June 11, 2024 (MLN): Despite a positive start to today’s session amid relief from interest rate cut, fear of stringent budgetary measures overshadowed sentiments at the Pakistan Stock Exchange (PSX) today.

The benchmark KSE-100 index concluded Tuesday's trading session at 72,589.49 showing a decrease of 663.07 points or 0.91%.

The index traded in a range of 1,390.40 points showing an intraday high of 73,866.45 (+613.89) and a low of 72,476.05 (-776.51) points.

The total volume of the KSE-100 index was 142.28 million shares.

In a key development, the State Bank of Pakistan (SBP) on Monday lowered its key policy rate by 150 basis points to 20.5%, a bigger margin than expected by market analysts.

The reduction was the first in almost four years and came ahead of the country’s annual budget 2024-25.

The central bank had kept borrowing costs at a record 22% since June 2023.

In Tuesday's trading session, of the 100 index companies 23 closed up, 68 closed down, 5 were unchanged, while 4 remained untraded.

KSE-100 index was let down by Oil & Gas Exploration Companies (151.02pts), Commercial Banks (136.11pts), Technology & Communication (110.47pts), Cement (101.1pts), and Fertilizer (68.23pts).

On the flip-side, the index was supported by Leather & Tanneries (24.33pts), Textile Composite (11.97pts), Food & Personal Care Products (9.69pts), Automobile Parts & Accessories (5.16pts), and Real Estate Investment Trust (3.54pts).

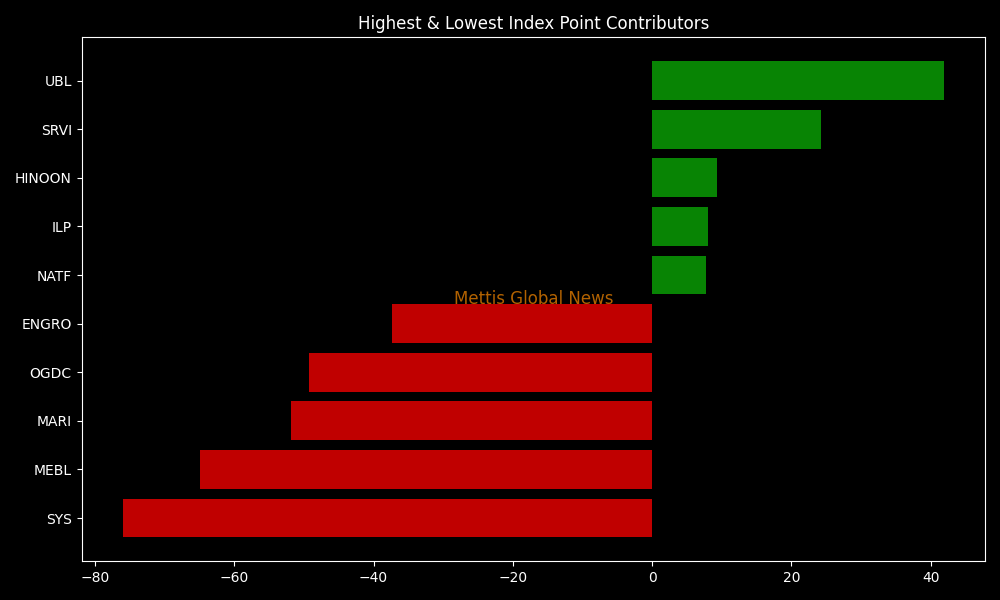

Companies that dragged the index lower were SYS (76.04pts), MEBL (64.99pts), MARI (51.9pts), OGDC (49.28pts), and ENGRO (37.32pts).

On the other hand, companies that added points to the index were UBL (41.92pts), SRVI (24.33pts), HINOON (9.27pts), ILP (8.03pts), and NATF (7.68pts).

In the broader market, the All-Share index closed at 46,677.02 with a net loss of 476.82 points.

Total market volume was 350.72 million shares compared to 350.72m from the previous session while traded value was recorded at Rs10.18 billion showing an increase of Rs1.45bn.

There were 161,193 trades reported in 433 companies with 133 closing up, 240 closing down and 60 remaining unchanged.

| Company | Volume |

|---|---|

| KEL | 45,897,256 |

| WTL | 33,249,426 |

| PASL | 29,026,271 |

| AMTEX | 20,549,793 |

| KOSM | 16,779,761 |

| FCCL | 13,750,403 |

| DGKC | 9,955,546 |

| CNERGY | 8,169,471 |

| HASCOL | 6,841,347 |

| HUMNL | 6,793,820 |

To note, the KSE-100 has gained 31,137 points or 75.11% during the fiscal year, whereas the ongoing calendar year has witnessed a cumulative increase of 10,138 points, equivalent to 16.23%.

Copyright Mettis Link News

Posted on: 2024-06-11T16:20:37+05:00