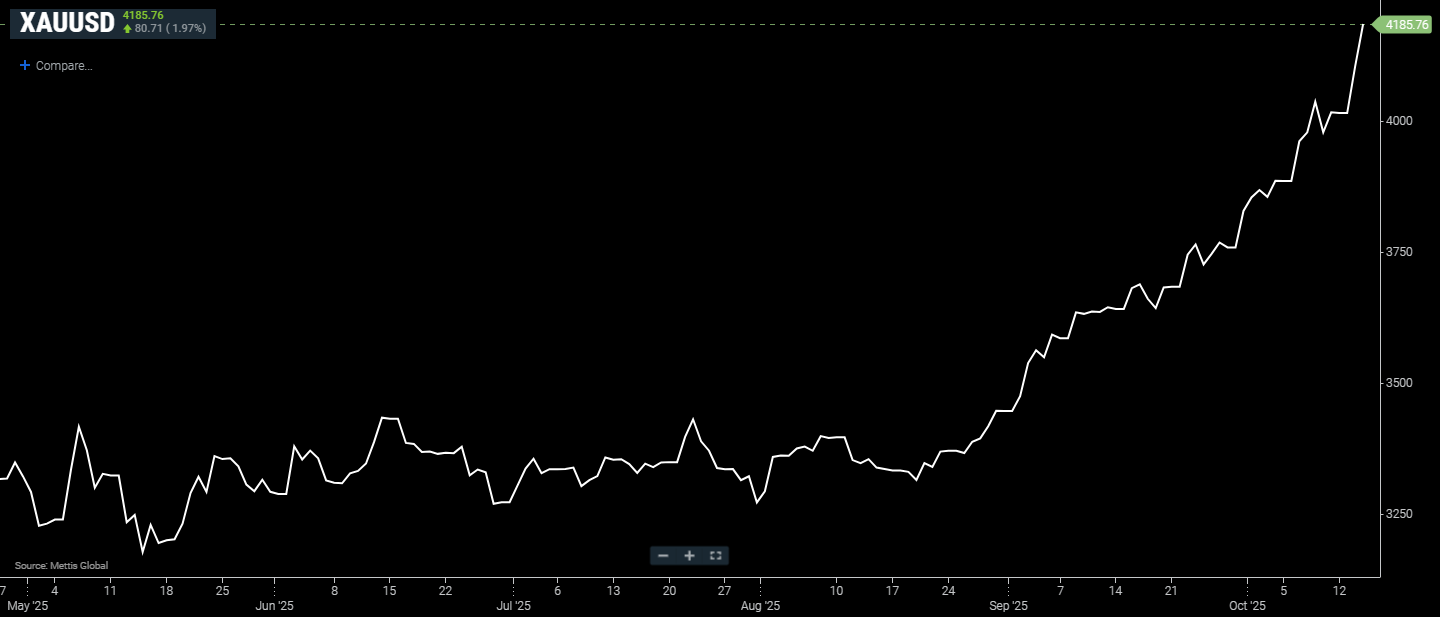

Gold nears record $4,200 as trade tensions boost demand

MG News | October 15, 2025 at 11:00 AM GMT+05:00

October 15, 2025 (MLN): Gold prices surged to a new record high, closing in on the $4,200-per-ounce mark on Wednesday, supported by growing expectations of additional U.S. interest rate cuts and rising concerns over U.S.-China trade relations that lifted demand for safe-haven assets.

Spot gold was up 1.97% at $4185.76 an ounce as of [10:58 am] PST, according to data reported by Mettis Global.

December U.S. gold futures climbed

0.8% to settle at $4,197.50 per ounce.

Market sentiment was further

influenced by U.S. President Donald Trump’s remarks on Tuesday, that his administration would unveil on Friday

a list of “Democrat programmes” to be shut down amid the ongoing federal

government closure.

Meanwhile, Federal Reserve Chair

Jerome Powell noted that while the U.S. labour market remains soft, the

broader economy appears to be on a “somewhat firmer trajectory than expected.”

He reiterated that future interest rate decisions will continue to be

determined “meeting by meeting,” balancing weak employment data against

inflation that remains above target levels.

Investors are now almost fully pricing

in 25-basis-point rate cuts in both October and December, according to

market expectations.

Gold has soared 59% so far this

year, driven by a combination of factors persistent geopolitical and economic

uncertainty, expectations of monetary easing in the U.S., record central bank

purchases, growing moves toward de-dollarisation, and solid inflows into

gold-backed exchange-traded funds (ETFs).

Adding to market jitters, Trump

revealed that Washington is weighing potential curbs on trade with China,

including restrictions related to cooking oil, as both nations began

implementing mutual port fees earlier this week.

Separately, the International

Monetary Fund (IMF) upgraded its 2025 global growth forecast, citing

improving financial and tariff conditions. However, it warned that renewed

tensions between the world’s two largest economies could once again pose risks

to global economic stability.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 179,603.73 379.80M | -0.50% -908.92 |

| ALLSHR | 108,021.19 705.75M | -0.35% -379.48 |

| KSE30 | 54,828.33 124.04M | -0.69% -379.24 |

| KMI30 | 253,396.08 110.85M | -0.77% -1976.44 |

| KMIALLSHR | 69,330.18 392.81M | -0.57% -398.02 |

| BKTi | 51,913.39 44.12M | -0.50% -259.93 |

| OGTi | 35,053.03 27.27M | -0.84% -295.86 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,980.00 | 69,580.00 65,970.00 | 3480.00 5.31% |

| BRENT CRUDE | 67.73 | 68.05 66.89 | 0.21 0.31% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -1.50 -1.54% |

| ROTTERDAM COAL MONTHLY | 104.60 | 104.60 104.60 | 1.30 1.26% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.81 | 63.26 62.14 | -0.03 -0.05% |

| SUGAR #11 WORLD | 13.55 | 13.57 13.42 | 0.07 0.52% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

Weekly Inflation

Weekly Inflation