PKR review: In shambles

MG News | December 01, 2021 at 09:43 PM GMT+05:00

December 1, 2021 (MLN): Along with rising global inflation, higher commodity prices, and surging dollar demand- enough to derail the Pakistani currency, November also brought obvious reasons for PKR to have some breathing space.

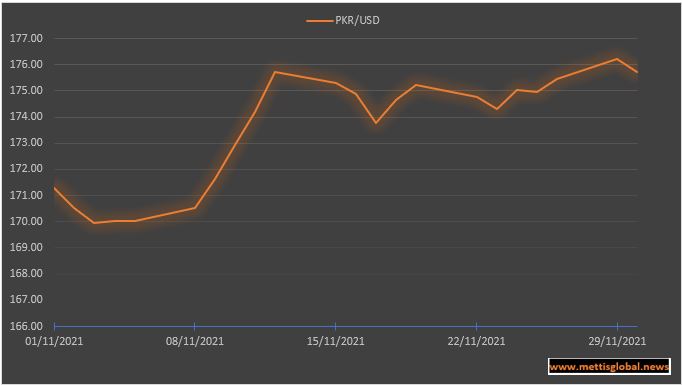

Enduring a seesaw journey, the home unit crossed the lowest ever mark on November 29 as it closed at 176.2, while the highest close was recorded on November 3 at 169.97 per USD.

Throughout the month, PKR shed its value by 4.06 rupees or 2.31% against USD compared to the PKR depreciation of 0.52% in November’20.

To note, the rupee took a breather in March’21 as it recorded a remarkable performance during the calendar year, wherein, the local unit had managed to gain its ground by 3.50%.

On the other hand, PKR saw a minimal loss during October’21 wherein the currency moved down by only 0.58%.

Cumulatively, the domestic unit saw a fall of 10.34% or 18.17 rupees in the fiscal year-to-date against the USD. Similarly, the rupee has weakened by 9.04% or 15.88 rupees in CY21.

Following the positive momentum created by the announcement of the Saudi government to provide financial support of $4.2 billion to Pakistan to help ease pressure on trade and increase foreign currency reserves in the last week of October, PKR kicked off the month of November’21 on the positive note.

Moreover, the ease in pressure was also a reflection of the international commodity market where prices had started cooling down. The situation was enough to suppress the impact of speculation and panic from the money market which pushed PKR to gain 1.6 rupees against the greenback during the first week of November.

However, the traders were keenly looking for a conclusive note from Government and International Monetary Fund (IMF) talks, which held PKR back to gain more strength in the interbank.

Malik Bostan, President Forex Association of Pakistan termed this delay in the final outcome of the IMF discussions as a “delaying tactic” to create political pressure.

He highlighted that IMF has posed its concern over the autonomous status of the State Bank of Pakistan. To recall, Pakistan reached an agreement with IMF in March 2021 with regards to grant autonomy to the central bank.

During the month, Adviser to Prime Minister on Finance and Revenue, Shaukat Tarin stated that the prevailing uncertainty pertaining to the IMF loan facility is going to be over soon. He also pointed out “speculators will soon bear the losses.”

While speaking to Mettis Global, Asad Rizvi, the Former Treasury Head at Chase Manhattan criticized his statement as it would create serious problems for the country on the front Financial Action Task Force (FATF).

Such developments including soaring inflation in the global market, upsurge in dollar demand, and uncertainty on the IMF front dragged PKR towards the rough patch and compelled it to lose more than it gained in the early week.

In a topsy turvy state of messed up economic triggers, PKR reflected some advantage on the hike of 150 basis points in the policy rate by MPC in its recent meeting. However, Asad Rizvi, the former Treasury Head at Chase Manhattan said, “the hike may not be enough to calm market sentiment, a rise in policy rate is not due to the booming economy.”

Right after the policy rate hike, Pakistan and IMF authorities had reached a staff-level agreement on policies and reforms needed to complete the sixth review under the Extended Fund Facility (EFF).

Completion of the review would make available SDR 750 million or about $1.059 billion, bringing total disbursements under the EFF to about $3,027 million and helping unlock significant funding from bilateral and multilateral partners.

PKR could have seen a sharp appreciation but the aforesaid development still requires the approval of the Executive Board, following the implementation of prior actions, notably on fiscal and institutional reforms. Thus, the rally quickly fizzled out as sentiments turned nervous realizing the conditions are very demanding.

“The challenge for approval is to meet all demands before its board meeting due in the next seven weeks,” he added.

Going forward, PKR also got hit by the plummeted FX reserves that reached an eight-month low at $22.77 billion during the week ended on November 19, 2021, due to an outflow of $961 million on account of debt repayments, weekly data released by the State Bank of Pakistan showed on Thursday.

Not to forget, the currency also got chopped off under the pressure of the soaring current account deficit, which has jumped by 46.65% MoM to stand at $1.66 billion in October 2021 from $1.13bn in September 2021. Persistently high international commodity prices and strong domestic activity kept the current account deficit elevated, SBP said in its recent monetary policy statement.

Meanwhile, Pakistan’s Real Effective Exchange Rate Index (REER) fell further to a provisional value of 95.6 in October 2021, a decline of 0.3% compared to 95.8 recorded in the previous month.

Cumulatively, REER has declined by 4.2% since June 2021 and 7.2% from its recent peak in April 2021, said the central bank in a tweet post, implying that Pakistan's goods become more competitive in the international markets.

Given this, the export sector found itself in a sweet spot as exports during November’21 jumped by 33% YoY to a historic monthly high of $2.903 billion as compared to $2.174bn during the corresponding period last year.

Speaking to Mettis Global lately, Zafar Paracha, Secretary General of Exchange Companies Association of Pakistan said, “In the backdrop of the notable plunge in the international commodity prices, the emergence of new Covid variant, stable export volume and the latest positive statement by the Shaukat Tarin, Advisor to the Prime Minister on Finance and Revenue, the downward slide of PKR is surprising.”

“The ongoing depreciation may be a part of IMF conditionalities,” he added.

He also lauded the apt measures taken by SBP in recent months such as revised prudential regulations for consumer financing to moderate import and demand growth in the auto sector.

In line with this, SBP had asked commercial banks to provide information about imports worth $500,000, to curb the free movement of the dollar and, the decision to impose 100% Cash Margin Requirements (CMR) on the import of 114 items, taking the total number of items subject to Cash Margin to 525 is also commendable.

The measure will help discourage imports of these items and thus support the balance of payments, he added.

To note, SBP had also raised the statutory Cash Reserve Ratio (CRR) by 100bps to 6% while the daily minimum CRR has also been increased to 4% from 3% during the month, in order to slash the lending capacity of the banks and contain aggregate money supply growth.

Not to forget, the Saudi Fund for Development (SFD) came as a fresh breeze right before the last close of November as it uplifted the market sentiments. Under this deposit agreement, SFD shall place a deposit of $3 billion. The deposit amount shall become part of SBP’s Foreign Exchange Reserves which would help support Pakistan’s foreign currency reserves and contribute towards resolving the adverse effects of the COVID-19 pandemic.

CPI: Victim of PKR fall

CPI numbers remained the major victim of the sliding PKR as the inflation augmented by 11.53%YoY in November, more than the market expectations of 10.2%YoY, taking the 5MFY22 average to 9.32%YoY on the back of a surprise increase in food, housing, water, electricity, gas and fuel prices.

Given this, the consumers’ confidence took a dip during October and November indicating their worsening financial standing and poor economic outlook for the months ahead.

As per SBP, the fall in the value of the rupee since May has been comparatively large. As other adjustment tools normalize, including interest rates and fiscal policy, pressures on the PKR should abate.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|