Weekly Market Roundup

MG News | July 12, 2024 at 08:18 PM GMT+05:00

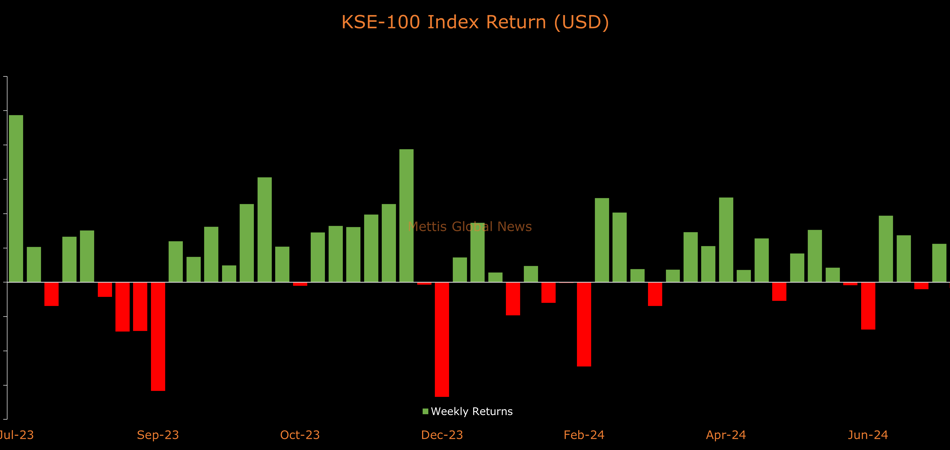

July 12, 2024 (MLN): The benchmark KSE-100 index closed this week at 79,944 showing a decrease of 269 points, or 0.3% in both PKR and USD terms.

Throughout the week, KSE-100 traded in a range of 2,476 points, between a high of 81,087 (+875) and a low of 78,612 (-1,601) points.

The 100 index is still up 17,493 points or 28% so far this year driven by optimism over improved economic conditions, enticing valuations, and the central bank's shift to monetary easing.

PSX average traded volume was recorded at 438.83 million shares worth Rs20.77 billion, a decrease of 0.3% WoW in the number of shares while an increase of 13.7% WoW in traded value.

Meanwhile, the PSX market capitalization increased by $125.43m or 0.3% to $38.18bn over the week. In PKR terms, market capitalization stood at Rs10.63 trillion.

Top Index Movers

Sector-wise, top negative contributors were Oil & Gas Exploration Companies with (154pts), Commercial Banks (136pts), Automobile Assembler (61pts), Power Generation & Distribution (54pts), and Inv. Banks / Inv. Cos. / Securities Cos. (35pts).

Contrary to that, the positive contributions came from Fertilizer (141pts), Food & Personal Care Products (71pts), Textile Composite (47pts), Technology & Communication (32pts), and Pharmaceuticals (17pts).

The worst-performing stocks during the week were MCB (102pts), HUBC (100pts), UBL (93pts), PPL (77pts), and TRG (57pts).

Whereas, HBL, NBP, FFC, SYS, and FFBL added 143, 104, 82, 73, and 63 points to the index respectively.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $3.96m worth of equities.

Flow-wise, Foreign corporations were the dominant buyers, with a net investment of $4.46m.

They allocated the majority of their capital, $1.97m, to All other Sectors, while divesting from the Cement sector, amounting to $1.52m in sales.

On the other hand, the leading sellers were Individuals, with a net sale of $2.58m.

Their most substantial sales activity was in All other Sectors, amounting to $2.98m, while they acquired $4.58m of equities in the Power Generation and Distribution.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 164,626.29 351.26M | -0.98% -1632.25 |

| ALLSHR | 98,999.23 613.73M | -0.76% -757.44 |

| KSE30 | 50,342.54 122.55M | -1.13% -575.33 |

| KMI30 | 229,014.43 138.56M | -1.61% -3757.33 |

| KMIALLSHR | 63,057.91 362.66M | -1.13% -722.77 |

| BKTi | 49,028.54 65.39M | -0.01% -2.61 |

| OGTi | 32,109.94 7.71M | -1.79% -583.79 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile