Pakistan’s outstanding external debt, liabilities reach $134bn in Q1FY26

MG News | November 14, 2025 at 04:22 PM GMT+05:00

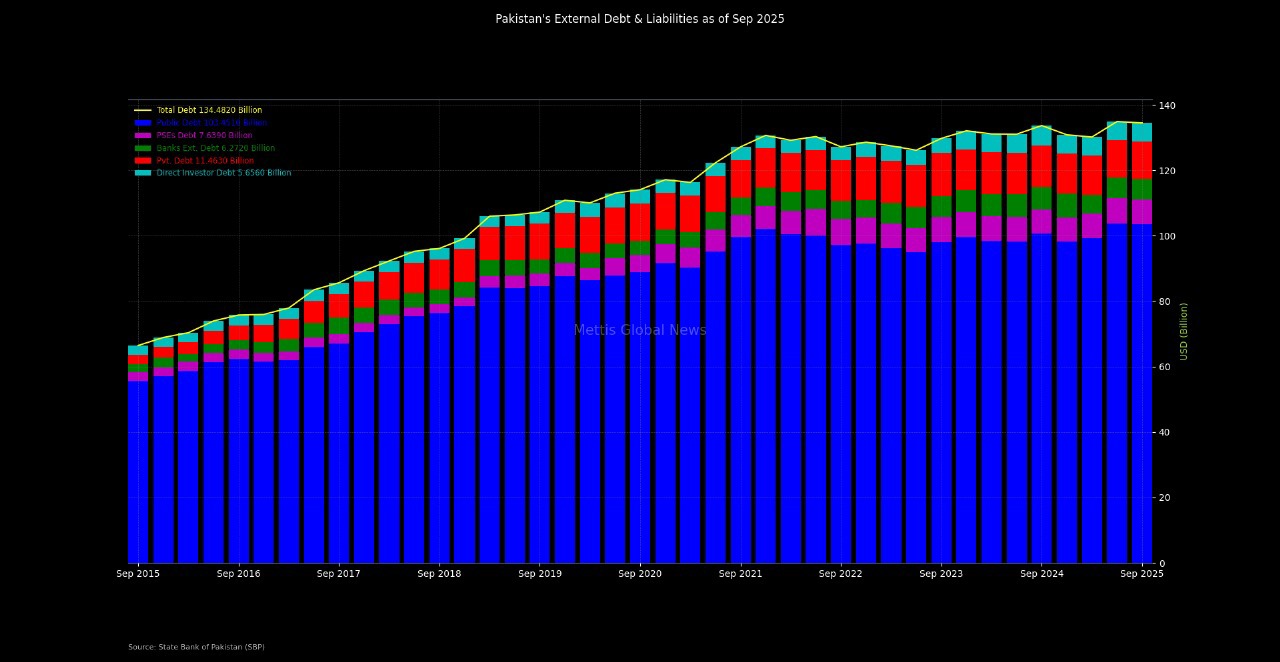

November 14, 2025 (MLN): Pakistan’s external debt and liabilities (outstanding) reached $134.48bn at the end of Q1FY26, reflecting a decrease of $429.79m or 0.32% QoQ, the central bank data showed on Friday.

On a yearly basis, the country’s external debt and liabilities went up by $696.792m or 0.52% YoY during Q1FY26, as the figure stood at $133.785bn at the end of Q1FY25.

According to the latest data issued by the SBP, 76.93% of the entire debt is attributed to public external debt, the combination of the government’s long-term and short-term external debt, IMF loans to the central bank, and foreign exchange liabilities.

The government's external debt stood at $82.41bn during Q1FY26, reflecting a decrease of 0.14% QoQ, while going up by 3.88% YoY.

Within the external debt, the long-term debt by the end of the respective quarter stood at $81.46bn, down by by 0.4% QoQ, while up by by 3.83% YoY.

Meanwhile, the short-term debt (less than one year) increased by 8.58% YoY to $952.522m compared to the $877.251m recorded in the same period last year.

The data further shows that International Monetary Fund (IMF's) loans to the central bank and federal government stood at $3.654bn and $5.381bn respectively during the quarter under review.

The foreign exchange liabilities outstanding during the period under review were recorded at $12.007bn, up by by 0.43% QoQ, while down by by 0.29% YoY.

Apart from public external debt, the remaining outstanding amount comprises borrowing from public sector enterprises, banks, and the private sector.

Outstanding external debt of public sector enterprises (PSEs) clocked in at $7.639bn, a decrease by 1.5% QoQ, while went up by 3.91% YoY.

The amount owed to banks stood at $6.272bn during the review period, in which short-term bank borrowing stood at $1.1bn, while long term borrowing was recorded at $1.319bn in the quarter under review.

Private sector debt, which attributed 8.52% of the total external debt amounted to $11.463bn by the end of 1QFY24, down by 0.23% QoQ and 9.9% YoY.

The last element of the total external debt and liabilities was debt liabilities to direct investors (Intercompany debt) which stood at $5.656bn.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 171,966.46 72.86M | -0.12% -203.83 |

| ALLSHR | 102,998.66 152.01M | -0.46% -477.99 |

| KSE30 | 52,713.59 25.45M | 0.10% 54.80 |

| KMI30 | 240,560.08 21.42M | 0.02% 48.79 |

| KMIALLSHR | 65,793.97 78.40M | -0.29% -194.07 |

| BKTi | 50,963.18 10.26M | -0.10% -49.73 |

| OGTi | 33,848.62 4.04M | 0.84% 283.15 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,280.00 | 67,665.00 66,880.00 | 75.00 0.11% |

| BRENT CRUDE | 71.91 | 72.16 71.59 | 0.25 0.35% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.10 -3.13% |

| ROTTERDAM COAL MONTHLY | 105.50 | 0.00 0.00 | -1.75 -1.63% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.64 | 66.86 66.31 | 0.24 0.36% |

| SUGAR #11 WORLD | 13.72 | 13.85 13.62 | -0.04 -0.29% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Roshan Digital Account

Roshan Digital Account