PSX Closing Bell: Theatre of the Absurd

By MG News | June 22, 2022 at 05:04 PM GMT+05:00

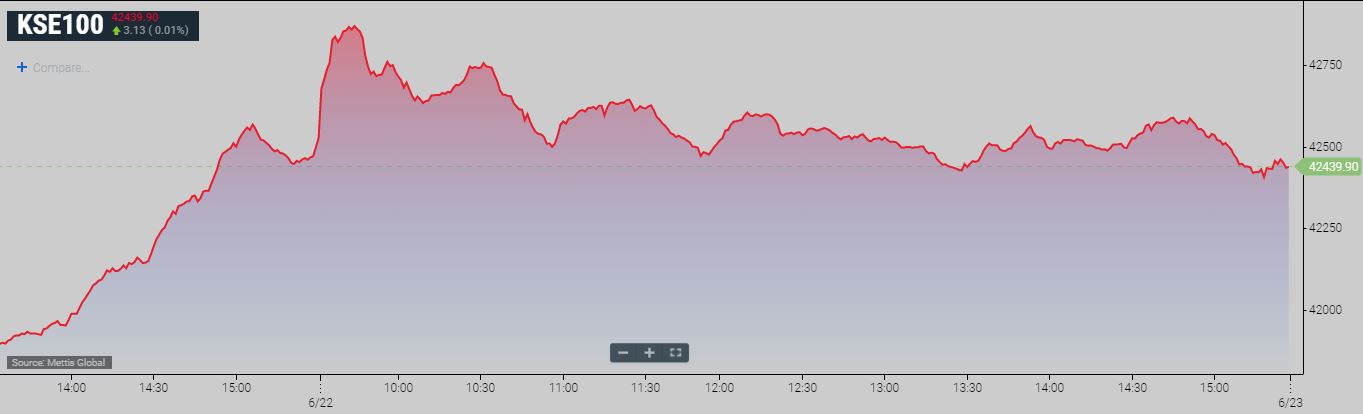

June 22, 2022 (MLN): In the backdrop of crucial development on the IMF front on Tuesday night, the Pakistan Stock Exchange (PSX) opened on a positive note as strong buying activity was being observed across the bourse. As a result, the KSE-100 index made an intraday high of 42,880.4354, while adding 354 points.

However, in the later hours, the trading floor succumbed to selling pressure which led the index to lose 67.81 points to close at 42,458.14.

Speaking to Mettis Global, Ahsan Mehanti, Director Arif Habib Group said, “PSX closed lower on govt commitment to raise over Rs422bn in tax targets and poverty taxes on firms which likely to impact corporate profits.”

Meanwhile, the slump in global crude oil prices and weak global equity played a catalyst role in the negative close, he added.

Shayan Jan, Equity Trader at Intermarket Securities told Mettis, “Confidence of investors has not fully restored yet owing to the dismal macros of the country.”

The IMF impact is temporary as other macroeconomic indicators need to be addressed, he said.

Of the 95 traded companies in the KSE100 Index 33 closed up 60 closed down, while 2 remained unchanged. The total volume traded for the index was 113.65 million shares.

Sector-wise, the index was let down by Cement with 40 points, Technology & Communication with 28 points, Oil & Gas Exploration Companies with 21 points, Oil & Gas Marketing Companies with 19 points, and Pharmaceuticals with 12 points.

The most points taken off the index were by COLG which stripped the index of 20 points followed by POL with 18 points, MEBL with 17 points, LUCK with 14 points, and TRG with 14 points.

Sectors propping up the index were Fertilizer with 49 points, Tobacco with 18 points, Commercial Banks with 17 points, Power Generation & Distribution with 5 points, and Insurance with 4 points.

The most points added to the index were by FFC which contributed 52 points followed by MCB with 27 points, BAHL with 27 points, PAKT with 18 points, and LOTCHEM with 10 points.

All Share Volume decreased by 34.50 million to 266.09 million shares. Market Cap decreased by Rs8.87 billion.

Total companies traded were 336 compared to 341 from the previous session. Of the scrips traded 133 closed up, 176 closed down while 27 remained unchanged.

Total trades decreased by 956 to 125,336.

Value Traded decreased by 1.00 billion to Rs8.47 billion

| Company | Volume |

|---|---|

| Pakistan Refinery | 23,874,098 |

| TPL Properties | 23,154,358 |

| Cnergyico PK | 16,793,997 |

| Ghani Global Holdings | 11,788,125 |

| Unity Foods | 11,479,283 |

| Telecard | 11,230,000 |

| Oilboy Energy(R) | 7,599,500 |

| Lotte Chemical Pakistan | 6,772,033 |

| TPL Corp | 6,772,000 |

| Hum Network | 6,357,500 |

| Sector | Volume |

|---|---|

| Technology & Communication | 44,359,058 |

| Refinery | 44,078,476 |

| Chemical | 27,748,681 |

| Miscellaneous | 24,244,258 |

| Food & Personal Care Products | 21,214,789 |

| Commercial Banks | 18,595,867 |

| Oil & Gas Marketing Companies | 17,351,768 |

| Cement | 11,827,163 |

| Cable & Electrical Goods | 11,222,850 |

| Power Generation & Distribution | 8,498,152 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,344.03 345.79M |

1.67% 2144.61 |

| ALLSHR | 81,023.99 1,021.87M |

1.55% 1236.37 |

| KSE30 | 39,908.26 141.62M |

2.05% 803.27 |

| KMI30 | 189,535.00 150.29M |

1.40% 2619.39 |

| KMIALLSHR | 54,783.66 508.76M |

1.07% 581.78 |

| BKTi | 34,940.73 55.86M |

4.37% 1464.05 |

| OGTi | 28,296.06 16.02M |

1.19% 333.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,370.00 | 110,105.00 109,205.00 |

-915.00 -0.83% |

| BRENT CRUDE | 68.53 | 69.00 68.41 |

-0.58 -0.84% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 109.20 | 110.00 108.25 |

1.70 1.58% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.90 | 67.50 66.78 |

-0.55 -0.82% |

| SUGAR #11 WORLD | 15.56 | 15.97 15.44 |

-0.14 -0.89% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

Trade Balance

Trade Balance

CPI

CPI