PSX Closing Bell: Left in Limbo

By MG News | September 02, 2024 at 04:30 PM GMT+05:00

September 02, 2024 (MLN): Pakistan stocks kicked off the week on a positive note owing to a rating upgrade by Moody’s last week and expectations of a significant slowdown in inflation.

However, concerns regarding a delay in the International Monetary Fund (IMF) executive board’s approval for the eagerly awaited $7 billion bailout package continued to take a toll on markets.

Moreover, earnings from the refinery sector failed to live up to investor hopes.

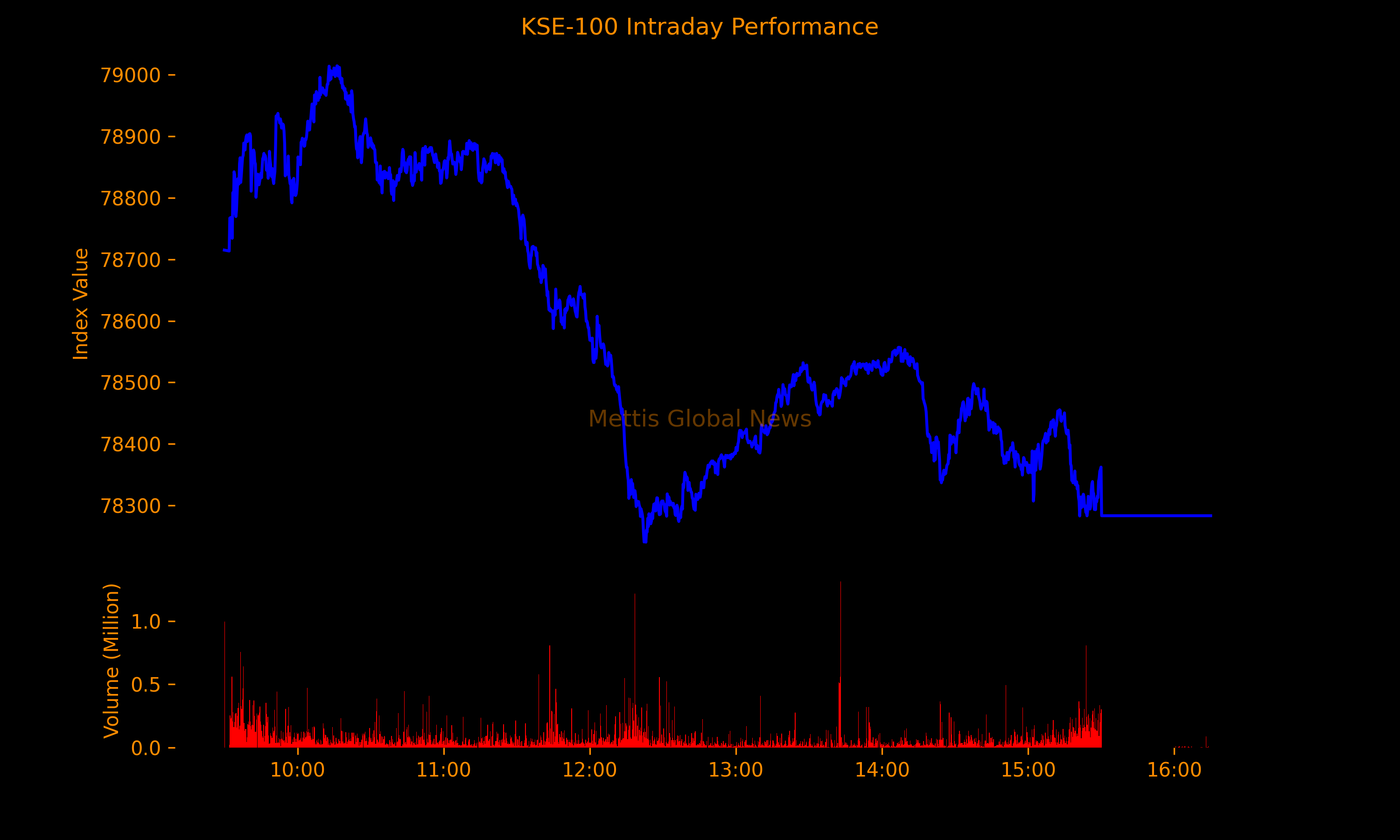

The benchmark KSE-100 ultimately closed Monday's trading session at 78,283.29, showing a decrease of 204.92 points or 0.26%. Last week, the index lost 0.4%.

The index traded in a range of 774.32 points showing an intraday high of 79,014.68 (+526.47) and a low of 78,240.36 (-247.85) points.

The total volume of the KSE-100 Index was 121.32 million shares.

On the economic front, Pakistan's inflation fell to 9.6% in August compared to 11.1% in the last month and 27.4% in August 2023, the Pakistan Bureau of Statistics (PBS) reported on Monday.

The annual rise in the consumer price index (CPI) was in line with the market expectations of 9.6%, and marked the first single-digit inflation since October 2021, when it was 9.2%.

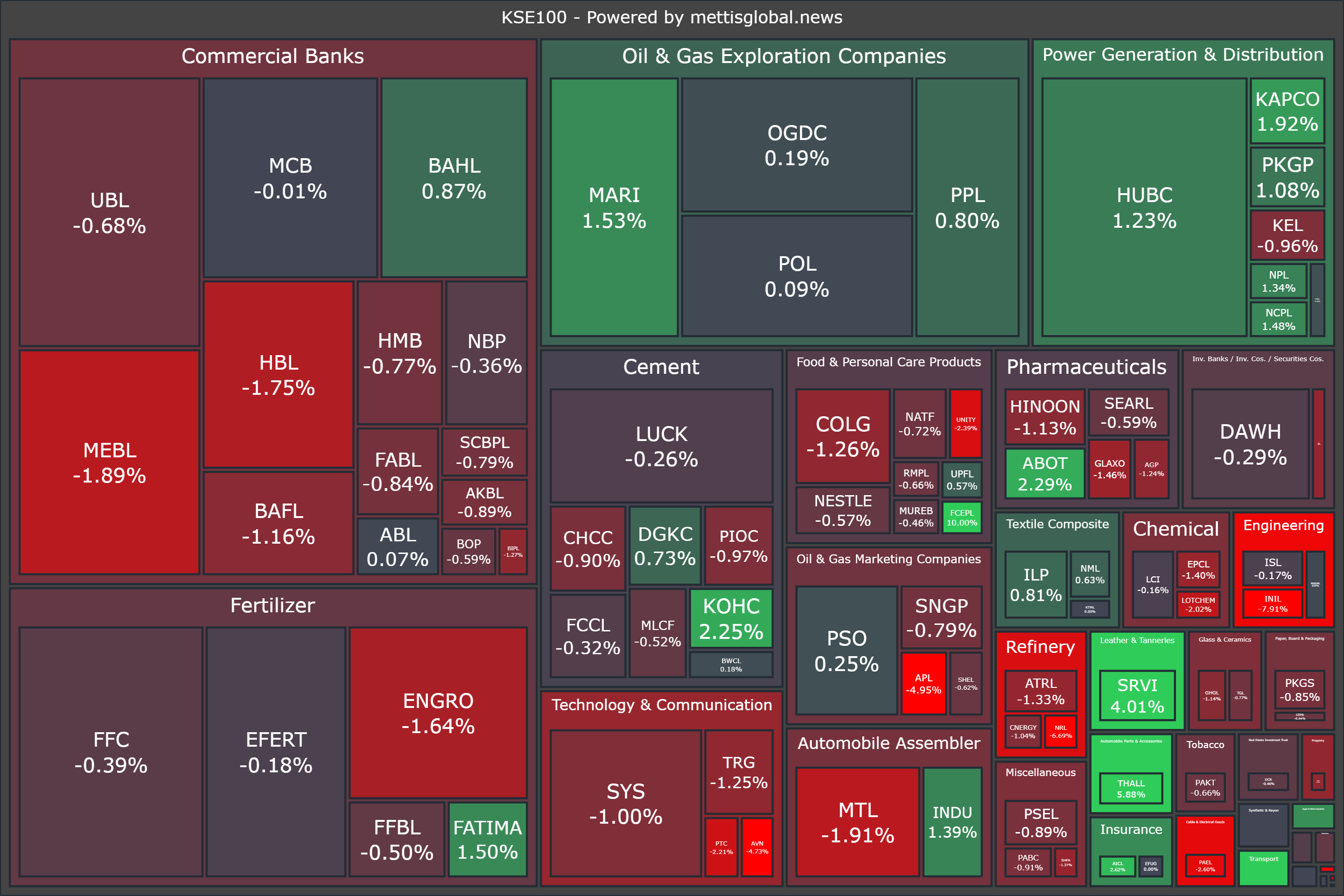

Of the 100 index companies 30 closed up, 65 closed down, while 5 were unchanged.

Top losers during the day were YOUW (-17.12%), INIL (-7.91%), NRL (-6.69%), BNWM (-6.28%), and APL (-4.95%).

National Refinery Limited (NRL) posted a loss after tax of Rs8.27 billion [LPS: Rs103.39] during the quarter ending June 2024.

On the other hand, top gainers were FCEPL (+10.00%), THALL (+5.88%), PGLC (+4.29%), SRVI (+4.01%), and PIBTL (+3.42%).

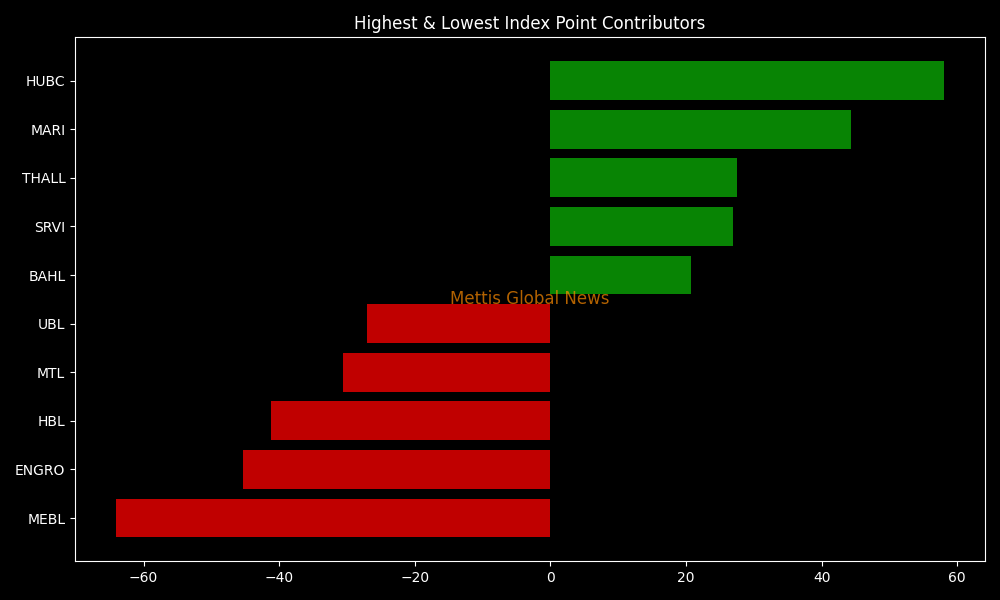

In terms of index-point contributions, companies that dragged the index lower were MEBL (-64.01pts), ENGRO (-45.32pts), HBL (-41.18pts), MTL (-30.62pts), and UBL (-26.99pts).

Meanwhile, companies that added points to the index were HUBC (+57.99pts), MARI (+44.39pts), THALL (+27.46pts), SRVI (+26.96pts), and BAHL (+20.69pts).

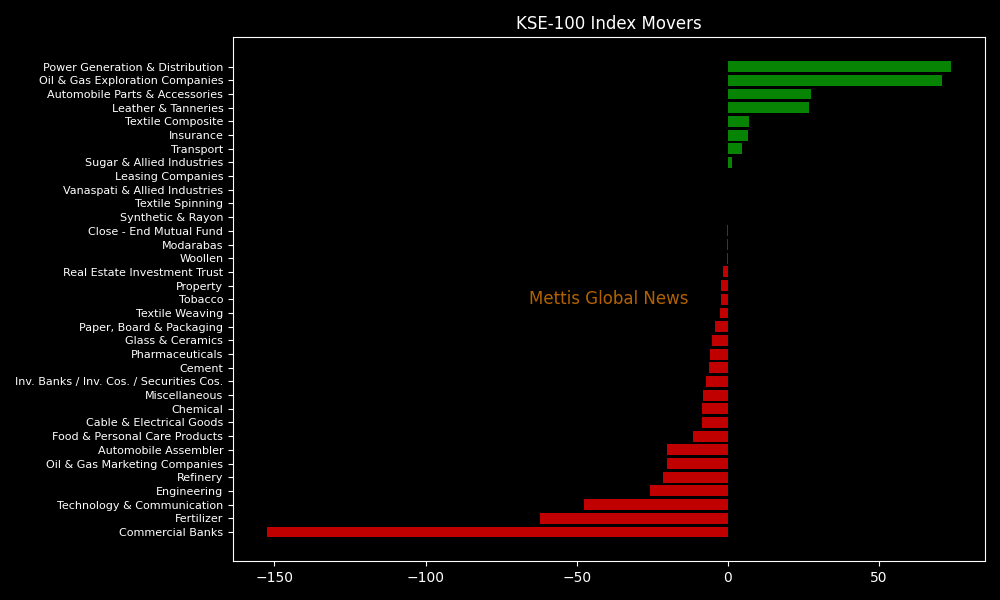

Sector-wise, KSE-100 Index was let down by Commercial Banks (-152.40pts), Fertilizer (-61.97pts), Technology & Communication (-47.40pts), Engineering (-25.82pts), and Refinery (-21.42pts).

While the index was supported by Power Generation & Distribution (+73.83pts), Oil & Gas Exploration Companies (+70.87pts), Automobile Parts & Accessories (+27.46pts), Leather & Tanneries (+26.96pts), and Textile Composite (+6.92pts).

In the broader market, the All-Share Index closed at 50,391.04 with a net loss of 283.69 points or 0.56%.

Total market volume was 457.28 million shares compared to 680.81m from the previous session while traded value was recorded at Rs15.87 billion showing a decrease of Rs5.31bn.

There were 242,162 trades reported in 447 companies with 107 closing up, 287 closing down, and 53 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| HASCOL | 7.65 | -3.16% | 46,430,036 |

| AGHA | 13.68 | -10.00% | 28,794,375 |

| SLGL | 14.89 | -9.04% | 21,545,106 |

| WTL | 1.19 | -1.65% | 20,750,623 |

| CTM | 7.14 | 8.84% | 18,033,345 |

| SYM | 8.99 | -3.75% | 16,280,853 |

| AIRLINK | 141.87 | -3.93% | 15,688,899 |

| DFML | 48.1 | -8.97% | 12,565,447 |

| CNERGY | 3.82 | -1.04% | 11,883,567 |

| YOUW | 4.84 | -17.12% | 11,478,320 |

To note, the KSE-100 has lost 162 points or 0.21% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 15,832 points, equivalent to 25.35%.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

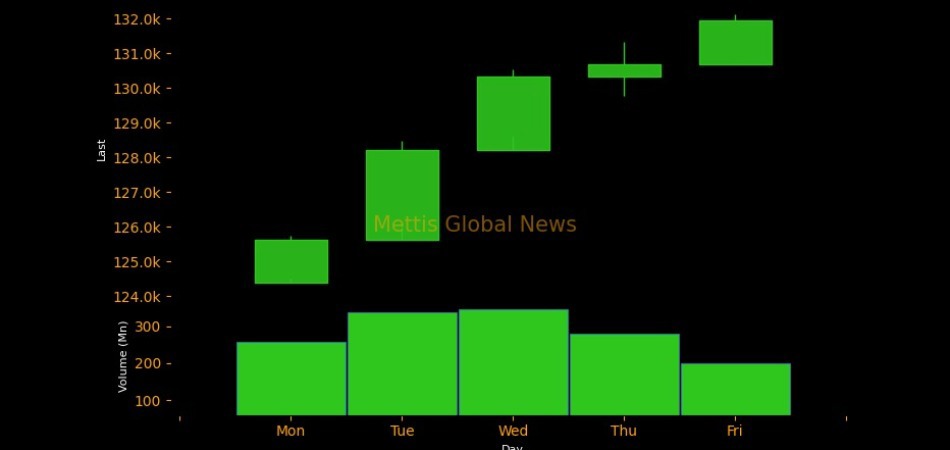

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI