Weekly Market Roundup

Abdur Rahman | February 23, 2024 at 07:47 PM GMT+05:00

February 23, 2024 (MLN): Pakistan’s stocks rose the most in over two months as the country’s major political parties reached a consensus to form a coalition government, ending uncertainty in the markets.

The benchmark KSE-100 index surged 2,943 points or 4.92% to close the week at 62,816.

The post-election losses have now been trimmed to 1,328 points or 2.1%.

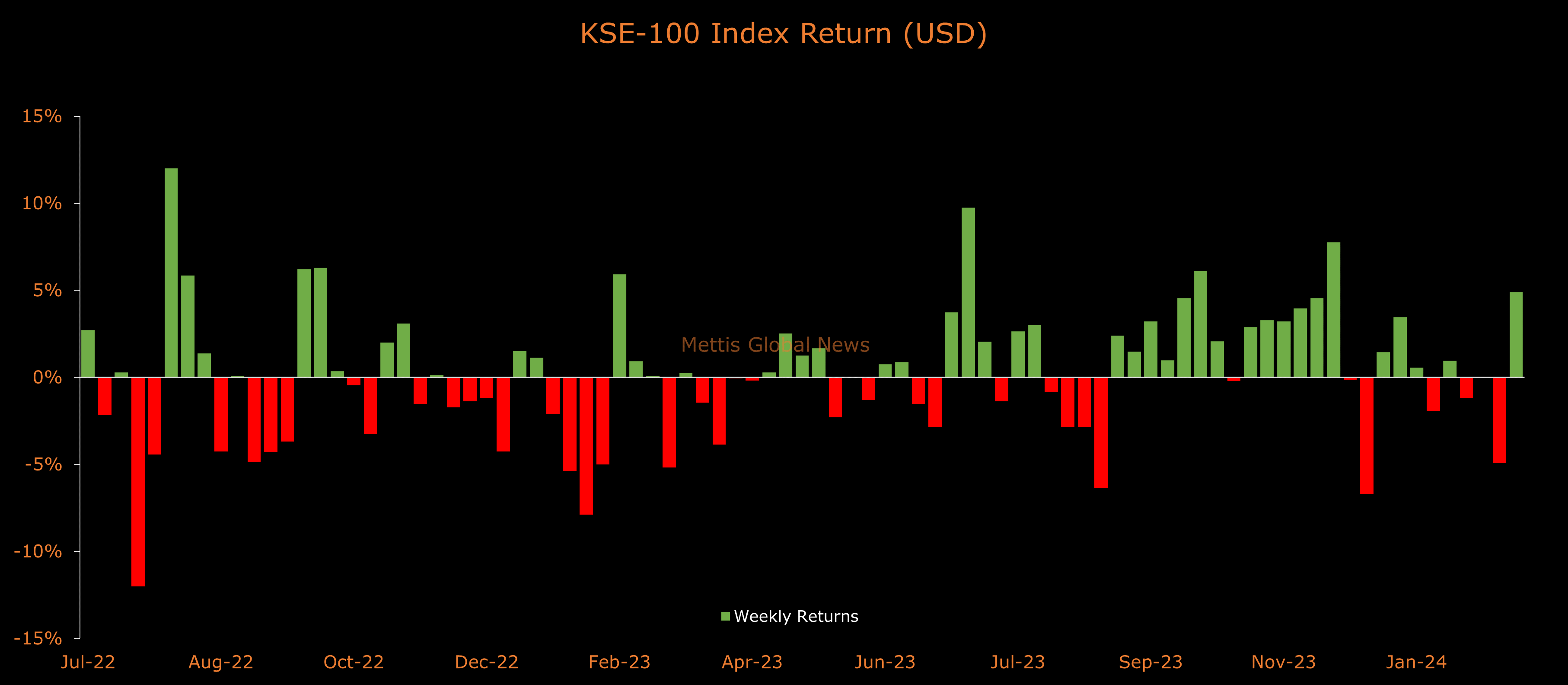

On the currency front, the Pakistani Rupee remained stable against the US Dollar during the week, hence the KSE-100 index gained 4.91% in USD terms.

The new government needs to secure a larger and longer International Monetary Fund (IMF) loan program to meet the country's high debt obligations.

Yesterday, the IMF expressed its eagerness to collaborate with the new government on policies to ensure macroeconomic stability.

Throughout the week, KSE-100 oscillated in a range of 3,754 points, between high and low of 62,945 and 59,192 levels, respectively, before settling the week near the weekly highs at 62,816.

The average traded volume arrived at 188 million shares worth Rs8.55 billion, marking a decrease of 1% MoM in the number of shares and 17% MoM in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 338m shares worth Rs12.65bn, marking decrease of 3.4% MoM in the number of shares and 6.3% MoM in traded value.

Major news flows during the week included the country posting a current account deficit of $269 million in January. Moreover, it saw the biggest negative FDI since October 2018, worth $173m.

Meanwhile, the cash-strapped nation attracted $142m under Roshan Digital Accounts during the month.

The government conducted three auctions during the week, picking up Rs361bn through MTBs, Rs6.35bn through PIB-PFL, and Rs45.6bn through Sukuk auction.

The cutoff yields in the MTBs auction witnessed a rise of up to 126bps. Yields have started to pick up since the central bank in its last meeting kept borrowing costs at a record high of 22% to curb inflation.

Top Index Movers

From the sector-specific lens, Oil & Gas Exploration Companies was the best-performing sector, as it added 623 points to the index.

This was followed by Commercial Banks with 513, Technology & Communication with 335, Power Generation & Distribution with 254, and Fertilizer with 240 points contribution, respectively.

The tech sector stood strong as Systems Limited shrugged off the potential negativity stemming from the 'alleged' accounting scandal that rocked its Swiss partner, Temenos AG.

Furthermore, pharmaceutical sector, which had been lagging behind the broader market, gained momentum as the government relaxed drug pricing policies.

Contrary to that, Miscellaneous, Chemical, Property, Automobile Parts & Accessories, and Synthetic & Rayon remained red, as they took away 26, 16, 8, 6, and 6 points from the index.

Scrip-wise, OGDC, PPL, HUBC, SYS, and MEBL were the best-performing stocks during the week as they added 340, 221, 216, 201, and 195 points to the index respectively.

Whereas, PSEL, NESTLE, COLG, FATIMA, and AKBL collectively took away 112 points from the index.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $2.88m worth of equities.

Flow-wise, Foreign Corporates were the dominant buyers, with a net investment of $4.64m.

They allocated the majority of their capital, $1.65m, to Commercial Banks, while divesting from the Technology and Communication sector, amounting to $1.19m in sales.

On the other hand, the leading sellers were Individuals, with a net sale of $6.19m.

Their most substantial sales activity was in Cement, amounting to $1.26m, while they acquired $1.74m of equities in the Fertilizer.

To note, the KSE-100 has gained 21,363 points or 51.54% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 365 points, equivalent to 0.58%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,597.36 256.32M | -0.05% -68.14 |

| ALLSHR | 85,286.16 608.38M | -0.48% -413.35 |

| KSE30 | 42,340.81 77.13M | -0.03% -12.33 |

| KMI30 | 193,554.51 76.19M | -0.83% -1627.52 |

| KMIALLSHR | 55,946.05 305.11M | -0.79% -443.10 |

| BKTi | 38,197.97 16.53M | -0.59% -225.01 |

| OGTi | 27,457.35 6.73M | -0.94% -260.91 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,670.00 | 121,165.00 117,035.00 | -1620.00 -1.36% |

| BRENT CRUDE | 69.23 | 70.77 69.14 | -0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.03 | 67.54 65.93 | -0.20 -0.30% |

| SUGAR #11 WORLD | 16.79 | 17.02 16.71 | 0.05 0.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Weekly Forex Reserves

Weekly Forex Reserves