Weekly Market Roundup

.jpeg?width=950&height=450&format=Webp)

Nilam Bano | April 20, 2025 at 07:11 PM GMT+05:00

April 20, 2025 (MLN): This week, the capital market witnessed a series of positive developments on the economic front, which helped restore investor confidence.

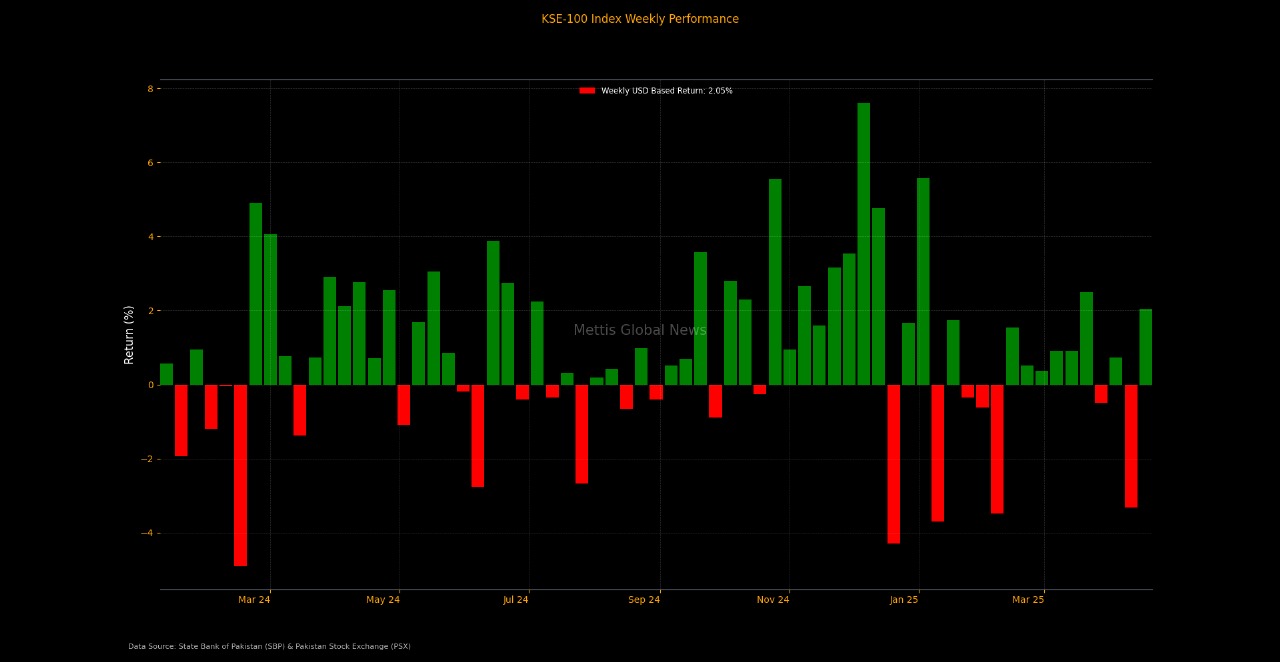

Accordingly, the benchmark KSE-100 Index gained 2,462.25 points, or 2.14%, to settle at 117,315.58 compared to last week’s close of 114,853.33.

Intraday swings were significant, with the index reaching a high of 117,888.13 (+572.55 points) and a low of 115,246.2 (-2,069.38 points).

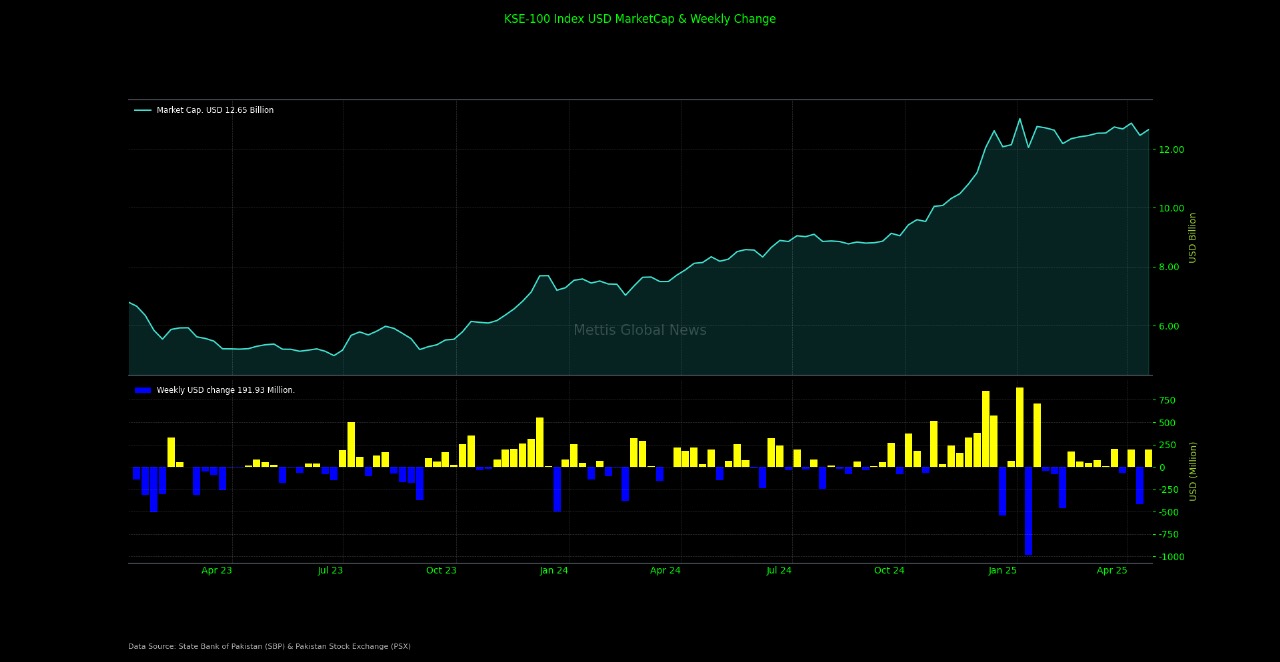

Market cap

The KSE-100 market capitalization stood at Rs3.55 trillion, up 1.63% from the previous week’s Rs3.49tr. In USD terms, the market cap was recorded at $12.65 billion, compared to $12.45bn in the prior week.

This week, the index return in USD terms was 1.54%, compared to -3.31% the previous week.

On the economic front, the week began with positive news as remittances reached a record high of $4.05bn in March 2025, marking a notable 37% YoY increase.

As a result, the country has recorded a current account surplus of $1.2bn.

Following the surge in remittances, the central bank has revised its full-year remittance forecast for FY25 to $38bn, up from the earlier estimate of $36bn.

Additionally, Pakistan is expected to receive $4–5bn from multilateral lenders and other external sources before the close of the fiscal year, according to State Bank of Pakistan (SBP) Governor Jameel Ahmad.

Also, Pakistan has recorded a Foreign Direct Investment (FDI) of $25.75m in March, compared to a FDI worth $294.17m in the Same Period Last Year (SPLY).

Further, Pak Rupee's Real Effective Exchange Rate Index (REER) decreased by 0.61% in March 2025 to a provisional value of 101.618 from the revised value of 102.246 in February 2025.

Fitch Ratings upgraded Pakistan's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'B-' from 'CCC+', with a Stable Outlook.

The foreign exchange reserves held by the State Bank of Pakistan (SBP) decreased by $127 million or 1.19% WoW to $10.57bn during the week ended on April 11, 2025.

SBP’s foreign exchange reserves- currently under pressure due to recent debt repayments, are projected to climb to $14bn by the end of June. This compares with a previous target of $13bn.

During the week, the Central Bank conducted an auction in which it sold Market Treasury Bills (MTBs) worth Rs964.63bn.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 49.55%, while CYTD return stood at 1.9%.

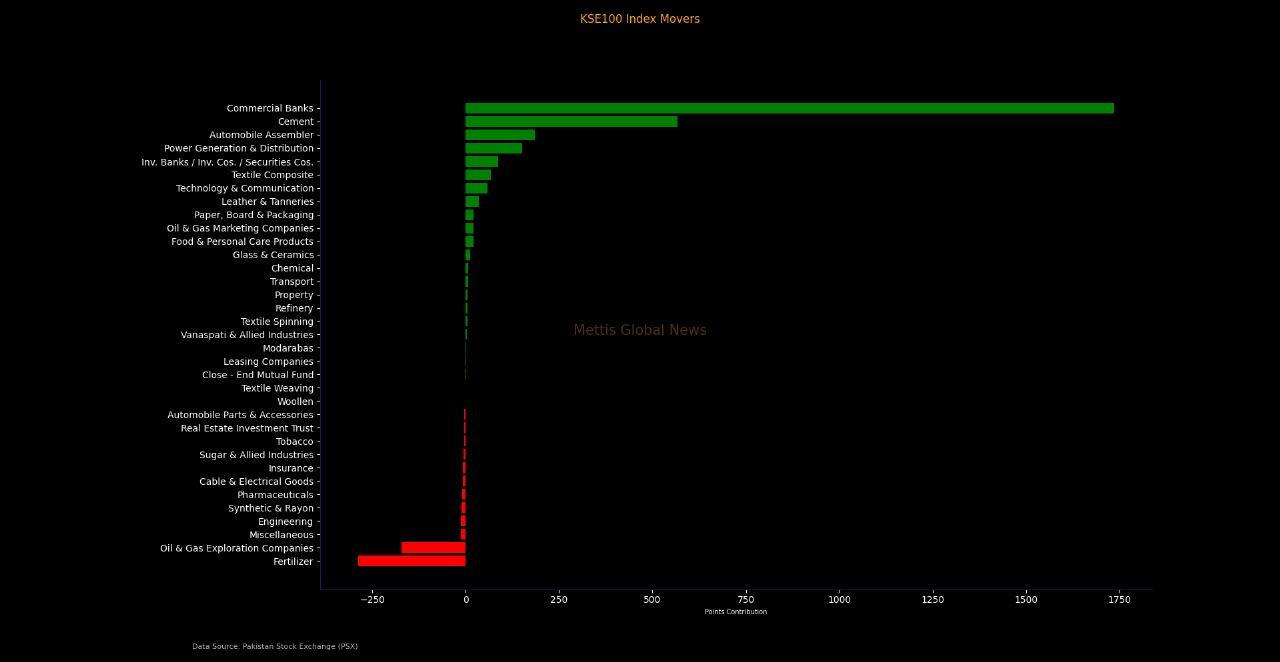

Top Index Movers

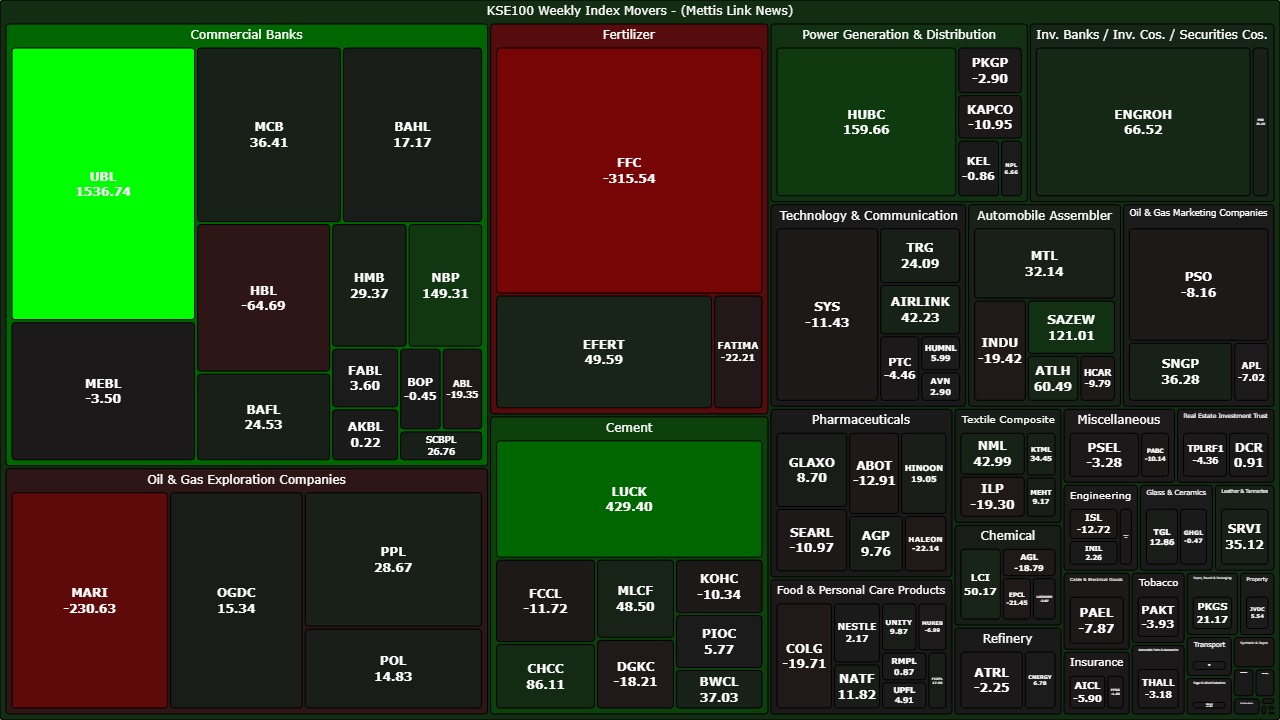

During the week, Commercial Banks, Cement, and Automobile Assemblers contributed 1,736.13, 566.54, and 184.41 points, respectively, to the index. On the flip side, Fertilizer eroded -288.14 from the index.

Among individual stocks, UBL gained 1,536.74 points, while LUCK, and HUBC added 429.39 and 159.66 points, respectively.

Conversely, FFC and MARI removed -315.53 and -230.63 points, respectively.

FIPI/LIPI

This week, Foreign Investors remained net sellers, selling equities worth $4.01m.

Foreign Corporates led the selling spree worth $4.84m, while Overseas Pakistanis purchased securities worth $0.80m.

On the other hand, local Investors were net buyers this week, purchasing equities worth $4.01m.

Banks & DFIs and Other Organizations bought securities worth $68.97m and $10.59m, respectively, whereas Mutual Funds sold securities worth $62.43m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,062.17 222.44M | -0.49% -830.92 |

| ALLSHR | 100,418.83 533.18M | -0.47% -469.95 |

| KSE30 | 51,322.39 95.56M | -0.78% -400.92 |

| KMI30 | 235,325.12 71.27M | -0.62% -1468.03 |

| KMIALLSHR | 64,292.17 192.91M | -0.54% -350.28 |

| BKTi | 49,115.42 49.83M | -0.78% -388.38 |

| OGTi | 32,316.78 8.08M | -1.33% -436.77 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

_20260227200326243_a8f892.jpeg?width=280&height=140&format=Webp)

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile