Weekly Market Roundup

By Abdur Rahman | November 09, 2024 at 06:00 AM GMT+05:00

November 09, 2024 (MLN): Pakistan stocks extended their record-breaking run as signs of improving economic conditions continue to boost sentiment.

The stock benchmark topped 93,000 for the first time on continued monetary easing and a healthy growth in overseas remittance inflows.

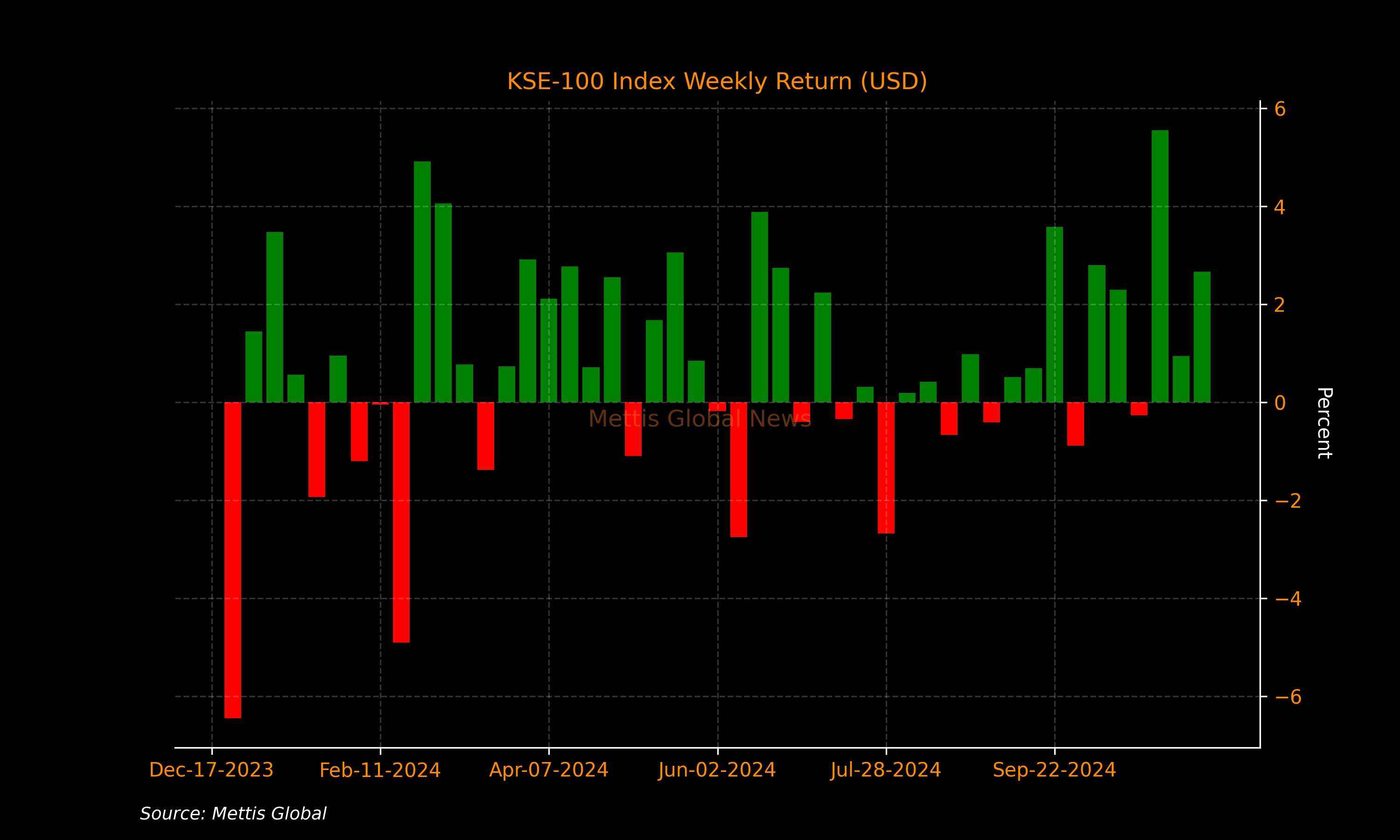

KSE-100 Index closed at 93,292 after a jump of 2,432 points or 2.7% from last week in both PKR and USD terms.

The State Bank of Pakistan (SBP) lowered its key policy rate by 250 basis points to 15% on Monday, higher than a median estimate of 200bps cut.

SBP has reduced interest rates by 700bps since June in four consecutive cuts, taking policy rate to the lowest in two years as policymakers look to bolster economic growth.

The central bank said that inflation has declined faster than expected and has reached close to the medium-term target range in October. It expects the average inflation for FY25 to be significantly lower than its previous forecast range of 11.5–13.5%.

Following SBP's decision, the government slashed 1-year GIS Ijara Sukuk bond yield to 10.99%.

Moreover, workers' remittances jumped 23.9% in October to $3.1 billion. In the first four month of FY25, the total remittances increased 34.7% to $11.85bn.

A robust growth in remittances has allowed the country to contain current account and sustain modest growth.

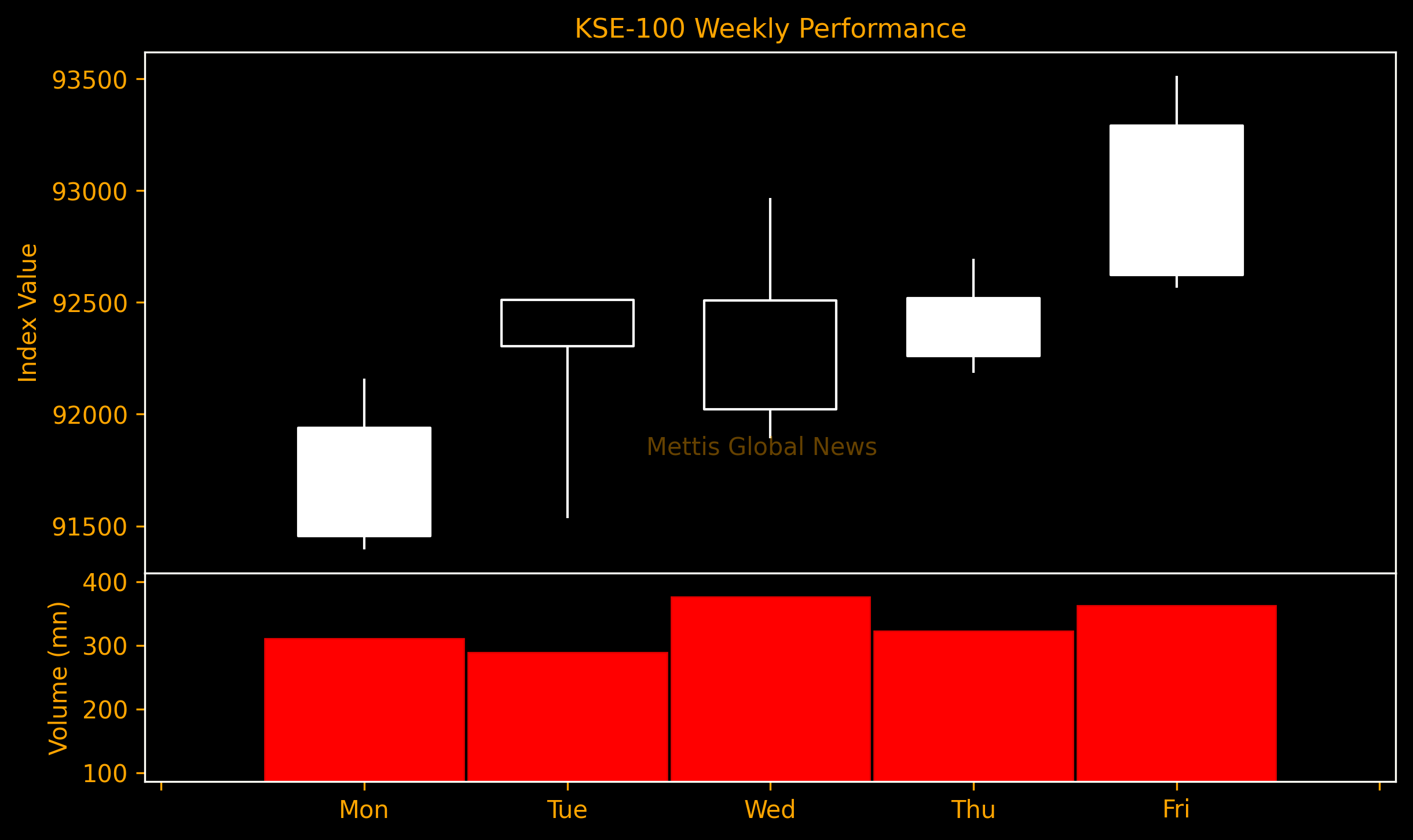

Throughout the week, KSE-100 traded in a range of 2,119 points, between a high of 93,515 (+2,655) and a low of 91,395 (+536) points.

Pakistan stock market's average traded volume rose 31.3% WoW to 734.68 million shares. Traded value also increased 12.4% WoW to Rs29.66 billion.

Market capitalization jumped by $966.55m or 2.3% to $43.13bn over the week. In PKR terms, market capitalization stood at Rs11.98 trillion.

Top Index Movers

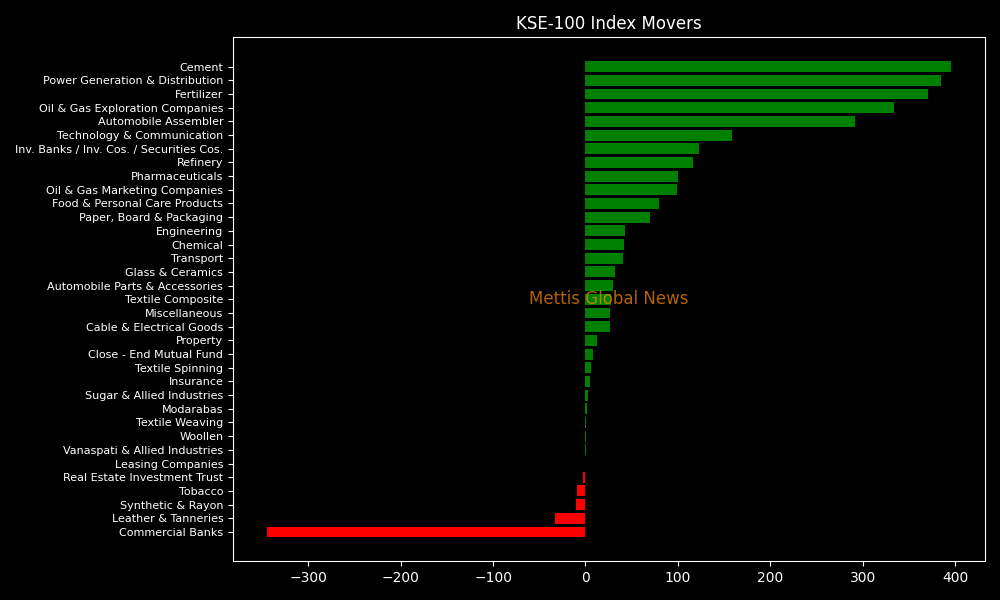

Sector-wise, top positive contributors were Cement (+396pts), Power Generation & Distribution (+385pts), Fertilizer (+371pts), Oil & Gas Exploration Companies (+334pts), and Automobile Assembler (+292pts).

Contrary to that, negative contributions came from Commercial Banks (-345pts), Leather & Tanneries (-33pts), Synthetic & Rayon (-10pts), Tobacco (-9pts), and Real Estate Investment Trust (-3pts).

The best-performing stocks during the week were OGDC (+313pts), HUBC (+304pts), LUCK (+227pts), ENGRO (+221pts), and DAWH (+118pts).

Whereas, the worst-performing were UBL (-120pts), HBL (-95pts), MCB (-68pts), BAHL (-62pts), and MEBL (-42pts).

FIPI/LIPI

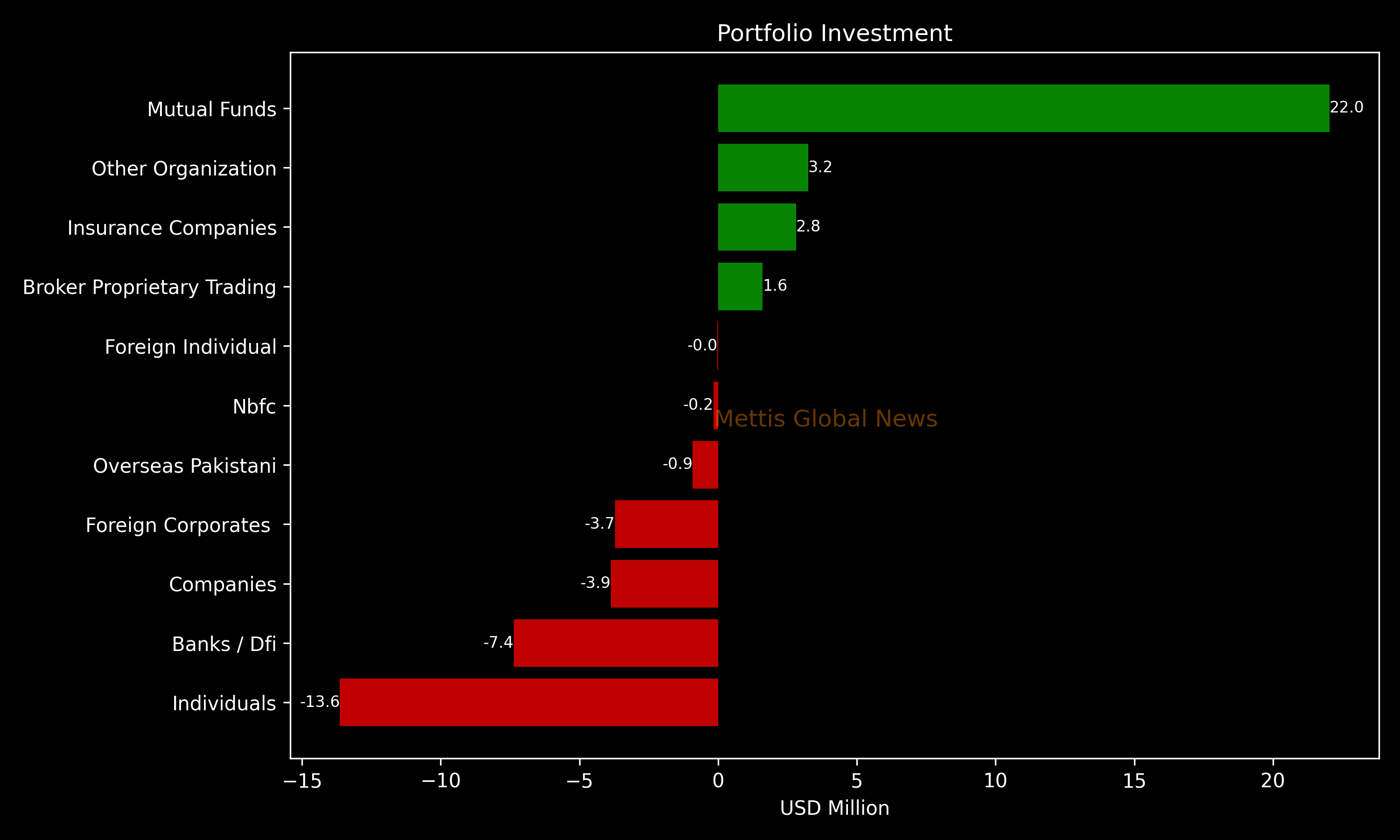

Foreign investors turned to net sellers during the week, dumping $4.7m worth of equities.

Flow-wise, Mutual Funds were the dominant buyers, with a net investment of $22.0m. On the other hand, the leading sellers were Individuals, with a net sale of $13.6m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI