Gold glitters at all time peak on fed cut hopes

MG News | October 14, 2025 at 02:08 PM GMT+05:00

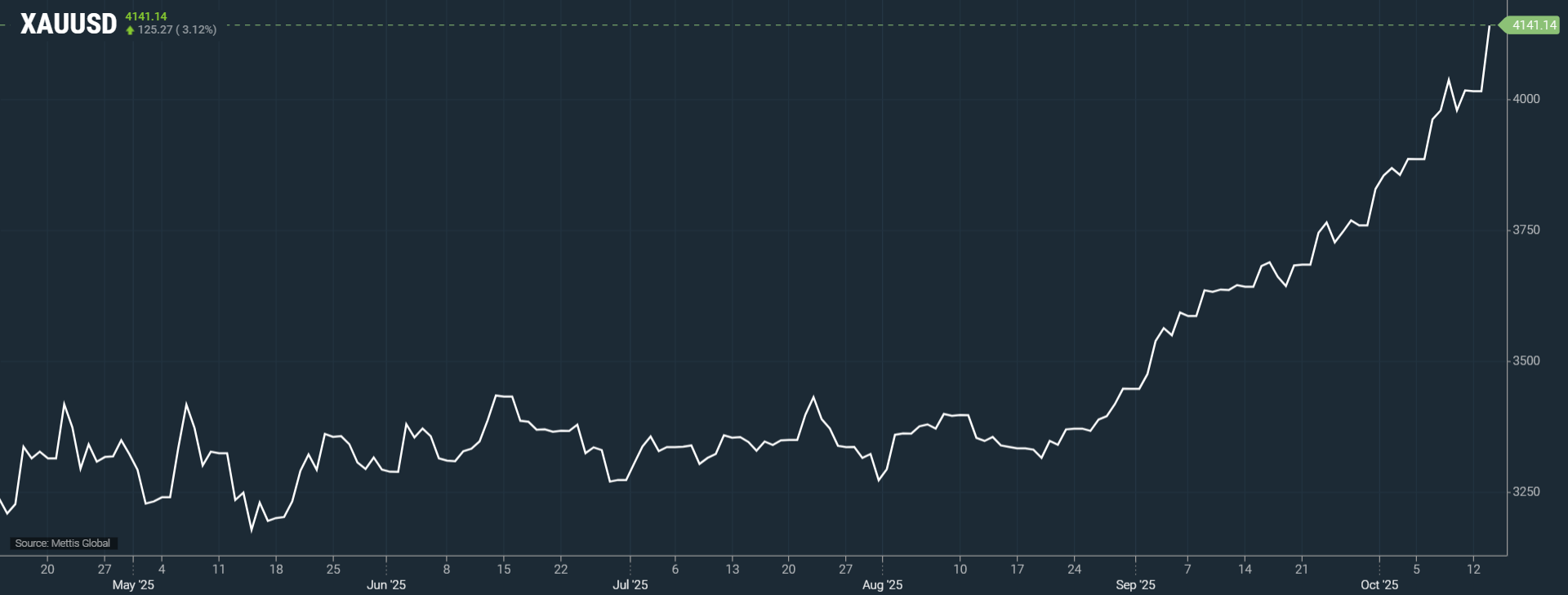

October 14, 2025 (MLN): Gold surged to an all-time high above $4,100 on Tuesday, driven by growing expectations of U.S. Federal Reserve rate cuts and renewed U.S.-China trade tensions that spurred investors toward safe-haven assets. Silver followed suit, hitting a record peak as well.

Spot gold was up 3.12% at $4,141.14 an ounce as of [2:06

pm] PST, according to data reported by Mettis Global.

Gold extended its rally on Monday, soaring past the key

$4,100 mark for the first time this year, with prices now up 58% year-to-date.

The precious metal continues to gain strength on the back of

global geopolitical and economic uncertainties, expectations of U.S. Federal

Reserve rate cuts, aggressive central bank purchases, and steady inflows into

gold-backed exchange-traded funds (ETFs).

Analysts at Bank of America and Société Générale project

that gold could reach $5,000 by 2026, while Standard Chartered has lifted its

2026 average price forecast to $4,488.

Spot silver also advanced 1.1% to $53.13, after hitting a

record $53.45 earlier in the session, supported by the same bullish factors

driving gold and by tightening supply in the spot market.

“The rally today isn’t mainly about trade tensions,” said

Kelvin Wong, senior market analyst at OANDA. “It’s more about the growing

conviction that the Fed will stick to its rate-cutting path, which lowers

long-term borrowing costs and reduces gold’s opportunity cost.”

Philadelphia Federal Reserve President Anna Paulson noted

that mounting risks to the labor market strengthen the argument for further

U.S. interest rate reductions.

Investors are now awaiting remarks from Fed Chair Jerome

Powell at the NABE annual meeting on Tuesday for further policy signals.

Market pricing shows a 97% probability of a 25-basis-point

rate cut in October and a 90% chance of another in December. Gold, which offers

no yield, typically benefits in lower interest rate environments.

On the geopolitical front, U.S. President Donald Trump is

still expected to meet Chinese President Xi Jinping in South Korea later this

month, according to Treasury Secretary Scott Bessent.

The renewed trade friction follows China’s recent decision

to expand export restrictions on rare earths, to which Trump responded with a

threat of 100% tariffs on Chinese imports and new export limits on key U.S.

software starting November 1.

Meanwhile, the ongoing U.S. federal government shutdown now in its 13th day is beginning to weigh on the country’s economic momentum, Bessent added.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,677.70 295.62M | 0.79% 1304.39 |

| ALLSHR | 100,309.12 590.21M | 0.65% 649.40 |

| KSE30 | 50,855.17 184.12M | 0.72% 361.13 |

| KMI30 | 239,315.92 162.68M | 0.94% 2217.63 |

| KMIALLSHR | 65,437.31 338.54M | 0.87% 565.13 |

| BKTi | 45,391.23 48.89M | 0.60% 270.74 |

| OGTi | 32,857.06 26.79M | 1.29% 418.64 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,500.00 | 0.00 0.00 | 435.00 0.48% |

| BRENT CRUDE | 62.32 | 63.39 62.12 | -0.55 -0.87% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 91.00 89.00 | 2.00 2.25% |

| ROTTERDAM COAL MONTHLY | 99.00 | 99.00 96.85 | 1.70 1.75% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.48 | 0.00 0.00 | -0.07 -0.12% |

| SUGAR #11 WORLD | 15.21 | 15.29 15.08 | 0.07 0.46% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Foreign Exchange Reserves

Foreign Exchange Reserves