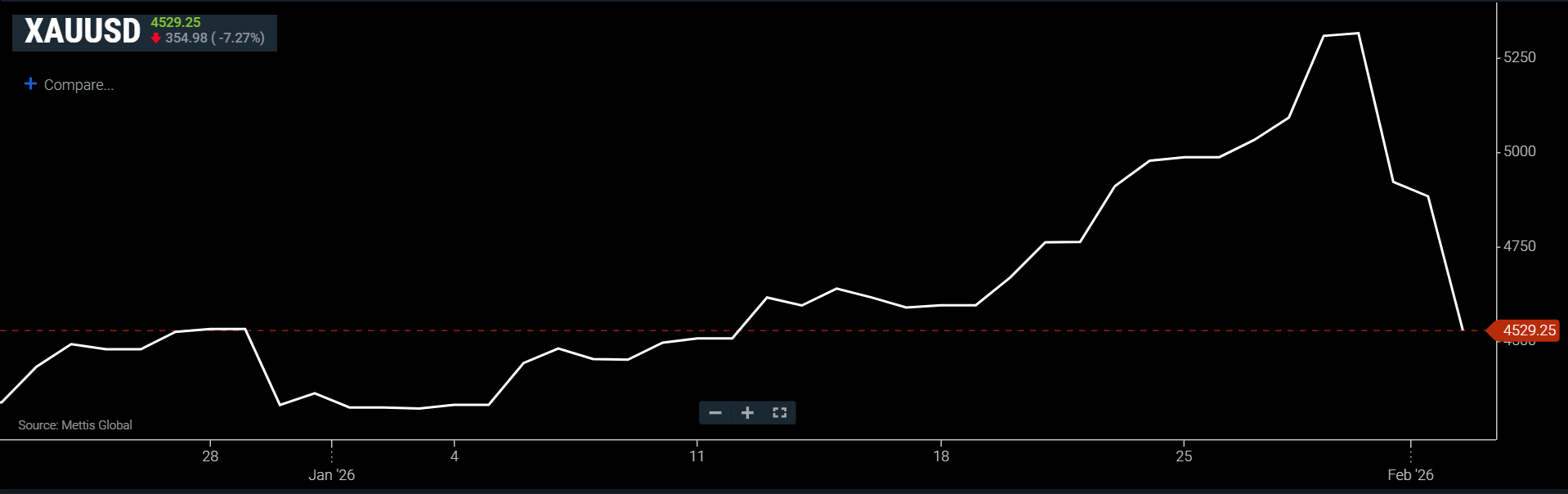

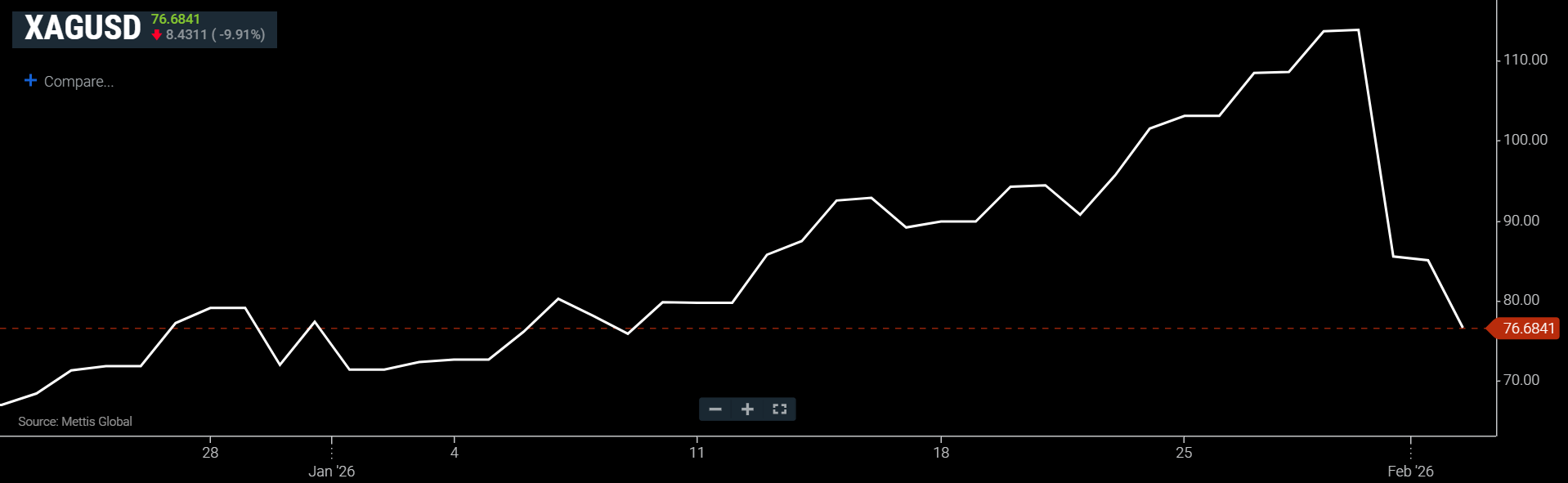

Gold down, silver slides further

MG News | February 02, 2026 at 11:18 AM GMT+05:00

February 2, 2026 (MLN): Fresh turbulence rattled

precious-metals markets this week, wiping out much of the momentum that had

driven gold and silver to record territory only days earlier as investors

rushed to secure profits and the U.S. dollar strengthened.

Gold extended its decline on Monday, adding to the steep

losses recorded at the end of last week.

Spot gold fell 7.27% to $4529.25 an ounce as of [11:09 PM] PST, according to data reported by Mettis Global, after a 8% plunge that dragged bullion below the $5,000 threshold.

The pullback

represents one of the sharpest short-term reversals in recent memory following

a powerful rally that had propelled prices to all-time highs.

Silver mirrored the volatility, after climbing rapidly on safe-haven demand and speculative inflows, Spot silver fell 9.91% to $76.68 an ounce as of [11:09 PM] PST, according to data reported by Mettis Global.

The metal endured a dramatic sell-off, diving around 25%, its worst single-day drop since 1980.

Market sentiment shifted quickly alongside developments in

U.S. monetary policy leadership. Hopes for interest-rate cuts were overshadowed

by uncertainty after President Donald Trump nominated former Federal Reserve

Governor Kevin Warsh to succeed Chair Jerome Powell when his term ends in May, according

to CNBC.

Warsh is widely perceived as favoring tighter monetary

policy, a view that helped lift the dollar and pressure non-yielding assets

such as gold and silver.

Rising rate expectations also increase the opportunity cost

of holding precious metals compared with interest-bearing government bonds.

Geopolitical risk premiums eased slightly as well after

remarks from President Trump hinted at potential progress toward a deal with

Iran, reducing some safe-haven demand.

Even with the recent downturn, both metals remain higher for

the year.

Silver is still up around 16% year to date, while gold holds

an approximate 8% gain.

Last year delivered far stronger advances, with gold rising

about 65% and silver surging roughly 145%, highlighting how quickly enthusiasm

in the precious-metals trade can reverse

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,767.43 96.56M | 1.28% 1990.22 |

| ALLSHR | 94,192.56 192.45M | 1.29% 1198.04 |

| KSE30 | 48,538.44 40.24M | 1.35% 647.68 |

| KMI30 | 223,302.35 33.64M | 1.49% 3287.28 |

| KMIALLSHR | 60,676.24 67.88M | 1.28% 765.52 |

| BKTi | 45,903.14 14.89M | 1.13% 514.54 |

| OGTi | 31,223.70 4.51M | 1.93% 592.36 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 72,990.00 | 73,600.00 72,390.00 | -455.00 -0.62% |

| BRENT CRUDE | 84.04 | 84.28 82.13 | 2.64 3.24% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 124.00 121.25 | -6.50 -5.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 77.42 | 77.65 75.56 | 2.76 3.70% |

| SUGAR #11 WORLD | 13.71 | 14.07 13.70 | -0.22 -1.58% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction