Gold, silver surge on USA, Venezuela tensions

MG News | January 05, 2026 at 11:30 AM GMT+05:00

January 05, 2026 (MLN): Gold prices jumped on Monday,

with gains spreading across the precious metals complex, after reports that the

United States had captured Venezuelan President Nicolás Maduro over the

weekend, heightening geopolitical uncertainty and driving investors toward

safe-haven assets.

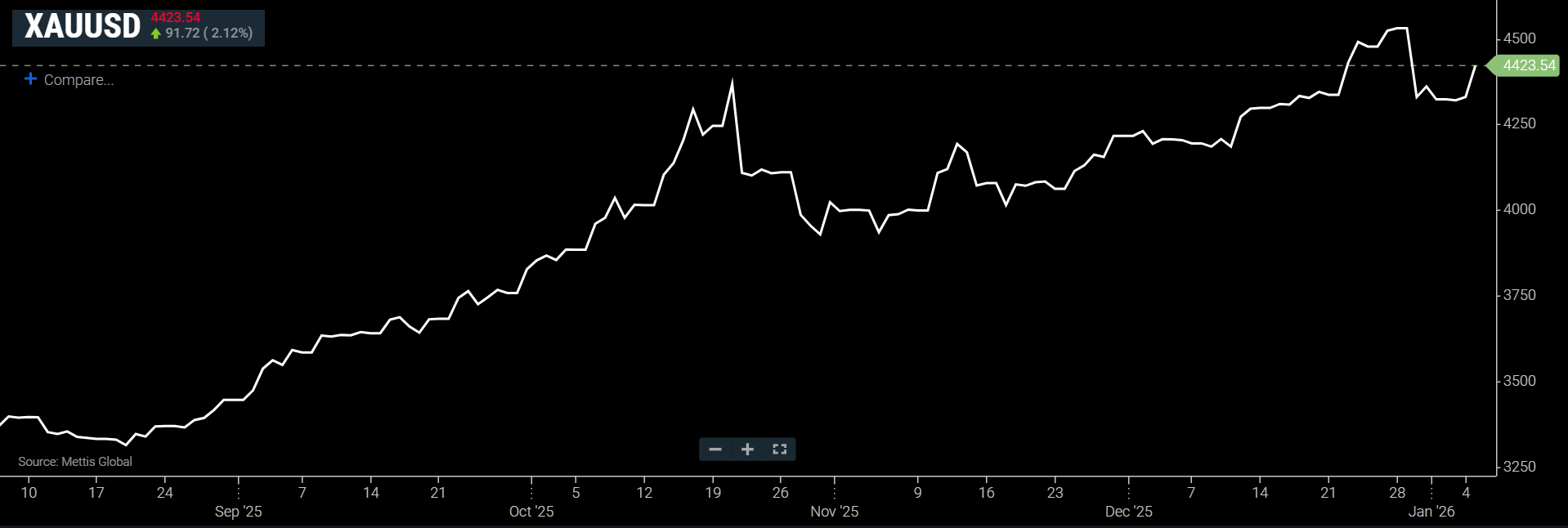

Spot gold was up 2.12% at $4,433.54 an ounce as of [11:27 am] PST, according to data reported by Mettis Global.

U.S. gold futures for February delivery rose 2.1% to

$4,419.90 an ounce, extending a rally fueled by political risk and expectations

of looser monetary policy, reported by CNBC.

According to Tim Waterer, chief market analyst at KCM Trade,

renewed turmoil in Venezuela has strengthened demand for defensive assets.

He said gold and silver are benefiting as investors seek

protection against escalating geopolitical risks.

Gold’s latest advance adds to an extraordinary run last

year, when bullion surged 64%, marking its strongest annual performance since

1979.

Support came from geopolitical tensions, aggressive interest-rate cuts, heavy central bank buying and strong inflows into gold-backed exchange-traded funds.

Prices reached a record high of $4,549.71 on

December 26, 2025.

Meanwhile, Philadelphia Federal Reserve President Anna Paulson said on Saturday that additional rate cuts may not come quickly following last year’s easing cycle.

Her remarks contrast with market

expectations, as investors continue to price in at least two U.S. Federal

Reserve rate cuts this year.

Precious metals typically perform well in environments

marked by lower interest rates and heightened geopolitical or economic

uncertainty, as they do not yield interest.

Silver outperformed again, with spot prices jumping 4.4% to

$75.82 an ounce.

The metal had reached an all-time high of $83.62 on December

29 and ended last year up an extraordinary 147%, its strongest annual gain on

record.

Silver’s rally has been driven by supply tightness, rising

industrial and investment demand, and its designation as a critical mineral in

the United States last year.

Platinum also advanced, rising 2.2% to $2,190.55 an ounce

after hitting a record high of $2,478.50 last week. Palladium gained 1.8% to

$1,667.45 an ounce, rounding out broad-based strength across the precious

metals market.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 185,057.83 215.80M | 0.00% 0.00 |

| ALLSHR | 111,198.99 737.64M | 0.00% 0.00 |

| KSE30 | 56,808.99 106.85M | 0.00% 0.00 |

| KMI30 | 262,806.56 83.35M | 0.00% 0.00 |

| KMIALLSHR | 71,591.94 222.57M | 0.00% 0.00 |

| BKTi | 53,634.85 44.18M | 0.00% 0.00 |

| OGTi | 38,885.40 12.11M | 0.00% 0.00 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 78,985.00 | 79,435.00 77,870.00 | 780.00 1.00% |

| BRENT CRUDE | 66.04 | 66.64 65.66 | -0.26 -0.39% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -4.75 -5.01% |

| ROTTERDAM COAL MONTHLY | 102.50 | 102.50 100.25 | -0.90 -0.87% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.94 | 62.46 61.55 | -0.20 -0.32% |

| SUGAR #11 WORLD | 14.26 | 14.35 14.13 | -0.01 -0.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI