PSX Closing Bell: Infinite Dreams

By MG News | October 15, 2021 at 07:09 PM GMT+05:00

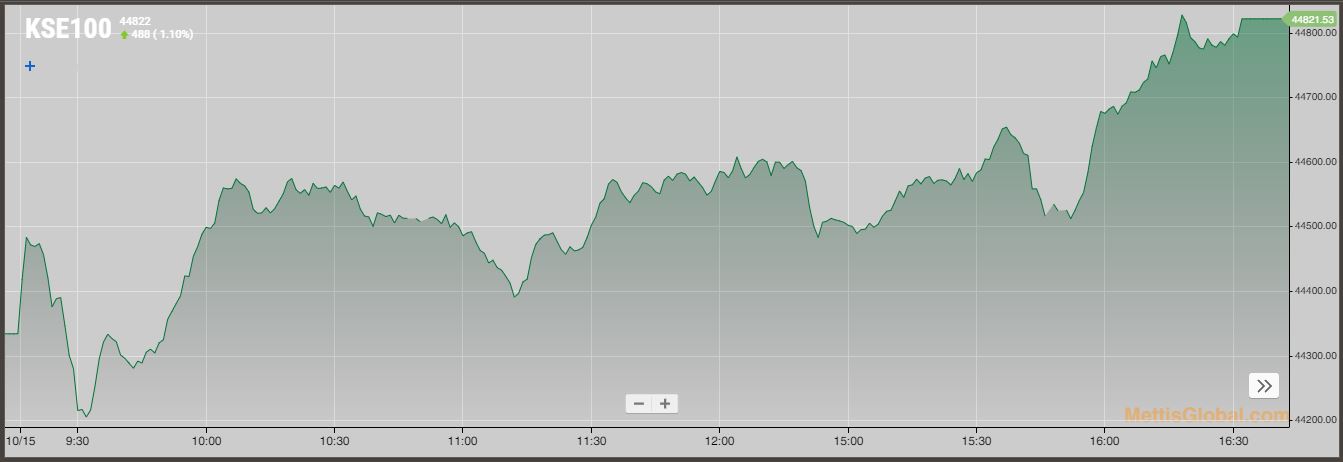

October 15, 2021 (MLN): Bulls held their ground for the second consecutive day at the local bourse as the benchmark KSE-100 index extended gains by 487.85 points to close the trade at 44,821.53.

However, the ongoing IMF talks remained the center of attention for the investors. Policy level meetings were held between Government and IMF in Washington, DC during the week for clubbing two reviews under the Extended Fund Facility and approving $1bn loan tranche; IMF reiterated its stance of increase in power tariff by Rs.1.39 per unit, cut down in sales tax exemptions and to take steps to curb increasing current account deficit, as per noted by market closing note by Topline Securities.

The Index traded in a range of 641.35 points or 1.45 percent of the previous close, witnessing an intraday high of 44,834.83 and a low of 44,193.48.

Of the 92 traded companies in the KSE100 Index 65 closed up 26 closed down, while 1 remained unchanged. Total volume traded for the index was 152.02 million shares.

Sectors propping up the index were Oil & Gas Exploration Companies with 138 points, Fertilizer with 79 points, Cement with 57 points, Commercial Banks with 46 points and Food & Personal Care Products with 25 points.

The most points added to the index was by PPL which contributed 49 points followed by POL with 43 points, MCB with 39 points, OGDC with 38 points and SYS with 31 points.

Sector wise, the index was let down by Tobacco with 14 points, Glass & Ceramics with 4 points and Miscellaneous with 2 points.

The most points taken off the index was by TRG which stripped the index of 25 points followed by PAKT with 14 points, HMB with 12 points, FABL with 7 points and AGP with 6 points.

All Share Volume decreased by 54.27 Million to 334.33 Million Shares. Market Cap increased by Rs.47.28 Billion.

Total companies traded were 356 compared to 557 from the previous session. Of the scrips traded 226 closed up, 116 closed down while 14 remained unchanged.

Total trades decreased by 13,289 to 121,303.

Value Traded decreased by 1.29 Billion to Rs.11.79 Billion

| Company | Volume |

|---|---|

| Service Fabrics | 34,261,500 |

| Unity Foods | 26,471,859 |

| Worldcall Telecom | 25,490,000 |

| Treet Corporation | 19,620,000 |

| Byco Petroleum Pakistan | 16,174,500 |

| Telecard | 11,564,500 |

| Hum Network | 11,008,500 |

| Azgard Nine | 9,278,000 |

| Lotte Chemical Pakistan | 8,723,000 |

| Ghani Global Holdings | 7,273,000 |

| Sector | Volume |

|---|---|

| Technology & Communication | 67,415,624 |

| Food & Personal Care Products | 52,975,369 |

| Textile Weaving | 35,825,500 |

| Commercial Banks | 22,292,329 |

| Chemical | 21,024,100 |

| Refinery | 20,673,072 |

| Cement | 16,607,984 |

| Textile Composite | 13,729,250 |

| Fertilizer | 9,665,680 |

| Oil & Gas Marketing Companies | 8,720,639 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 130,344.03 345.79M |

1.67% 2144.61 |

| ALLSHR | 81,023.99 1,021.87M |

1.55% 1236.37 |

| KSE30 | 39,908.26 141.62M |

2.05% 803.27 |

| KMI30 | 189,535.00 150.29M |

1.40% 2619.39 |

| KMIALLSHR | 54,783.66 508.76M |

1.07% 581.78 |

| BKTi | 34,940.73 55.86M |

4.37% 1464.05 |

| OGTi | 28,296.06 16.02M |

1.19% 333.47 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,490.00 | 110,105.00 109,405.00 |

-795.00 -0.72% |

| BRENT CRUDE | 68.50 | 69.00 68.48 |

-0.61 -0.88% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 109.20 | 110.00 108.25 |

1.70 1.58% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.86 | 67.50 66.83 |

-0.59 -0.87% |

| SUGAR #11 WORLD | 15.56 | 15.97 15.44 |

-0.14 -0.89% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

Trade Balance

Trade Balance

CPI

CPI