PSX Closing Bell: Roses Are Red

MG News | December 19, 2024 at 04:21 PM GMT+05:00

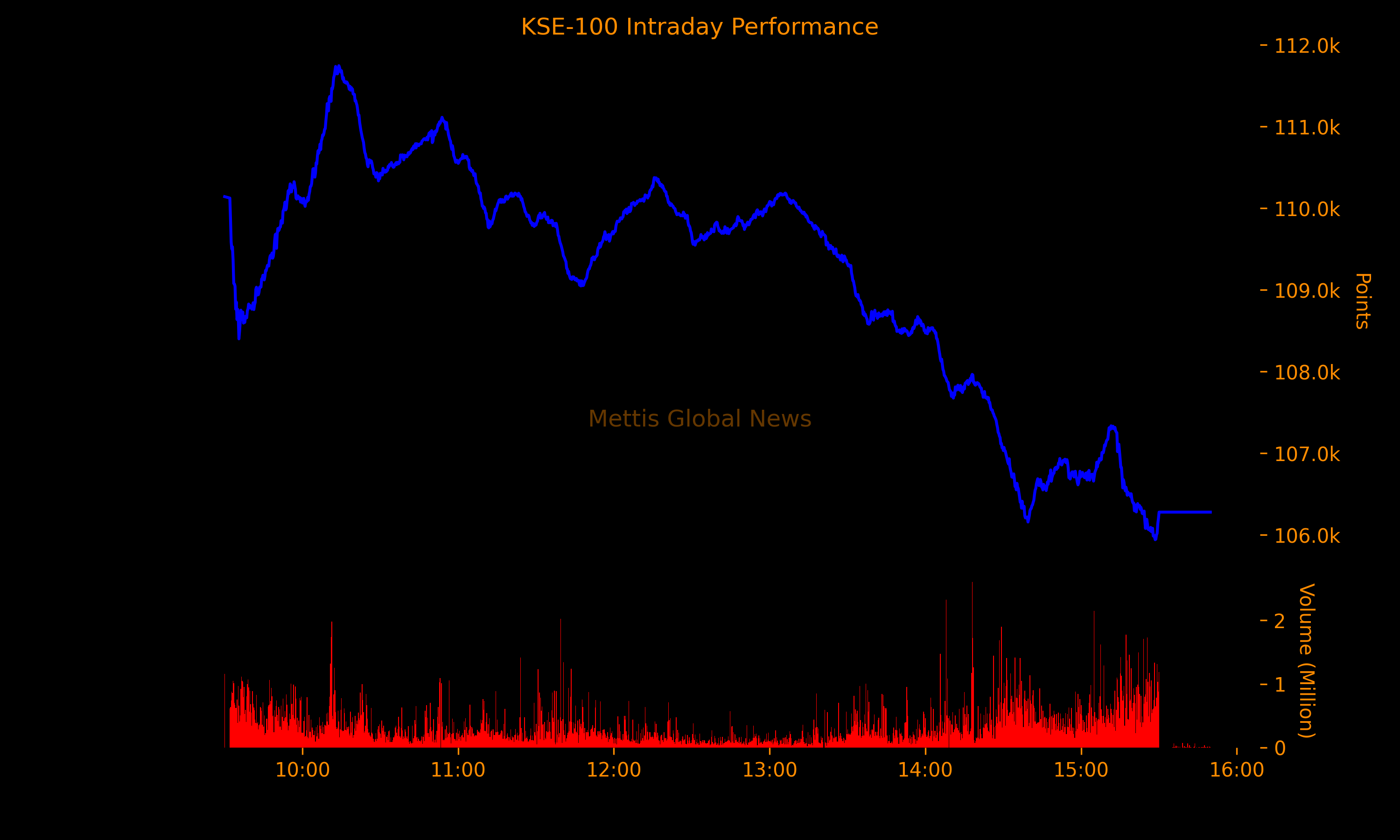

December 19, 2024 (MLN): The benchmark KSE-100 Index extended its losing streak on Thursday to reach at 106,274.97, showing a decrease of 4,795.32 points or 4.32%.

Despite the downturn, analysts are of the view that this dip may present buying opportunities for investors who missed out on the rally earlier.

The current market conditions could be seen as an opportunity to capitalize on lower stock prices, particularly in sectors that have been hit hardest in recent days.

The index traded in a range of 5,807.65 points showing an intraday high of 111,745.02 (+674.73) and a low of 105,937.37 (-5,132.92) points.

The total volume of the KSE-100 Index was 531.31 million shares.

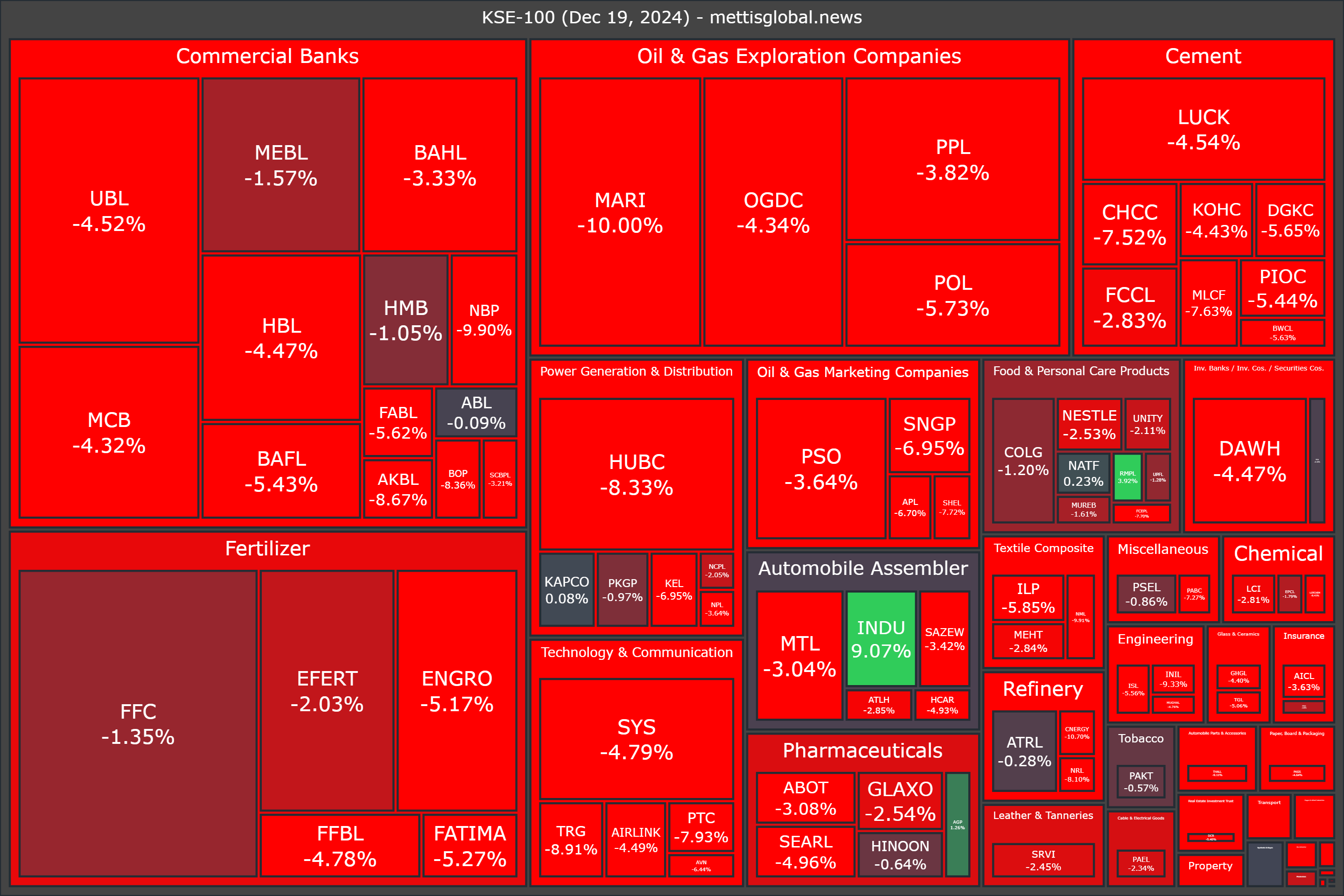

Of the 100 index companies 6 closed up, 94 closed down.

Top losers during the day were CNERGY (-10.70%), KOSM (-10.32%), MARI (-10.00%), NML (-9.91%), and NBP (-9.90%).

On the other hand, top gainers were INDU (+9.07%), PGLC (+8.81%), RMPL (+3.92%), AGP (+1.26%), and NATF (+0.23%).

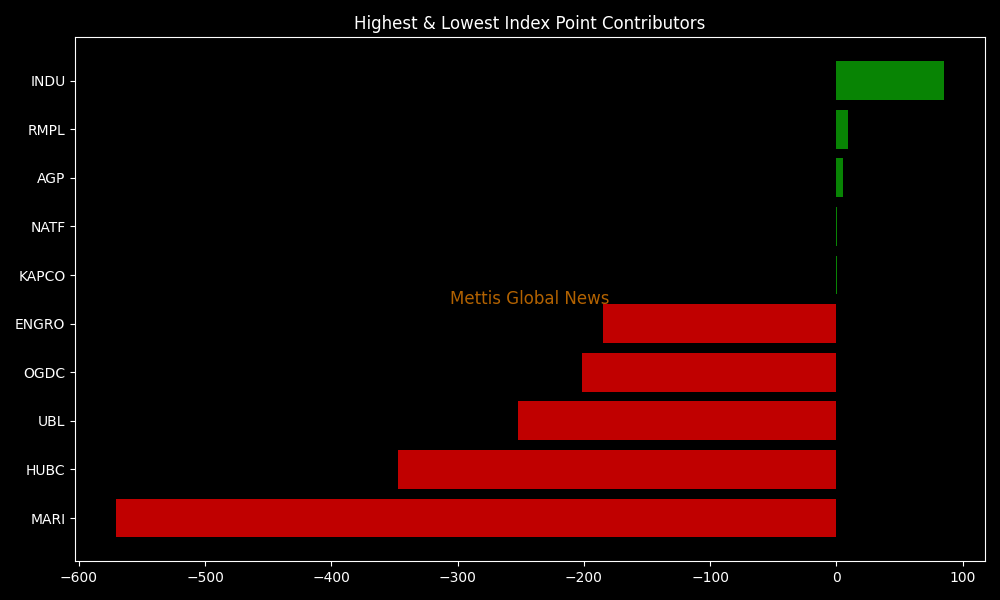

In terms of index-point contributions, companies that dragged the index lower were MARI (-570.15pts), HUBC (-347.39pts), UBL (-252.06pts), OGDC (-201.57pts), and ENGRO (-184.80pts).

Meanwhile, companies that added points to the index were INDU (+84.86pts), RMPL (+8.93pts), AGP (+5.47pts), NATF (+0.80pts), and KAPCO (+0.45pts).

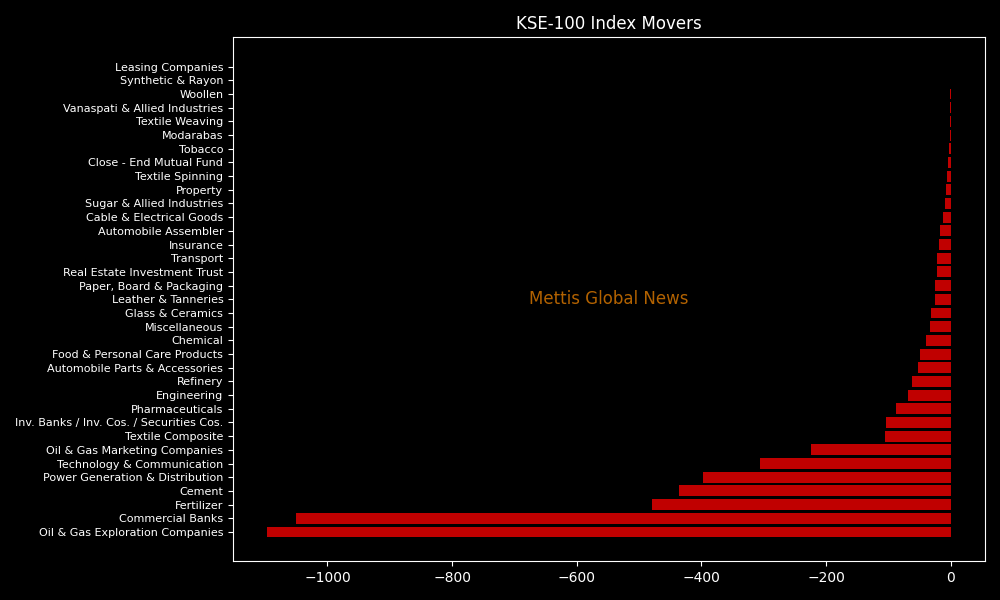

Sector-wise, KSE-100 Index was let down by Oil & Gas Exploration Companies (-1096.68pts), Commercial Banks (-1049.68pts), Fertilizer (-479.50pts), Cement (-435.40pts), and Power Generation & Distribution (-397.35pts).

Leasing companies was the only sector to close in the green, with a minor contribution of 0.3pts.

In the broader market, the All-Share Index closed at 67,484.26 with a net loss of 2,684.19 points or 3.83%.

Total market volume was 1,167.36 million shares compared to 1,111.92m from the previous session while traded value was recorded at Rs56.80 billion showing a decrease of Rs3.44bn.

There were 470,602 trades reported in 472 companies with 66 closing up, 371 closing down, and 35 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| WTL | 1.52 | -11.11% | 177,645,248 |

| KEL | 5.22 | -6.95% | 81,901,542 |

| CNERGY | 5.84 | -10.70% | 68,345,098 |

| PAEL | 37.58 | -2.34% | 57,974,101 |

| PRL | 38.17 | -2.20% | 45,251,944 |

| SSGC | 46.48 | 4.24% | 37,757,587 |

| BOP | 9.32 | -8.36% | 35,598,669 |

| SYM | 19.44 | 8.66% | 34,869,613 |

| ASL | 10.49 | -5.15% | 28,556,537 |

| FFL | 12.75 | -8.27% | 24,691,490 |

To note, the KSE-100 has gained 27,830 points or 35.48% during the fiscal year, whereas it has increased 43,824 points or 70.17% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 153,866.17 113.04M | -0.36% -555.27 |

| ALLSHR | 92,322.41 289.91M | -0.18% -165.37 |

| KSE30 | 47,054.02 67.50M | -0.57% -268.71 |

| KMI30 | 220,139.18 52.42M | -0.81% -1787.82 |

| KMIALLSHR | 59,630.44 114.87M | -0.43% -258.98 |

| BKTi | 44,089.65 23.49M | -0.09% -38.05 |

| OGTi | 31,668.31 6.28M | -0.15% -47.11 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 72,500.00 | 72,855.00 70,200.00 | 1855.00 2.63% |

| BRENT CRUDE | 99.48 | 102.75 98.45 | -0.98 -0.98% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -10.80 -9.80% |

| ROTTERDAM COAL MONTHLY | 123.80 | 123.80 123.80 | 0.00 0.00% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 93.92 | 98.09 93.12 | -1.81 -1.89% |

| SUGAR #11 WORLD | 14.40 | 14.47 14.32 | 0.02 0.14% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Auto Numbers

Auto Numbers