Weekly Market Roundup

Nilam Bano | March 28, 2025 at 12:31 PM GMT+05:00

March 28, 2025 (MLN): The capital market kicked off the week on a negative note as investors succumbed to selling pressure following news of the power tariff. However, the bulls made a comeback as soon as Pakistan and the IMF reached a staff-level agreement, reigniting confidence in the market.

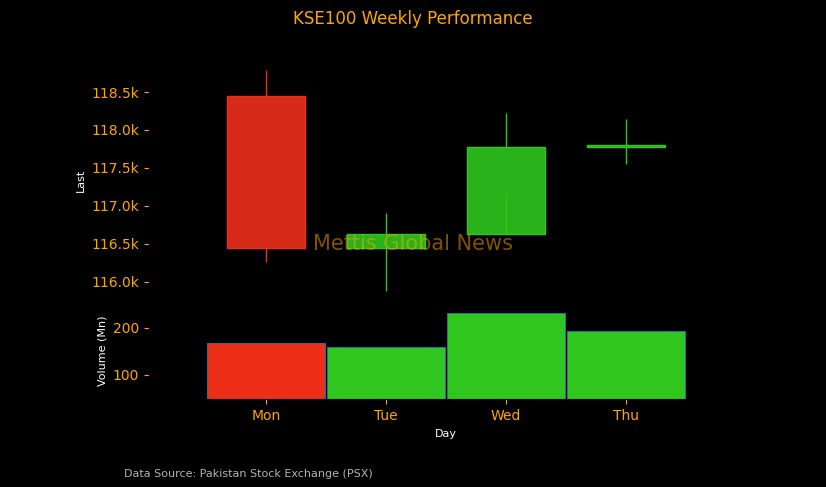

Despite the bull run, the KSE-100 index reflected a drop of 635.43 points, closing at 117,806.74, compared to the previous week’s close of 118,442.17. The decline was partly attributed to the shortened trading week, which had only four sessions due to the Eid holidays.

Intraday swings were significant, with the index reaching a high of 118797.7 (+990.96 points) and a low of 115,877.88 (-1,928.86 points).

Market cap

The KSE-100 market capitalization stood at Rs3.55 trillion, down 0.55% from the previous week’s Rs3.57tr. In USD terms, the market cap was recorded at $12.67 billion, compared to $12.74bn in the prior week.

This week, the index return in USD terms turned to -0.52% compared to 2.49% in the previous week.

During the week, Pakistan’s Gross Domestic Product (GDP) posted a growth of 1.73% in the second quarter of FY25 despite contraction in industry of -0.18%. This growth was bolstered by due to positive growth in agriculture (1.10%) and services (2.57%), according to the National Accounts Committee (NAC).

The State Bank of Pakistan (SBP) conducted an auction in which it sold Market Treasury Bills (MTBs) worth Rs639.77bn.

The total money supply circulating within the economy till February 2025 has been recorded at Rs40.57 trillion.

In addition, the foreign exchange reserves held by the Central Bank decreased by $540m or 4.84% WoW to $10.61bn during the week ended on March 21, 2025.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 50.17% while CYTD return stood at 2.32%.

Top Index Movers

During the week, Commercial Banks, Power Generation & Distribution and Pharmaceuticals contributed 492.21, 111.97, and 76.12 points, respectively to the index. On the flip side, Fertilizer and Technology & Communication lost -332.92 and -279.52 points, respectively.

Among individual stocks, UBL added 462.24 points to the index, while HUBC, and OGDC contributed to the index by 169.40 and 115.13, respectively.

Conversely, FFC, SYS and ENGROH eroded -239.02, -198.46, and -159.75 points, respectively.

FIPI/LIPI

This week, Foreign Investors bought equities worth $3.92m.

Among them, Overseas Pakistanis led the buying spree worth $4.42m while Foreign Corporates sold securities worth $0.53m.

On the other hand, this week, local Investors were net sellers, selling equities worth $3.92m.

Insurance companies sold securities worth $10.52m, whereas Mutual Funds bought securities worth $8.46m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)