PKR sees massive fall, down by 6.4 rupees in a week

By MG News | June 17, 2022 at 05:55 PM GMT+05:00

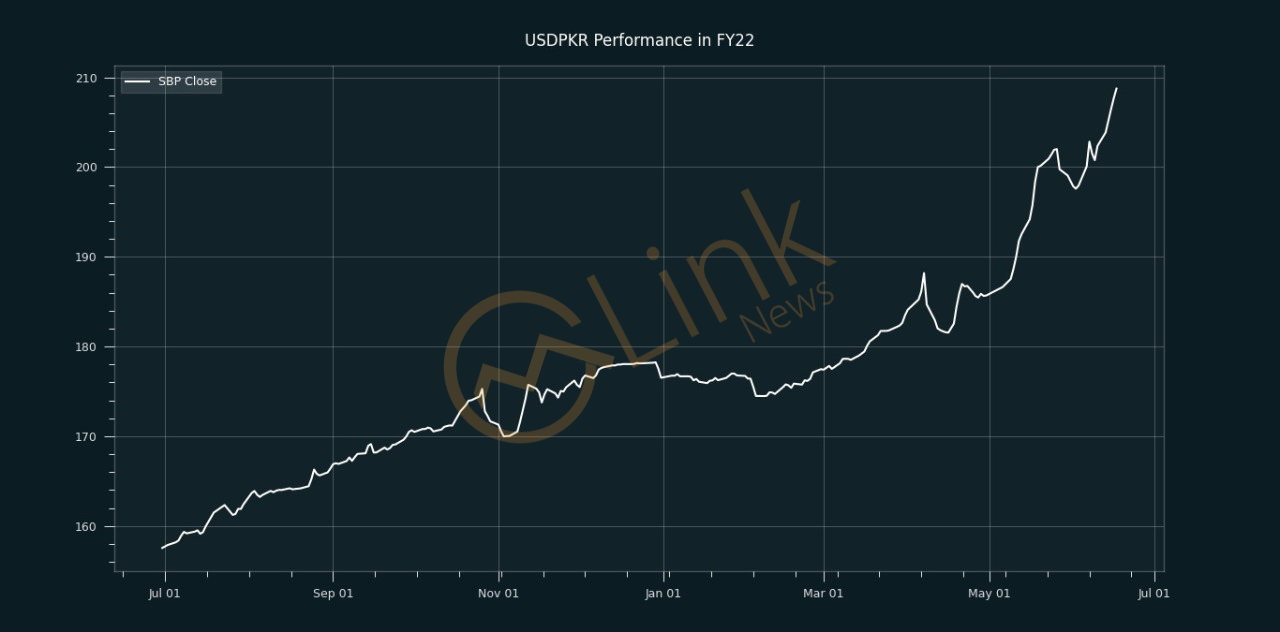

June 17, 2022 (MLN): Dismal macros along with no respite from the IMF side have further pushed the Pakistani rupee toward a colossal loss of 6.4 rupees in five consecutive sessions to settle the week at PKR 208.75, compared to the previous week’s was concluded at PKR 202.35 per USD.

In today’s session, the domestic unit lost 1.1 rupees after being traded in a band of over 1.5 rupees, showing an intraday high bid of 208.75 and an intraday low offer of 207.75. While, in the open market, PKR was traded at 209/210.50 per USD.

Market experts are of the view that the situation needs the government’s immediate attention with respect to curtailing import bill through cutting unnecessary expenditures. Otherwise, in the absence of IMF tranche, Pakistan’s foreign exchange reserves will keep on depleting.

Speaking to Mettis Global, Malik Bostan, President of Forex Association of Pakistan said that only the green signal from the IMF will be able to stop the freefall of PKR. He also emphasized banning the imports of unnecessary/luxury items to prevent foreign exchange reserves to touch the deadliest level.

On the other hand, Zafar Paracha, President of Exchange Companies Association of Pakistan (ECAP) told Mettis, “No significant measure by the government to halt the continues drop in PKR indicates that currency depreciation may be a part of IMF agreement.”

He said that under the given circumstances, PKR should not be more than 190-192 per USD.

During the week, importers had to face difficulty opening LCs as foreign banks are demanding a 100 percent cash margin due to melting reserves.

“This is the reason behind intraday volatility as the demand for dollar during the intraday trade heightened up as importers have to deposit full amount within a day. Resultantly, the spread margin on US dollar across banks have increased to 2-3 rupees from 20-30 paisa,” Malik Bostan said.

As per the data issued by SBP, the total liquid foreign exchange reserves held by the country dropped by $233.5 million or 1.53% WoW to stand at the lowest level of $14.94 billion since July 19, 2019, during the week ended on June 10, 2022, compared to $15.17bn in the previous week.

Meanwhile, the trade deficit increased by 58% to $43.4bn during 11MFY22 mainly on the back of a historic surge in oil import bill.

From July’21 to date, the local unit has lost Rs50.20 against the USD. Similarly, the rupee fell by Rs32.23 in CY21, with the month-to-date (MTD) position showing a decline of 4.93%, as per data compiled by Mettis Global.

During the last 52 weeks, PKR lost 24.84% against the greenback while reaching its lowest at 207.74 today, and the highest of 156.89 on June 18, 2021.

Furthermore, the local unit has weakened by 14.93% since its high on July 02, 2021, against EUR while, it has dropped by 15.38% against GBP since its high on July 02, 2021.

The performance of local unit remained bleak against other major currencies during the previous seven sessions as the currency lost its value by 4.41%, 3.06%, 3.04%, 2.92%, 2.64%, 2.08%, and 1.70% against CHF, AED, SAR, CNY, JPY, EUR, and GBP, respectively.

The currency lost 5.2 rupees to the Pound Sterling as the day's closing quote stood at PKR 256.76 per GBP, while the previous session closed at PKR 251.52 per GBP.

Similarly, PKR's value weakened by 3.6 rupees against EUR which closed at PKR 219.58 at the interbank today.

On another note, within the money market, the State Bank of Pakistan (SBP) on Friday injected Rs868.9 billion through reverse repo purchase and Shariah-compliant mudarabah-based Open Market Operation (OMO).

The overnight repo rate towards the close of the session was 13.50/13.75 percent, whereas the 1-week rate was 13.85/13.95 percent.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,125.00 | 110,525.00 107,865.00 |

-2290.00 -2.07% |

| BRENT CRUDE | 68.51 | 68.89 67.75 |

-0.29 -0.42% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 67.18 66.04 |

-0.50 -0.75% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI