Spot gold rises as Trump’s tariffs kick in, dollar dips

By MG News | April 09, 2025 at 04:02 PM GMT+05:00

April 09, 2025 (MLN): Gold prices firmed on Wednesday as traders sought the safe-haven asset after U.S. President Donald Trump's reciprocal tariffs came into effect, while a weaker dollar and the rising prospect of U.S. rate cuts lent support.

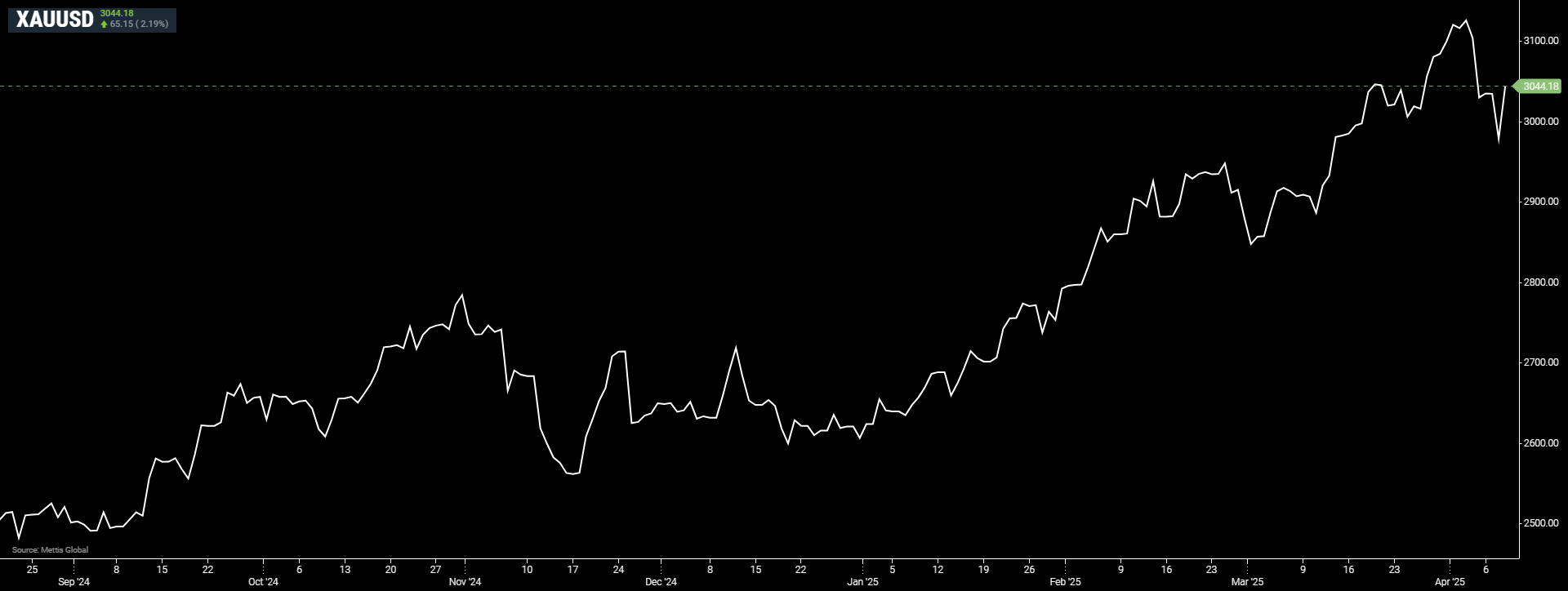

Spot gold rose 2.19% at $3,044.18 an ounce, as of [3:50 pm] PST.

U.S. gold futures also gained 2.4% to $3,062.40.

The U.S. dollar index (DXY) fell 0.7%, making greenback-priced gold cheaper for overseas buyers.

Trump's tariffs, which included a 104% duty on Chinese goods, came into effect, intensifying concerns about a global trade war and recession.

China is set to hold a high-level meeting in response to the tariffs and its central bank asked state lenders to reduce dollar purchases, as per Reuters.

"Trade war concerns are weighing on the prospects of the U.S. economy. Market participants are starting to price in several rate cuts by the U.S. Fed this year," which is supporting gold, said UBS analyst Giovanni Staunovo.

"We continue to see gold prices moving up to $3,200/oz over the coming months", Giovanni Staunovo added.

Nearly 60% of traders are anticipating the Fed beginning rate cuts as early as May. Zero-yield bullion tends to thrive in a low-interest-rate environment, Reuters further added.

Markets are awaiting the minutes of the Federal Reserve's policy meeting later in the day, as well as the U.S. consumer price index on Thursday.

"CPI will be of less relevance, as the focus will be on how tariffs impact inflation over the coming months. As the Fed has a dual mandate, if the U.S. economy starts to weaken, we can still see rate cuts this year," Staunovo said.

Spot gold prices have continued to build on last year's gains, surging more than $400 in 2025 and hitting a record high of $3,167.57 on April 3.

Gold-backed exchange-traded funds registered the largest quarterly inflow in three years from January-March 2025, World Gold Council data showed.

Spot silver gained 1.7% to $30.34 an ounce, platinum rose 0.4% to $917.43, and palladium added 0.1% to $908.05.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,344.03 345.79M |

1.67% 2144.61 |

| ALLSHR | 81,023.99 1,021.87M |

1.55% 1236.37 |

| KSE30 | 39,908.26 141.62M |

2.05% 803.27 |

| KMI30 | 189,535.00 150.29M |

1.40% 2619.39 |

| KMIALLSHR | 54,783.66 508.76M |

1.07% 581.78 |

| BKTi | 34,940.73 55.86M |

4.37% 1464.05 |

| OGTi | 28,296.06 16.02M |

1.19% 333.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,100.00 | 109,165.00 105,440.00 |

3350.00 3.17% |

| BRENT CRUDE | 67.74 | 68.10 66.94 |

0.63 0.94% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 109.20 | 110.00 108.25 |

1.70 1.58% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.96 | 66.43 65.23 |

0.51 0.78% |

| SUGAR #11 WORLD | 15.47 | 15.97 15.45 |

-0.23 -1.47% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance

CPI

CPI