Weekly Market Roundup

By Abdur Rahman | December 30, 2023 at 02:25 PM GMT+05:00

December 30, 2023 (MLN): After a tug of war between bulls and bears throughout the week, bulls came out on top to close the final week of the year 2023 in green, ending a streak of two weekly losses.

The week commenced with intense selling pressure that wiped out 2,534 points or 4.11% from the index in a single day, marking the largest DoD drop in absolute terms ever recorded.

However, this overextended selling created a buying opportunity for value hunters, which led to a strong rebound in the market.

Ultimately, the week closed at 62,451 with a gain of 756 points or 1.21% WoW.

Meanwhile, the Pakistani Rupee (PKR) extended its winning streak for the seventh consecutive week by recording a marginal gain of 0.24% WoW.

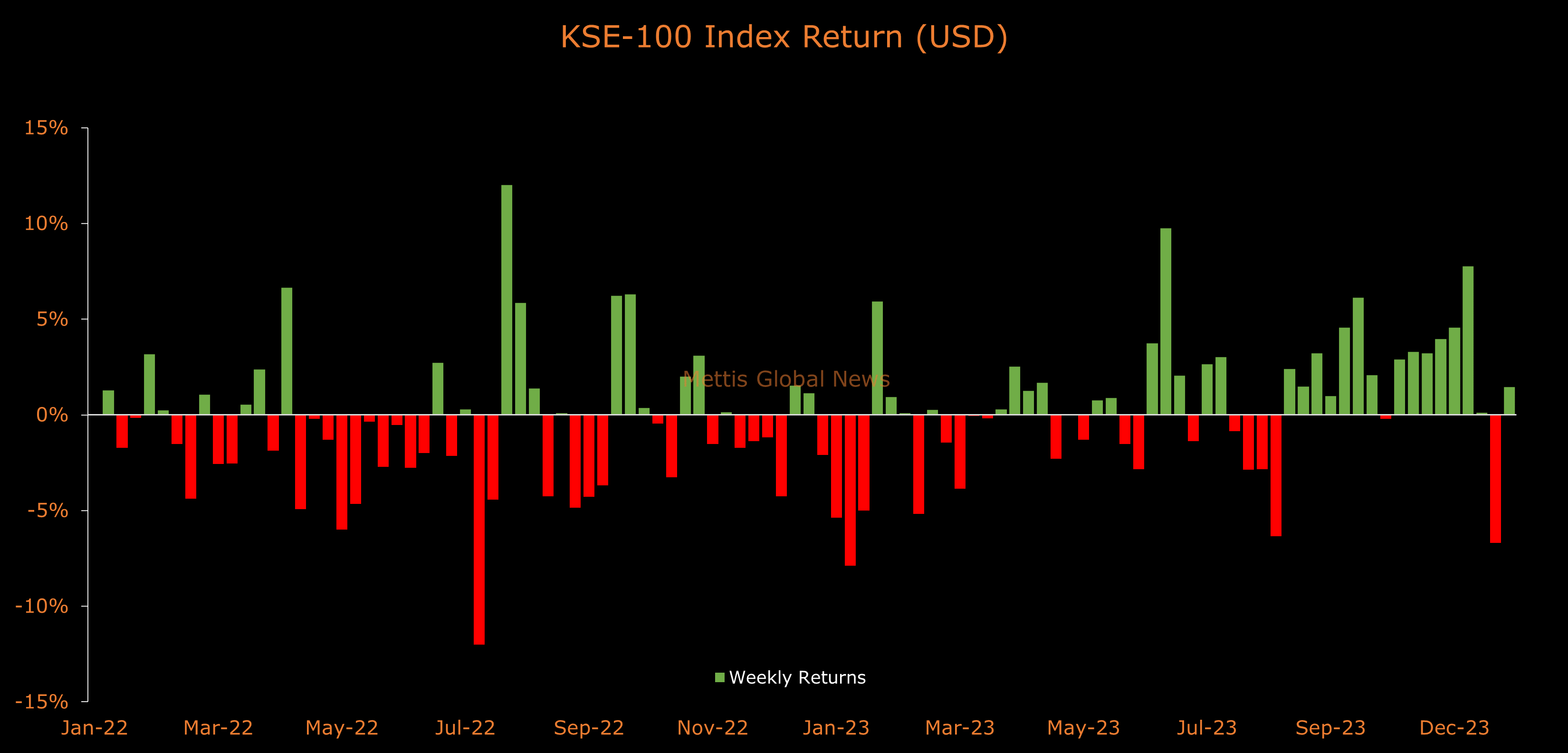

In USD terms, the KSE-100 index gained 1.45% this week.

Throughout the week, KSE-100 oscillated in a wide range of 3,993 points, between high and low of 62,751 and 58,758 levels, respectively, before settling the week near weekly highs at 62,451.

The market turnover saw a significant decline during the week, with an average traded volume of 383 million shares worth Rs13.45 billion, marking a decrease of 44.27% MoM in the number of shares and 15.7% MoM in traded value.

Moreover, the overall PSX average traded volume (All-Share) was recorded at 651.5m shares worth Rs17.59bn, marking a decrease of 46.36% MoM in the number of shares while a decrease of 20% MoM in traded value.

Top Index Movers

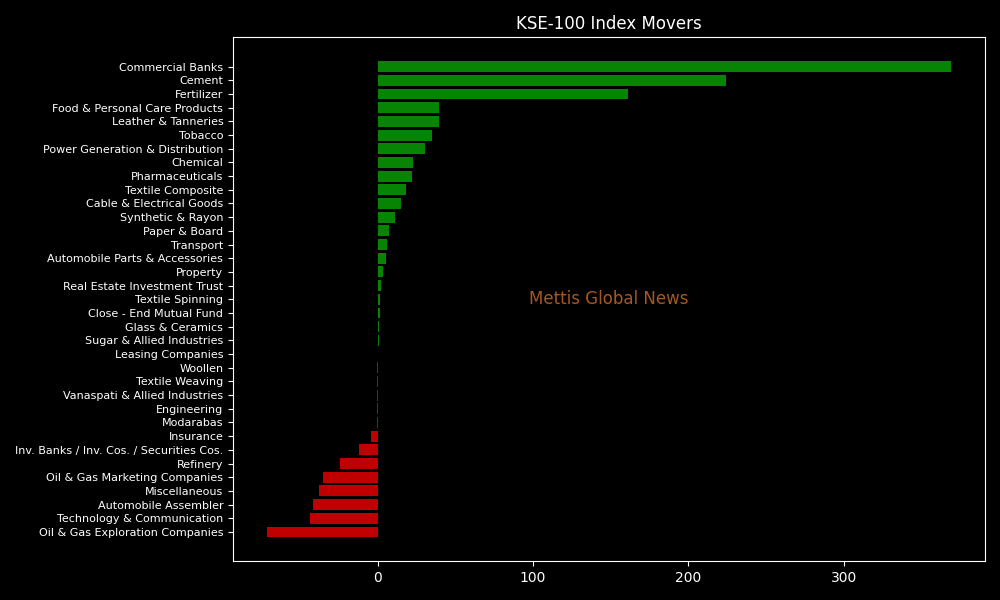

From the sector-specific lens, commercial banks took back their top spot after being the top losers for two consecutive weeks, as they added 369 points to the index.

This was followed by Cement, Fertilizer, Food & Personal Care Products, and Leather & Tanneries as they kept the index in positive territory by adding 224, 161, 40, and 39 points, respectively.

Contrary to that, Oil & Gas Exploration Companies, Technology & Communication, Automobile Assembler, Miscellaneous, and Oil & Gas Marketing Companies remained red, as they took away 71, 43.7, 41.6, 37.8, and 35.2 points from the index.

Scrip-wise, MEBL, UBL, EFERT, LUCK, and MCB were the best-performing stocks during the week as they added 143, 106, 80, 64, and 60 points to the index respectively.

Whereas, PSO, TRG, PSEL, PPL, and HBL collectively took away 270 points from the index.

FIPI/LIPI

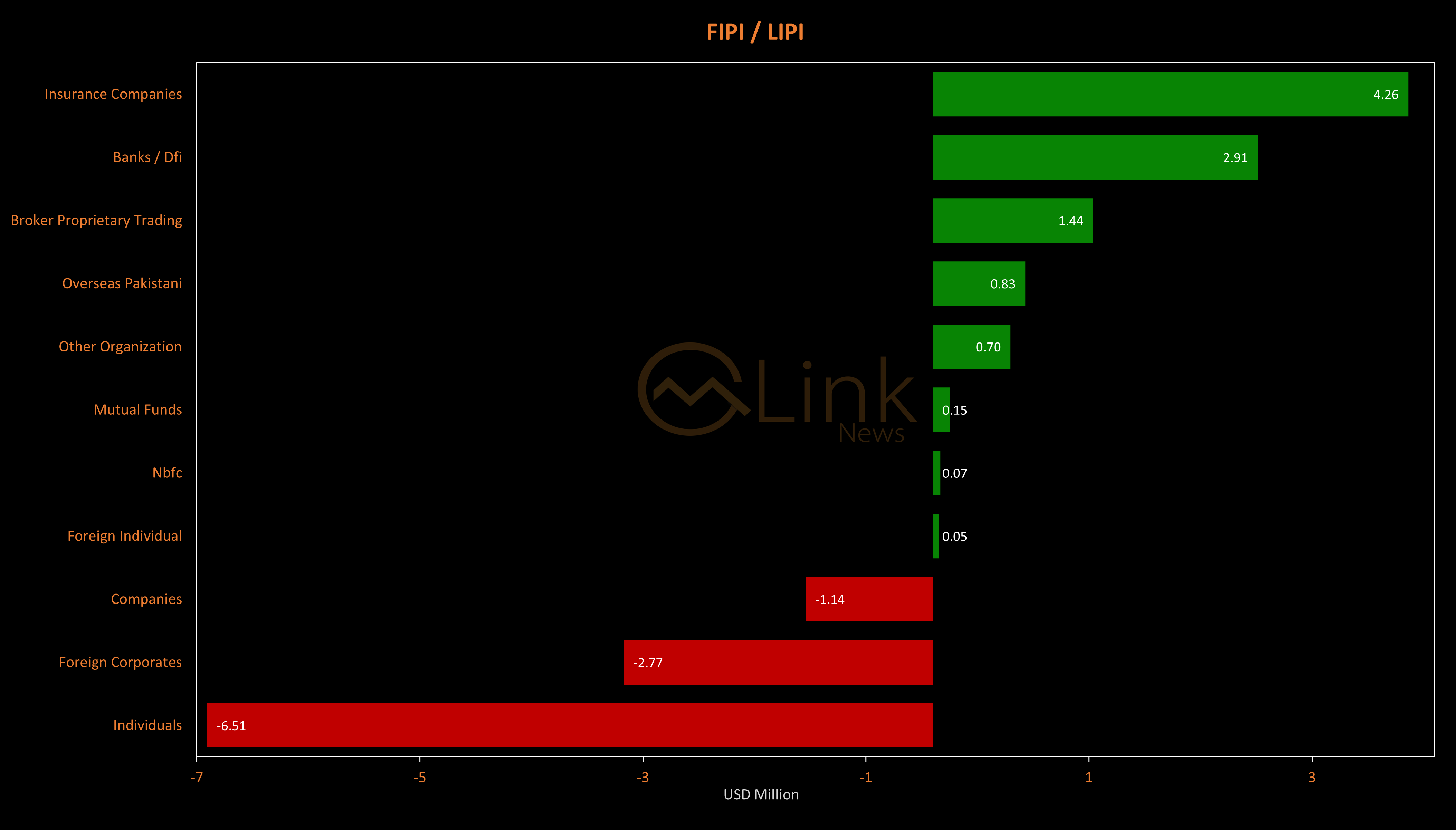

Foreign investors turned to net sellers after seven weeks, offloading $1.89m of equities during the week.

Flow-wise, Insurance Companies remained the dominant buyers for the second consecutive week, with a net investment of $4.26m.

They allocated the majority of their capital, $1.77m, to Oil and Gas Exploration Companies, while divesting from the Technology and Communication sector, amounting to $0.28m in sales.

On the other hand, the leading sellers were Individuals, with a net sale of $6.51m.

Their most substantial sales activity was in Textile Composite, amounting to $1.75m, while they acquired $1.82m of equities in the Oil and Gas Exploration Companies.

To note, the local stock market has been on a bullish streak amid hopes of improved economic conditions following the expected inflows from IMF and friendly countries, relatively stable currency amid government-backed administrative efforts, and a possible slash in the interest rates.

The KSE-100 gained 22,031 points, equivalent to 54.5% in the calendar year 2023.

Analysts expect this trend to continue in 2024 owing to robust earnings growth, attractive valuation, and steady economic growth.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 133,294.14 125.38M |

0.54% 717.15 |

| ALLSHR | 83,418.44 417.48M |

0.52% 434.76 |

| KSE30 | 40,486.72 19.33M |

0.32% 127.93 |

| KMI30 | 191,294.66 23.99M |

0.30% 567.34 |

| KMIALLSHR | 55,944.94 206.20M |

0.44% 246.47 |

| BKTi | 36,607.10 7.88M |

1.01% 365.04 |

| OGTi | 28,179.40 2.60M |

-0.51% -144.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 111,790.00 | 112,170.00 111,395.00 |

-455.00 -0.41% |

| BRENT CRUDE | 70.35 | 70.42 69.91 |

0.16 0.23% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.45 1.51% |

| ROTTERDAM COAL MONTHLY | 108.00 | 109.00 107.95 |

0.90 0.84% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.50 | 68.57 68.04 |

0.12 0.18% |

| SUGAR #11 WORLD | 16.54 | 16.61 16.08 |

0.41 2.54% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Worker Remittances

Worker Remittances