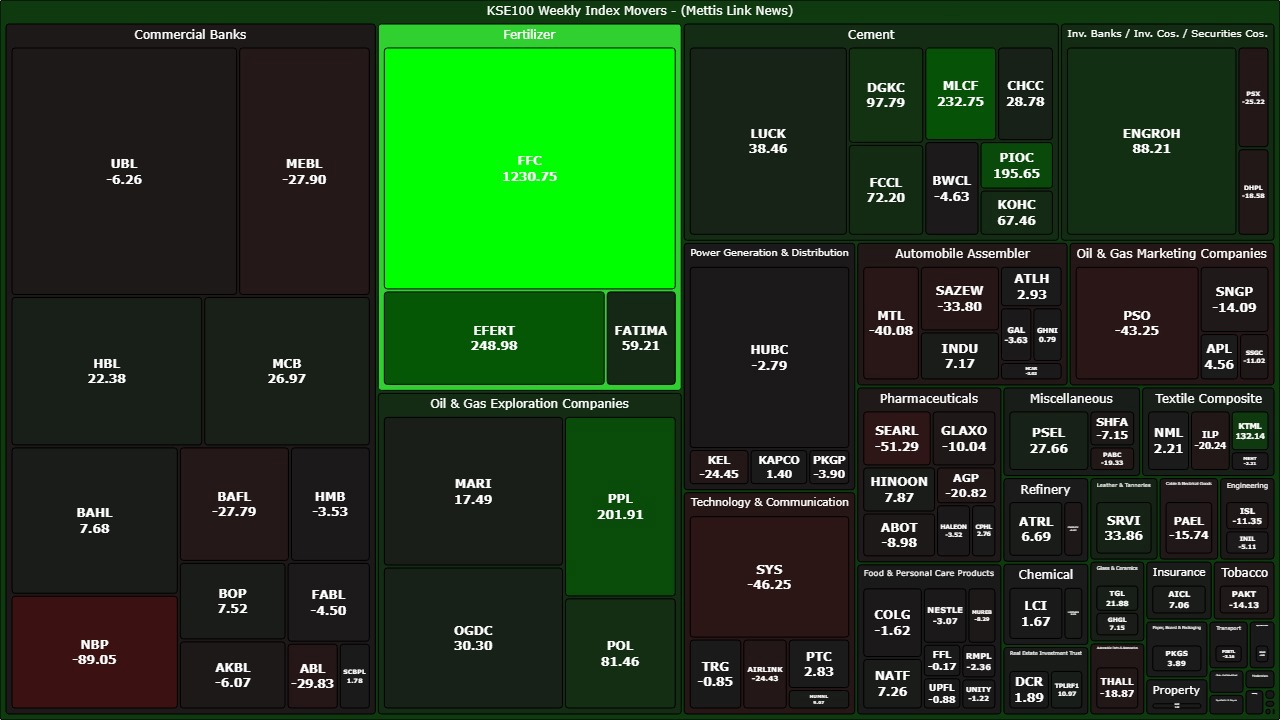

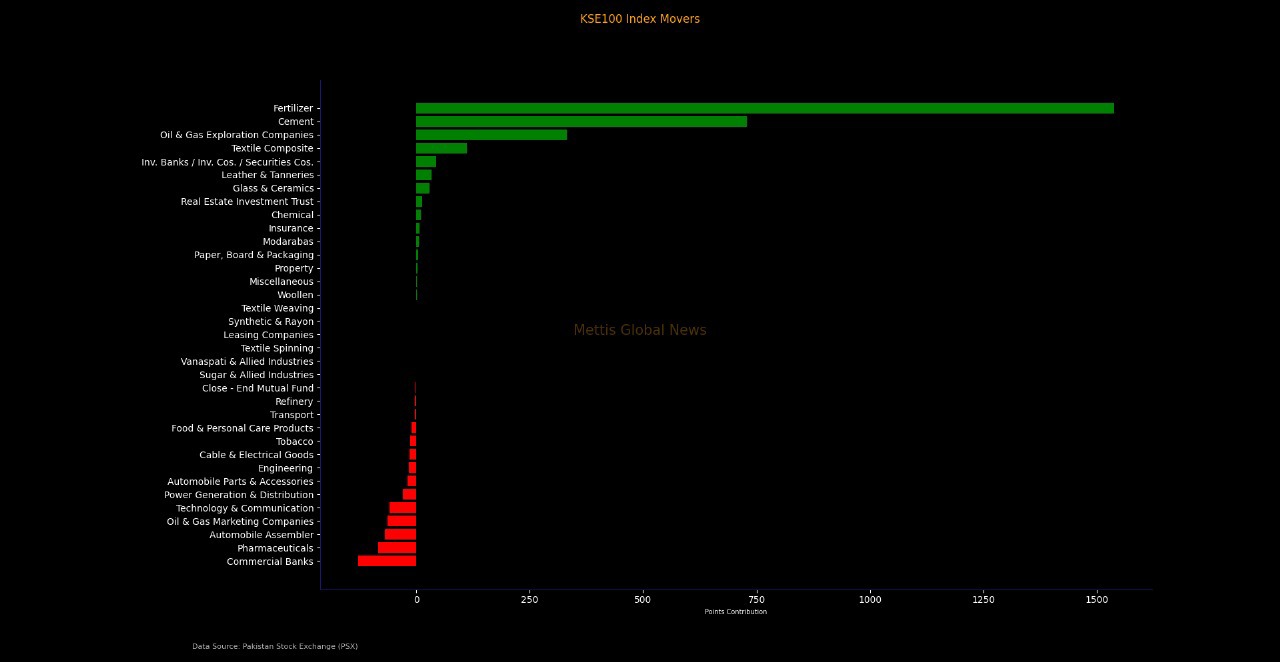

Fertilizers emerged as the single largest contributor to the index’s movement, adding a staggering 1,538.93 points to the KSE-100.

At the heart of this surge was FFC, which alone contributed 1,230.75 points, an exceptional performance that underscores the sector’s dominance.

EFERT added another 248.98 points, while FATIMA chipped in with a further boost, making fertilizers the clear backbone of the week’s rally.

Cement followed with force of its own, aided by renewed whispers of M&A activity that reignited investor confidence.

This sector contributed 728.46 points to the index, driven by strong performances across names such as MLCF, which accounted for 232.75 points, PIOC, adding 195.65 points, and DGKC, which brought in 97.79 points.

Even the larger cement names such as LUCK, KOHC, and FCCL added notable value, painting a picture of sector-wide momentum rather than isolated gains.

The oil and gas exploration sector added meaningful depth to the week’s rise, contributing 331.16 points, reflecting improved investor sentiment and steady global energy market conditions.

Companies like PPL added 201.91 points, while POL and OGDC also pushed the index upward, contributing 81.46 and 30.29 points, respectively.

Textile composite stocks performed surprisingly wel,l too, contributing 111.91 points as selective buying emerged in names such as KTML, which alone added 132.14 points.

Real estate investment trusts, glass and ceramics, and investment companies also added positive, albeit smaller, contributions, showcasing the breadth of participation across sectors.

Leather, though a small sector in weight, recorded a dramatic contribution of 33.85 points, driven primarily by SRVI.

Meanwhile, investment banks and securities companies strengthened the momentum further with 44.40 points, underscoring increased market activity.

On the flip side, the market faced notable pressure from commercial banks, which emerged as the biggest drag, pulling down the index by 128.59 points. The sector struggled under the weight of muted sentiment and concerns over regulatory developments.

Key names such as NBP stood out for negative contributions, with the bank erasing 89.05 points, the steepest decline among all scrips.

Other large banks like UBL, MEBL, ABL, and BAFL also added to the sector’s weakness, collectively reflecting investors’ cautious tone.

Pharmaceuticals followed with a negative contribution of 84.02 points, with SEARL and ABOT weighing on the sector.

Autos lost 69.64 points, dragged down by companies such as MTL and HCAR.

The oil marketing sector subtracted 63.80 points, led by PSO’s decline of 43.24 points, while the technology and communication sector shed 59.62 points, largely due to pressure on SYS, which contributed a negative 46.24 points.

Power generation companies, cable and electrical goods, tobacco, and food and personal care products also posted mild negative contributions, but none were severe enough to overshadow the strong momentum created by fertilizers and cement.

Macroeconomic indicators provided a steady platform for the week’s bullishness. In the latest T-bill auction, the government raised Rs492.9bn against a target of Rs550bn, with participation soaring to Rs1.62 trillion.

Roshan Digital Account inflows continued their upward march, reaching $11.31bn as of October 2025.

On the external front, SBP reserves increased modestly by $21.8 million to reach $14.5 billion.

The PKR/USD exchange rate held firmly around 280.72, providing currency stability to bolster foreign investor confidence.

FIPI/LIPI:

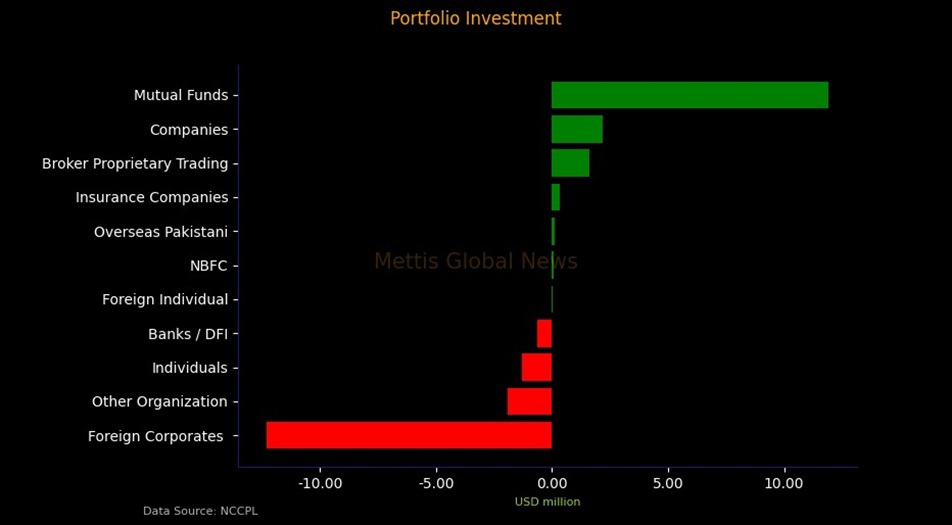

While foreign corporates were net sellers once again, offloading $12.32 million, the market held firm thanks to the resilience of domestic investors.

Mutual funds emerged as the largest buyers with $11.92 million in net purchases, absorbing much of the foreign outflow.

Companies and broker proprietary traders also lent support, while individuals and banks remained on the selling side.

The way local institutions stepped up once again confirmed the long-standing market pattern: whenever foreign investors step back, domestic players are willing to fill the void.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,202.86 341.59M | -0.20% -384.80 |

| ALLSHR | 112,423.22 745.46M | -0.07% -79.96 |

| KSE30 | 57,956.48 141.89M | -0.12% -70.41 |

| KMI30 | 267,375.33 135.18M | -0.39% -1043.48 |

| KMIALLSHR | 72,363.20 391.84M | -0.20% -146.78 |

| BKTi | 53,485.97 53.11M | 0.26% 139.85 |

| OGTi | 38,916.61 17.01M | 0.72% 278.13 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,690.00 | 88,985.00 87,550.00 | 105.00 0.12% |

| BRENT CRUDE | 66.17 | 66.78 65.00 | 0.58 0.88% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.65 -2.96% |

| ROTTERDAM COAL MONTHLY | 99.00 | 0.00 0.00 | 0.30 0.30% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.22 | 61.86 60.14 | 0.59 0.97% |

| SUGAR #11 WORLD | 14.93 | 14.98 14.74 | 0.14 0.95% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market