Weekly Market Roundup

By MG News | September 01, 2024 at 11:29 AM GMT+05:00

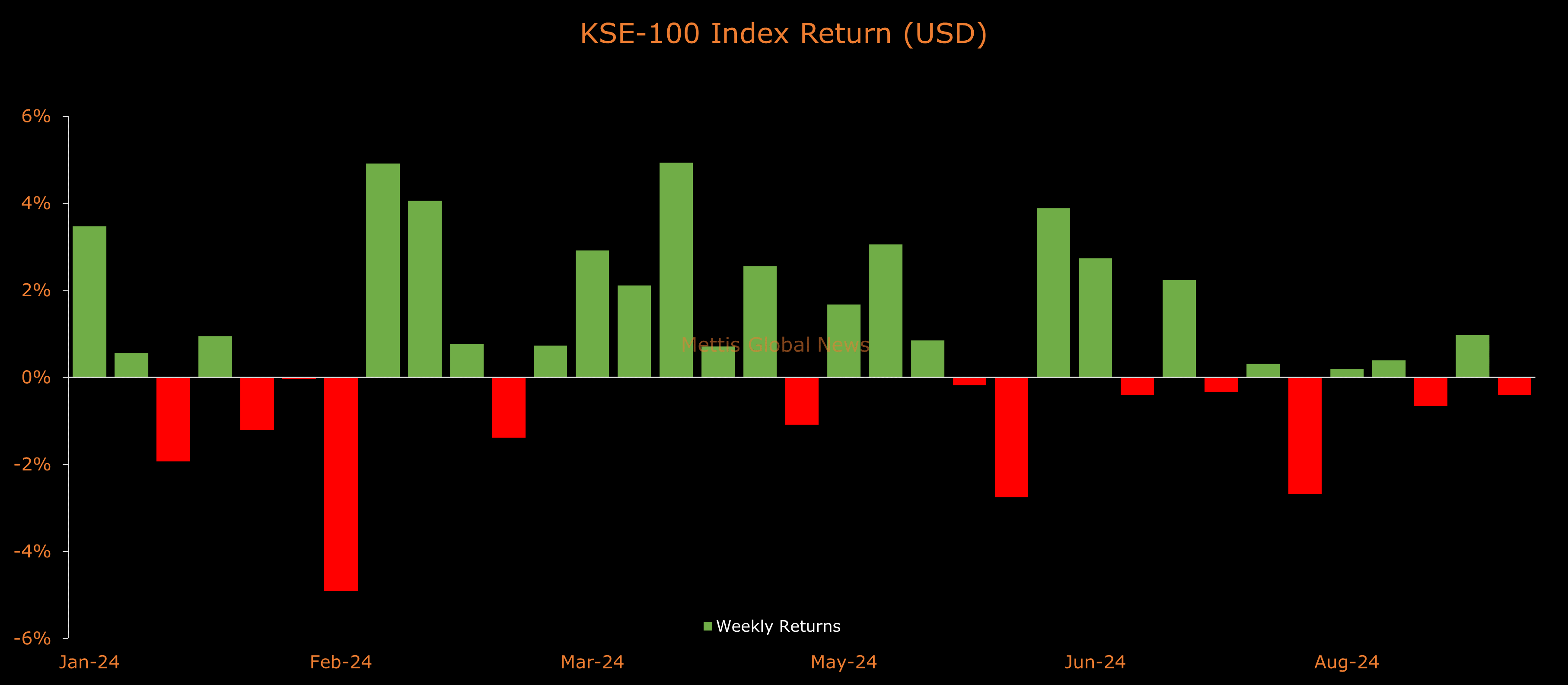

September 01, 2024 (MLN): The benchmark KSE-100 Index closed this week at 78,488 showing a decrease of 313 points or 0.4% in both PKR and USD terms.

Throughout the week, KSE-100 traded in a range of 1,170 points, between a high of 79,160 (+359) and a low of 77,990 (-811) points.

PSX average traded volume was recorded at 604.1 million shares worth Rs18.78 billion, marking an increase of 4.5% WoW in the number of shares and 20.5% WoW in traded value.

Meanwhile, the PSX market capitalization decreased by $100.5m or 0.3% to $37.64bn over the week. In PKR terms, market capitalization stood at Rs10.49 trillion.

Top Index Movers

Sector-wise, the largest drags on the index were Commercial Banks (-369pts), Cement (-138pts), Pharmaceuticals (-96pts), Technology & Communication (-66pts), and Leather & Tanneries (-63pts).

Contrary to that, the positive contributions came from Power Generation & Distribution (+176pts), Fertilizer (+106pts), Chemical (+93pts), Automobile Assembler (+84pts), and Oil & Gas Exploration Companies (+65pts).

The worst-performing stocks during the week were HBL (-162pts), BAHL (-81pts), MEBL (-80pts), UBL (-67pts), and SRVI (-63pts).

Whereas, HUBC, NBP, MARI, COLG, and MTL added 175, 136, 128, 96, and 74 points to the index respectively.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $3.72m worth of equities.

Flow-wise, Individuals were the dominant buyers, with a net investment of $5.84m.

They allocated the majority of their capital, $3.23m, to Fertilizer, while divesting from the Commercial Banks sector, amounting to $1.53m in sales.

On the other hand, the leading sellers were Banks / Dfi, with a net sale of $3.85m.

Their most substantial sales activity was in Fertilizer, amounting to $1.54m, while they acquired $2.27m of equities in the All other Sectors.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,782.35 104.03M |

-0.47% -620.84 |

| ALLSHR | 83,056.54 585.87M |

-0.16% -131.52 |

| KSE30 | 40,406.00 36.54M |

-0.60% -245.46 |

| KMI30 | 191,084.46 41.55M |

-0.52% -999.45 |

| KMIALLSHR | 55,761.59 300.08M |

-0.15% -86.10 |

| BKTi | 36,237.54 6.50M |

-0.51% -185.34 |

| OGTi | 28,275.82 7.38M |

-0.57% -161.79 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,165.00 | 109,545.00 108,625.00 |

-50.00 -0.05% |

| BRENT CRUDE | 70.26 | 70.26 69.85 |

0.11 0.16% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

2.05 2.15% |

| ROTTERDAM COAL MONTHLY | 106.65 | 106.65 106.25 |

0.50 0.47% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.42 | 68.42 67.78 |

0.09 0.13% |

| SUGAR #11 WORLD | 16.12 | 16.15 16.08 |

-0.01 -0.06% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)