Weekly Market Roundup

Abdur Rahman | October 04, 2024 at 08:16 PM GMT+05:00

October 04, 2024 (MLN): Pakistan stocks surged this week as falling bond yields amid a larger-than-expected drop in inflation and an improvement in economic conditions boosted sentiment.

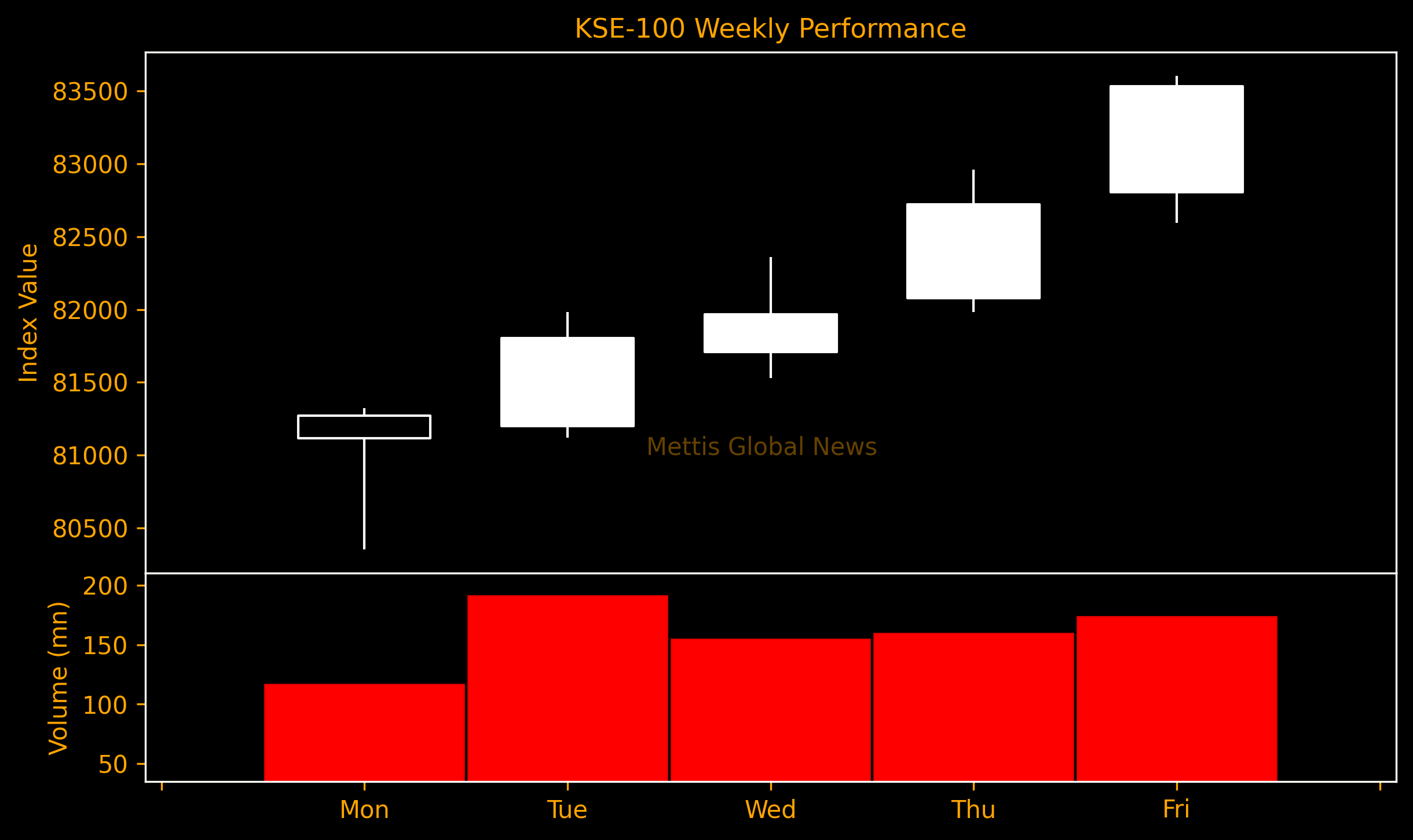

The equity benchmark KSE-100 Index jumped 2,240 points or 2.8% from last week in both PKR and USD terms to close at a record high of 83,532.

That comes despite a significant foreign selling of $26.1m.

The bullish momentum is largely driven by the International Monetary Fund (IMF) board’s approval of a $7 billion loan, a slump in bond yields amid a larger-than-expected drop in September inflation, and an improvement in central bank's reserves.

Pakistan's inflation slowed to the lowest in almost four years, with consumer prices rising by 6.9% in September over the prior year. That is within the central bank's target range of 5-7%.

The inflation pace was significantly lower than the market expectations of 7.5% and was the lowest reading since January 2021.

Consequently, the State Bank of Pakistan (SBP) slashed Market Treasury Bills (MTBs) yields to the lowest yields since early 2022.

Moreover, the central bank's foreign exchange reserves jumped to $10.7 billion, the highest since April 2022, following the disbursement of $1.03bn from the IMF under EFF program

Throughout the week, KSE-100 traded in a range of 3,254 points, between a high of 83,606 (+2,314) and a low of 80,352 (-940) points.

Pakistan stock market's average traded volume was recorded at 343.89 million shares worth Rs16.72 billion, a decrease of 12.1% WoW in the number of shares and 1.3% WoW in traded value.

Meanwhile, market capitalization increased by $830.8m or 2.2% to $39.2bn over the week. In PKR terms, market capitalization stood at Rs10.88 trillion.

Top Index Movers

Sector-wise, top positive contributors were Fertilizer (+677pts), Oil & Gas Exploration Companies (+617pts), Commercial Banks (+302pts), Cement (+263pts), and Oil & Gas Marketing Companies (+129pts).

Contrary to that, negative contributions came from Engineering (-42pts), Glass & Ceramics (-14pts), Pharmaceuticals (-10pts), Chemical (-6pts), and Paper, Board & Packaging (-5pts).

The best-performing stocks during the week were FFC (+493pts), PPL (+235pts), OGDC (+231pts), UBL (+106pts), and POL (+105pts).

Whereas, the worst-performing were TRG (-84pts), INIL (-29pts), KAPCO (-24pts), EPCL (-19pts), and FABL (-15pts).

FIPI/LIPI

Foreign investors remained net sellers for the fifth week in a row, dumping $26.06m worth of equities. The persistent selling is likely due to FTSE rebalancing, which demoted Pakistan from Secondary Emerging to Frontier Market in July.

The most substantial sales activity this week was in Oil and Gas Exploration Companies' stocks, as foreigners offloaded $7.22m worth of stocks, followed by Fertilizer with net sales of $6.20m, and Power Generation and Distribution at $5.96m.

On the local front, Mutual funds absorbed this selling pressure, with a net investment of $26.14m.

They allocated the majority of their capital, $7.58m, to Oil and Gas Exploration Companies.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 136,502.54 259.91M |

1.64% 2202.77 |

| ALLSHR | 85,079.90 838.35M |

1.26% 1061.74 |

| KSE30 | 41,552.62 97.27M |

1.81% 738.33 |

| KMI30 | 193,330.76 84.69M |

0.39% 741.60 |

| KMIALLSHR | 56,315.31 366.02M |

0.43% 243.06 |

| BKTi | 38,498.08 37.91M |

4.13% 1526.33 |

| OGTi | 28,138.38 5.66M |

-0.36% -101.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 120,395.00 | 123,615.00 118,675.00 |

1865.00 1.57% |

| BRENT CRUDE | 69.16 | 71.53 69.08 |

-1.20 -1.71% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.25 0.26% |

| ROTTERDAM COAL MONTHLY | 106.50 | 106.60 106.50 |

-2.20 -2.02% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.90 | 69.65 66.84 |

-1.55 -2.26% |

| SUGAR #11 WORLD | 16.31 | 16.67 16.27 |

-0.26 -1.57% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|