SNGP reports 11% YoY profit dip at Rs8.4bn for nine months ended March 2023

MG News | November 15, 2023 at 03:18 PM GMT+05:00

November 15, 2023 (MLN): Sui Northern Gas Pipelines Limited (PSX: SNGP) has revealed its financial results for the nine months March 2023, as per which the company's profit fell by 11% YoY to clock in at Rs8.4 billion [EPS: 13.24], compared to the profit of Rs9.44bn [EPS: 14.88] reported in the Same Period Last Year (SPLY).

Going by the results, the company's revenue through gas sales marked an increase of 8.06% YoY to Rs764.84bn as compared to Rs707.77bn in SPLY.

The tariff adjustment during the review period stood at Rs272.9bn, up by 89.2% compared to the adjustment of Rs144.24bn incurred last year.

The cost of sales also went up by 20.79% YoY, but as the increase in costs was lower than proportionate to the sales increase, the gross profit improved by 39.05% YoY to Rs65.27bn for the nine months.

On the expense side, the company observed a rise in Selling cost by 19.95% YoY and other operating expenses by 2.2x YoY to clock in at Rs6.81bn and Rs3.84bn respectively during the review period.

The profit and loss statement further reveals that the administrative expenses of the company inched up by 0.396% YoY to Rs6.3bn.

SNGP's profit got support from the massive increase of 98.45% YoY in its other operating income to stand at Rs34.47bn.

However, the profit still declined as the company’s finance costs surged by 86.52% YoY and stood at Rs66.77bn compared to Rs35.8bn recorded in SPLY, mainly due to higher interest rates.

On the tax front, the company paid a higher tax worth Rs5.35bn against the Rs4.59bn paid in the corresponding period of last year, depicting a rise of 16.53% YoY.

| Condensed interim Financial Results for Nine months ended March 2023 (Rupees in '000) | |||

|---|---|---|---|

| March 23 | March 22 | % Change | |

| Revenue from contracts with customers - gas sales | 764,839,192 | 707,774,016 | 8.06% |

| Add: Tariff adjustment | 272,902,140 | 144,238,970 | 89.20% |

| Cost of sales | (972,469,284) | (805,071,267) | 20.79% |

| Gross Profit | 65,272,048 | 46,941,719 | 39.05% |

| Selling cost | (6,808,308) | (5,676,172) | 19.95% |

| Administrative expenses | (6,297,862) | (6,273,632) | 0.39% |

| Expected credit loss | (2,275,791) | (791,671) | 187.47% |

| Add: Other Operating Income | 34,466,801 | 17,367,626 | 98.45% |

| Other operating expenses | (3,839,205) | (1,741,439) | 120.46% |

| Finance cost | (66,768,123) | (35,797,349) | 86.52% |

| Profit before tax | 13,749,560 | 14,029,082 | -1.99% |

| Taxation | (5,350,603) | (4,591,774) | 16.53% |

| Net profit for the period | 8,398,957 | 9,437,308 | -11.00% |

| Basic and diluted earnings/ (loss) per share | 13.24 | 14.88 | - |

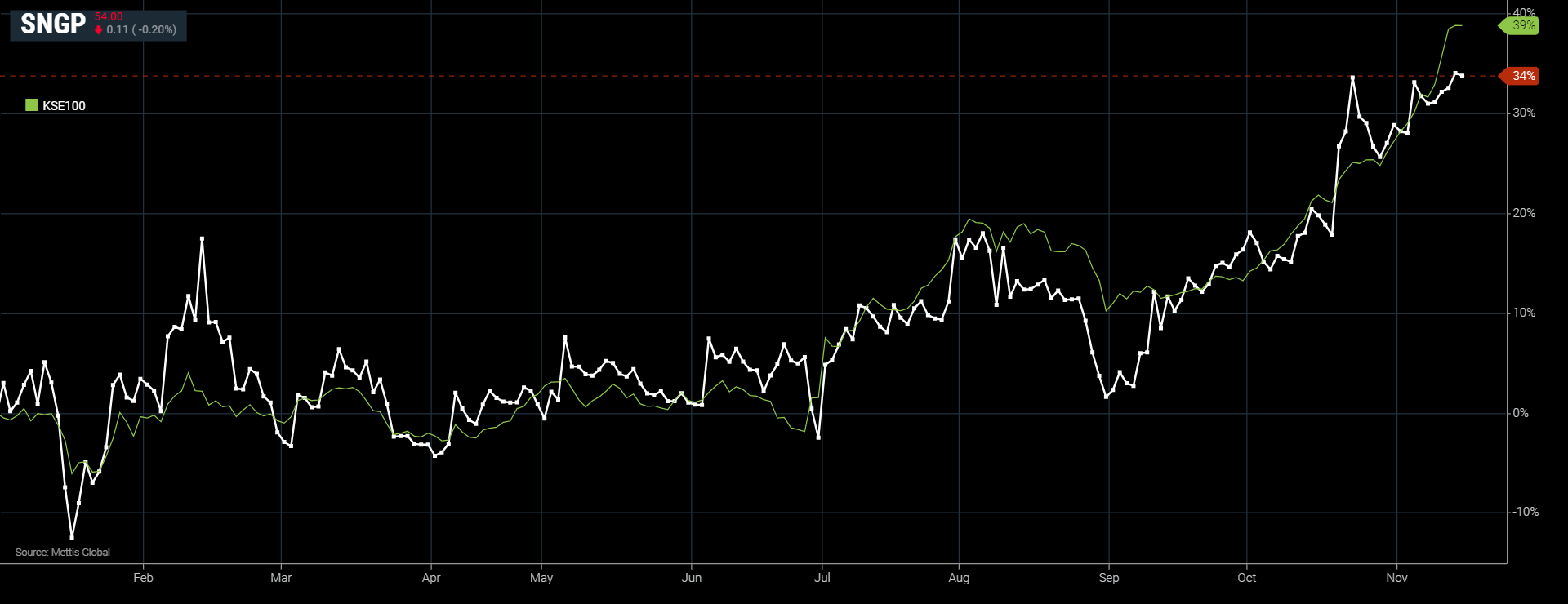

SNGP and KSE-100 YTD Performance

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 178,853.10 424.99M | 3.29% 5702.68 |

| ALLSHR | 107,335.86 693.28M | 2.85% 2972.30 |

| KSE30 | 54,676.69 210.97M | 3.52% 1860.41 |

| KMI30 | 250,620.93 139.36M | 2.14% 5257.28 |

| KMIALLSHR | 68,647.30 398.45M | 1.89% 1273.91 |

| BKTi | 52,773.10 107.33M | 7.09% 3494.44 |

| OGTi | 35,032.42 34.95M | 0.79% 274.54 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,010.00 | 67,030.00 66,300.00 | 680.00 1.03% |

| BRENT CRUDE | 70.56 | 70.63 70.19 | 0.21 0.30% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.00 -3.03% |

| ROTTERDAM COAL MONTHLY | 105.50 | 105.50 105.50 | -0.10 -0.09% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 65.31 | 65.38 64.77 | 0.26 0.40% |

| SUGAR #11 WORLD | 13.77 | 13.78 13.47 | 0.29 2.15% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Roshan Digital Account

Roshan Digital Account