Unilever's profit surges by 55% in 9MCY23, announces Rs179 dividend

By MG News | October 24, 2023 at 03:36 PM GMT+05:00

October 24, 2023 (MLN): Unilever Pakistan Foods Limited (PSX: UPFL) reported a profit after tax of Rs7.47 billion [EPS: Rs1,173.27] in 9MCY23 compared to a profit of Rs4.81bn [EPS: Rs755.8] in the same period last year (SPLY).

Along with the results, the company recommended a second interim cash dividend of Rs179 per ordinary share.

This takes the cumulative interim dividend declared for nine months ended September 30, 2023 to Rs251 per ordinary share.

This will be payable to the members on the number of ordinary shares held by them at the close of business on November 07, 2023.

Going by the results, the company's top line inflated by 33.81% YoY led by pricing to Rs26.45bn as compared to Rs19.77bn in SPLY.

Volumes came under pressure as a result of sustained double-digit inflation and consequential erosion of consumer purchasing power.

However, EPS grew by 55.2% mainly on the back of gross margin improvement driven by a combination of pricing and cost efficiency measures.

Moreover, during the review period, other income saw a significant rise of 3.45x YoY to stand at Rs1.9bn in 9MCY23 as compared to Rs551.56m in SPLY.

On the expense side, the company observed a rise in distribution, Admin & others by 48.68% YoY to clock in at Rs5.33bn during the review period.

The company’s finance costs grew by 17.69% YoY and stood at Rs63.53m as compared to Rs53.98m in 9MCY22, mainly due to higher interest rates.

On the tax front, the company paid a higher tax worth Rs484.69m against the Rs279.62m paid in the corresponding period of last year, depicting an increase of 73.34% YoY.

Future Outlook

Pakistan's economic and operating environment remains challenging, after the IMF standby arrangement and administrative measures taken by the government we have seen relative stability.

However, the conditions continue to remain challenging as persistent double-digit inflation is forcing consumers to reduce discretionary expenses.

Structural reforms would be required to drive long-term stability.

In light of the above, the company expects the current pressure on demand to continue.

Despite these difficult circumstances, the company stated that the management team remains committed to overcoming the challenges and driving value for its stakeholders.

Moreover, it stressed its commitment to stay connected to consumers by harnessing the strength of its brand, introducing delightful innovations, continuously striving for value-for-money offerings, and driving cost efficiencies throughout the value chain.

| Unconsolidated (un-audited) Financial Results for Nine months ended 30 September, 2023 (Rupees in '000) | |||

|---|---|---|---|

| Sep 23 | Sep 22 | % Change | |

| Sales | 26,448,888 | 19,766,070 | 33.81% |

| Cost of sales | (15,000,498) | (11,586,529) | 29.46% |

| Gross Profit | 11,448,390 | 8,179,541 | 39.96% |

| Distribution, Admin & Others | (5,327,207) | (3,583,072) | 48.68% |

| Other Income | 1,900,720 | 551,560 | 244.61% |

| Finance cost | (63,530) | (53,979) | 17.69% |

| Profit before taxation | 7,958,373 | 5,094,050 | 56.23% |

| Taxation | (484,685) | (279,616) | 73.34% |

| Net profit for the period | 7,473,688 | 4,814,434 | 55.24% |

| Basic earnings/ (loss) per share | 1,173.27 | 755.80 | - |

Amount in thousand except for EPS

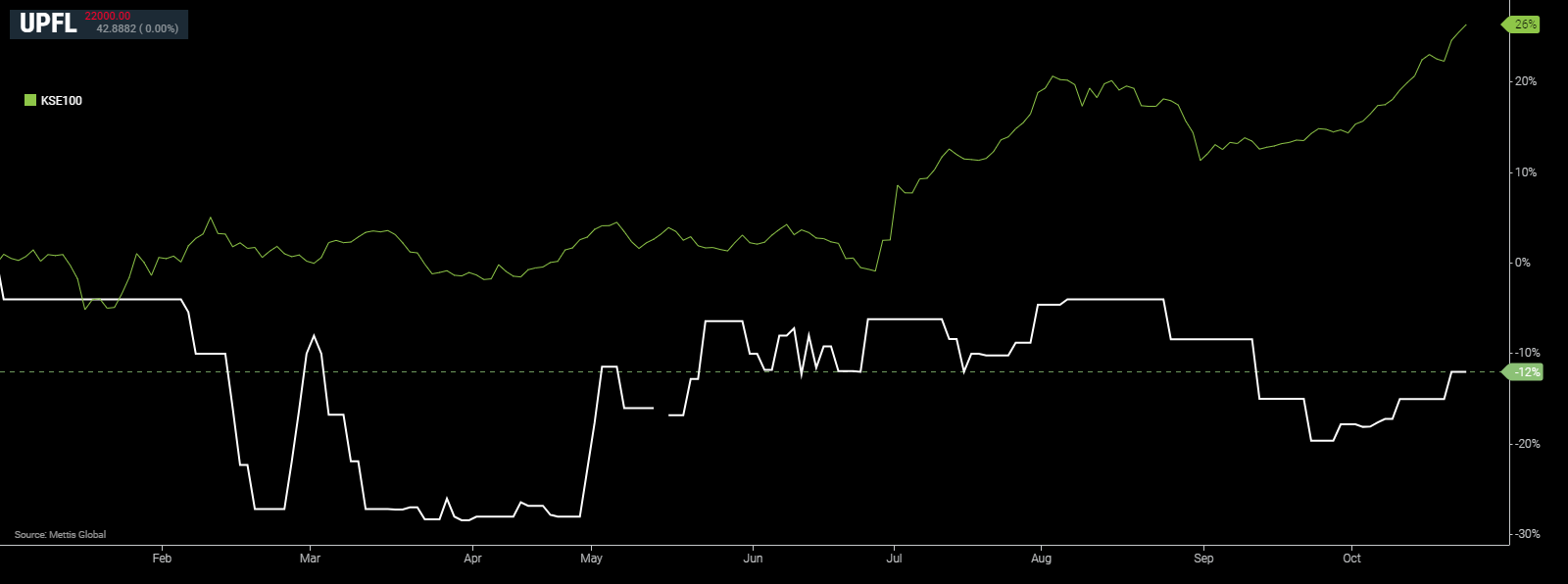

UPFL and KSE-100 YTD Performance

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,344.03 345.79M |

1.67% 2144.61 |

| ALLSHR | 81,023.99 1,021.87M |

1.55% 1236.37 |

| KSE30 | 39,908.26 141.62M |

2.05% 803.27 |

| KMI30 | 189,535.00 150.29M |

1.40% 2619.39 |

| KMIALLSHR | 54,783.66 508.76M |

1.07% 581.78 |

| BKTi | 34,940.73 55.86M |

4.37% 1464.05 |

| OGTi | 28,296.06 16.02M |

1.19% 333.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,350.00 | 108,390.00 105,440.00 |

2600.00 2.46% |

| BRENT CRUDE | 67.90 | 68.00 66.94 |

0.79 1.18% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 103.80 | 0.00 0.00 |

-3.70 -3.44% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.24 | 66.31 65.23 |

0.79 1.21% |

| SUGAR #11 WORLD | 15.87 | 15.97 15.77 |

0.17 1.08% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI