PKR strengthens by 20 paisa against USD

MG News | April 13, 2022 at 03:39 PM GMT+05:00

April 13, 2022 (MLN): Moving on to the upward trail, the Pakistani rupee (PKR) has further appreciated by 20 paisa against the US dollar on Wednesday in the interbank session as the currency closed the trade at PKR 181.82, compared to yesterday's closing of PKR 182.02 per USD.

The rupee traded in a range of 55 paisa per USD showing an intraday high bid of 182 and an intraday low offer of 181.55.

Apart from the clarity on the political front, the other helping factor could be the slow demand for dollars from importers as they may be waiting for some more correction.

The flow of remittances increases during Ramzan which is also helping, Asad Rizvi, the former Treasury Head at Chase Manhattan Bank said.

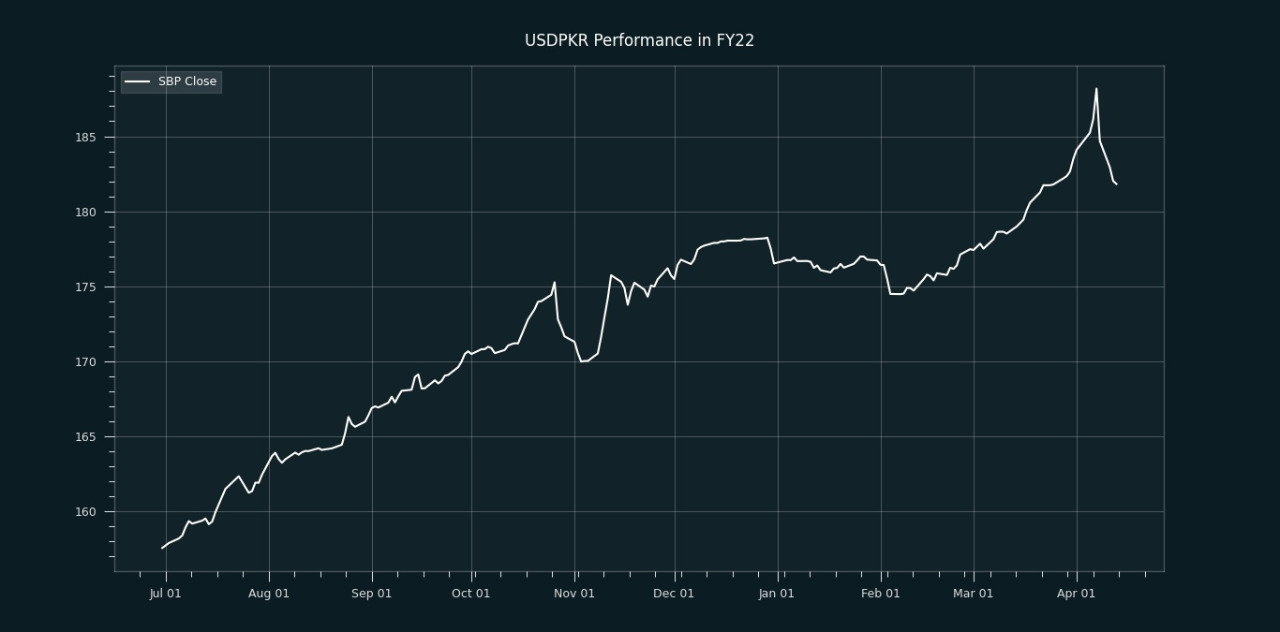

From July’21 to date, the local unit has lost Rs24.27 against the USD. Similarly, the rupee fell by Rs5.3 in CYTD, with the month-to-date (MTD) position showing an up of 0.91%, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 16.25% against the greenback, reached its lowest at 181.82 today and touched its high of 152.27 on May 7, 2021.

Furthermore, the local unit has weakened by 7.12% since its high on April 16, 2021, against EUR. While, it has dropped by 11.20% against GBP since its high on April 16, 2021.

In addition, the performance of PKR remained satisfactory against major currencies during the month to date as it appreciated by 4.70%, 3.98%, 1.95%, 1.85%, 1.28%, 0.91%, and 0.88% against JPY, EUR, GBP, CHF, CNY, AED, and SAR, respectively.

Within the open market, PKR was traded at 180.5/181.5 per USD.

Meanwhile, the currency gained 41 paisa against the Pound Sterling as the day's closing quote stood at PKR 236.44 per GBP, while the previous session closed at PKR 236.84 per GBP.

Similarly, PKR's value strengthened by 92 paisa against EUR which closed at PKR 196.9 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) conducted an Open Market Operation in which it injected Rs.1.78 trillion for 7 days at 8.91 percent.

The overnight repo rate towards the close of the session was 13.00/12.75 percent, whereas the 1-week rate was 12.30/12.40 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,390.42 291.21M | 0.71% 978.17 |

| ALLSHR | 86,260.96 576.29M | 0.65% 558.00 |

| KSE30 | 42,618.60 119.41M | 0.86% 363.76 |

| KMI30 | 196,907.86 123.77M | 1.44% 2798.27 |

| KMIALLSHR | 57,276.87 259.26M | 0.99% 563.20 |

| BKTi | 37,820.27 20.77M | -0.03% -11.06 |

| OGTi | 28,214.64 47.07M | 2.82% 774.00 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 116,250.00 | 117,125.00 114,800.00 | -1185.00 -1.01% |

| BRENT CRUDE | 71.67 | 71.85 71.57 | -0.03 -0.04% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.21 | 69.46 69.13 | -0.05 -0.07% |

| SUGAR #11 WORLD | 16.35 | 16.61 16.28 | -0.10 -0.61% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey